- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- K-1 Box 20 Code Z Section 199A how to fill in and deal with dual business types

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Box 20 Code Z Section 199A how to fill in and deal with dual business types

Hi,

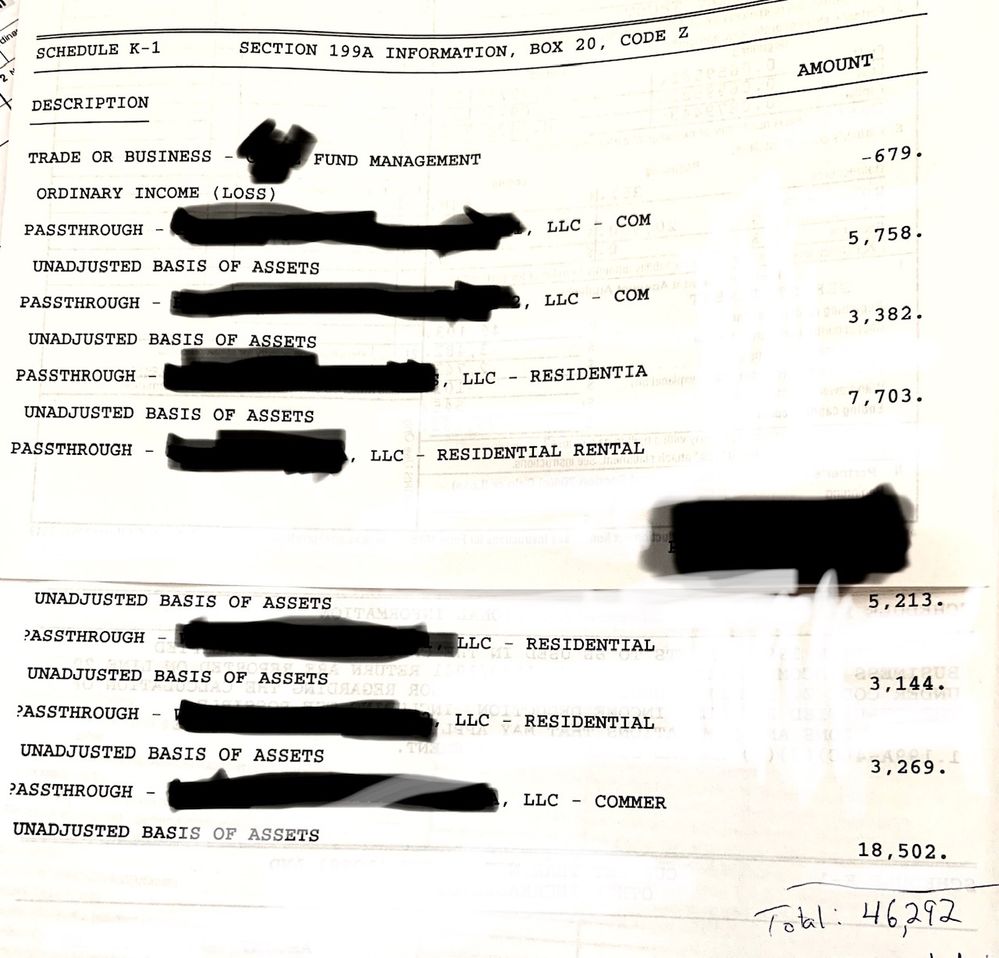

For a K-1, Boz 20, Code Z, I received the following Information. In Box 20, for code Z, should I add up all the amounts ($46,292 in this case) to enter into the box 20 code Z?

Also, because this K-1 needs to be split into 2 separate turbotax K-1's, because it has 1) Ordinary Income and 2) net rental real estate income, do I enter this Box 20 information on Both of the K-1s? (and in general which K-1 boxes need to be entered on both sides or each side)?

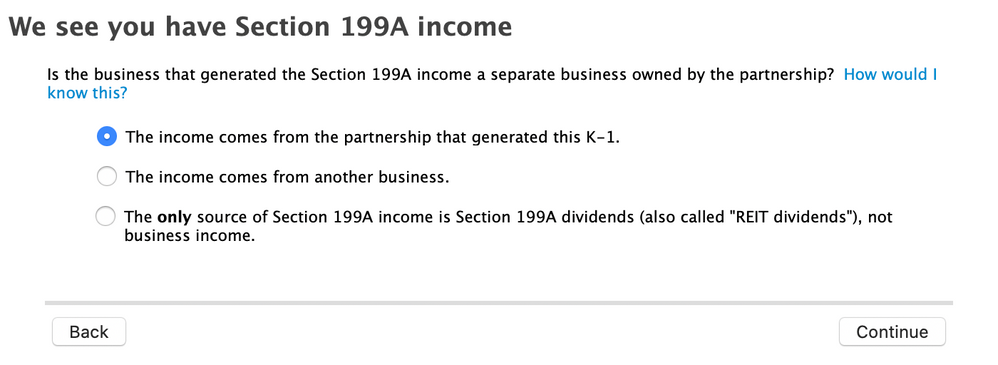

Then in the next step it asks the following questions: How do I determine the answer as it is not obvious to me what the income type is? (and should I answer this Differently for the 2 split entries for this K-1 or answer it the same?)

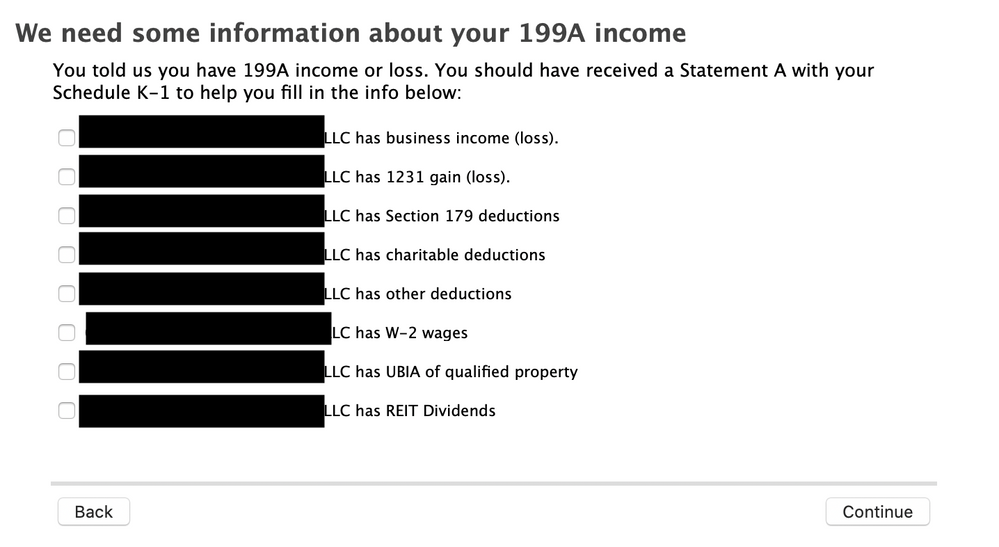

And then in the step after that, I don't understand what to enter for the below:

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Box 20 Code Z Section 199A how to fill in and deal with dual business types

You don't add up the amount to enter with the code Z on the box 20 screen. Just leave the amount blank on that box 20 screen, it doesn't get used in the calculation. The "We need more information about your 199A income" is where the entries matter. When you check a box on a line you need, boxes will open up for you to enter your amounts from that 199A statement.

You'll need a separate K-1 for the "main" partnership and each passthrough entity on that Section 199A statement. And, any of those separate entities have box 1 and box 2 amounts, you have to split that as well.

During the first part of the K-1 entry, all the separate K-1s use the name, address, and EIN of the "main" partnership shown in Part I and Part II of the K-1 you actually received. For Part II, I recommend that the information through Line I (India) be entered, and the appropriate at-risk answer under Line K. Don't put the partner percentages or the partner capital account amounts on the additional K-1s.

The boxes 1-20 on the K-1 you received are the combined totals of the main entity and the passthrough entities. You must figure out how much of each box 1-20 is for the main entity versus each passthrough entity, and that is the "split" you use to enter the box 1-20 on the separate K-1s. The total each numbered box for your separate K-1 forms must equal the total for that box on the K-1 you actually received. For example, all box 1 amounts on the separate K-1s should add up to the box 1 amount for the actual K-1 you received. If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts. Note that the box 20 code Z information is already split for you.

Note that when you enter each K-1, you'll encounter the question "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen, TurboTax is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. So, on one of the K-1s you enter you will answer that it is from the "main" partnership, and on the other you will enter that it is from the pass-through entity. TurboTax will ask for the name and EIN of each pass-through entity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Box 20 Code Z Section 199A how to fill in and deal with dual business types

Hi,

Thanks for the reply, I think.... your answer is good, but it seems to be extremely complicated and cumbersome to do. Is there a way to avoid splitting this single K-1 into *8* separate K-1s and then Further splitting Box 1 and Box 2 information into subparts (which to me seems impossible to do with the K-1 information as far as I can tell)?

Also, when splitting the K-1 into K-1 subparts, do any or all the following also need further splitting or should I use the numbers given in the K-1.

* Box 13, W

* Box 18 C

* Box 20 A, Z

In specific, I I don't really care about maximizing deductions or maximizing my return, are there simpler ways to enter this as a single (or at most 2) K-1s?

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Box 20 Code Z Section 199A how to fill in and deal with dual business types

No, unfortunately you'll need a separate K-1 for each passthrough entity in addition to your "main" partnership. But, if the "main" partnership only has only one kind of activity (ordinary income (loss) or rental income (loss) but not both), and each of the passthrough entities only have one kind of activity (ordinary income (loss) or rental income (loss) but not both) you won't need split any entity further.

For the box 13 code W amount, you'll need to determine if that is for the "main" partnership or one of the passthrough entities. The description of what the amount is for may give you a clue. For example, if it is for state income tax withheld on your behalf, that is for the main partnership.

For the box 18C, that will be for the main partnership, i.e., expenses that are not deductible by the partnership, but are instead passed to the partners.

For box 20 code A, that is for investment income, so you'll need to determine if that is for the "main" partnership or one of the passthrough entities.

For box 20 code Z, that split is given to you by the Section 199A Statement.

If you can't deduce the split from the information you have, you'll need to contact the preparer of the K-1 for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilenearg

Level 2

RE-Semi-pro

New Member

davsemah

New Member

RyanK

Level 2

sslee

New Member