- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Box 20 Code Z Section 199A how to fill in and deal with dual business types

Hi,

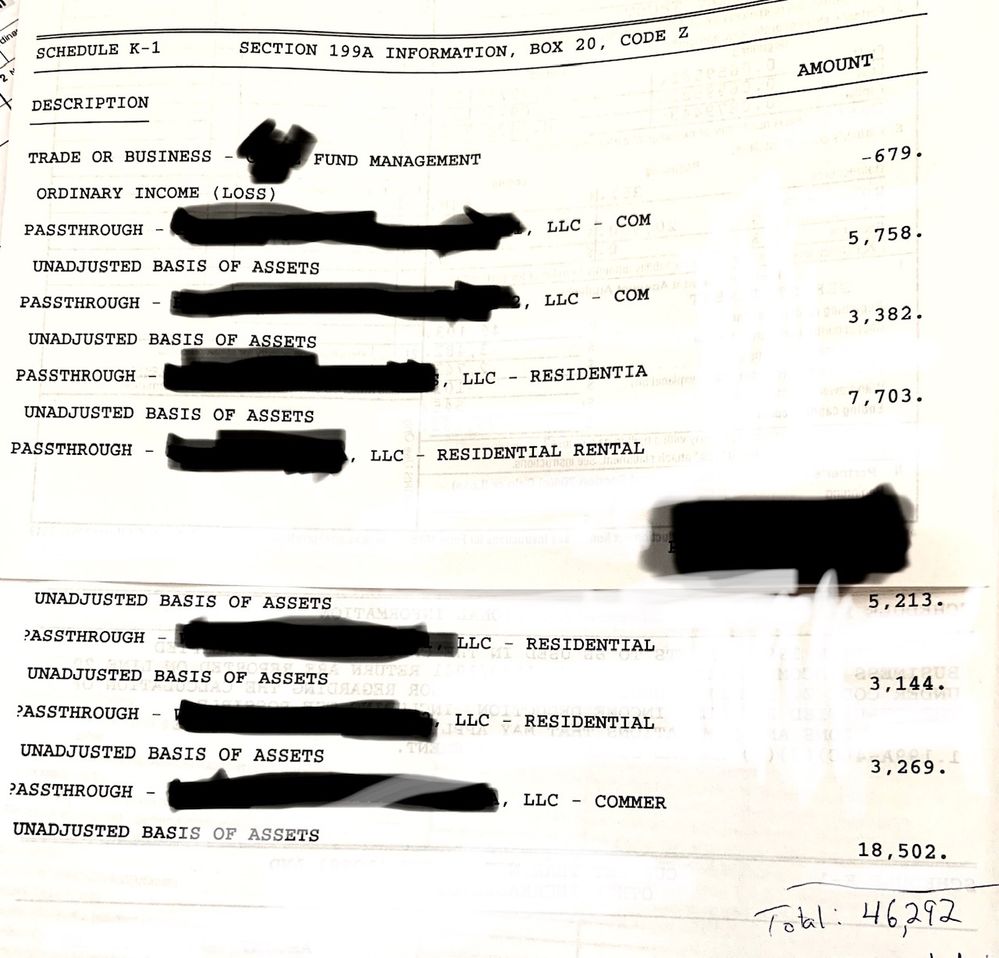

For a K-1, Boz 20, Code Z, I received the following Information. In Box 20, for code Z, should I add up all the amounts ($46,292 in this case) to enter into the box 20 code Z?

Also, because this K-1 needs to be split into 2 separate turbotax K-1's, because it has 1) Ordinary Income and 2) net rental real estate income, do I enter this Box 20 information on Both of the K-1s? (and in general which K-1 boxes need to be entered on both sides or each side)?

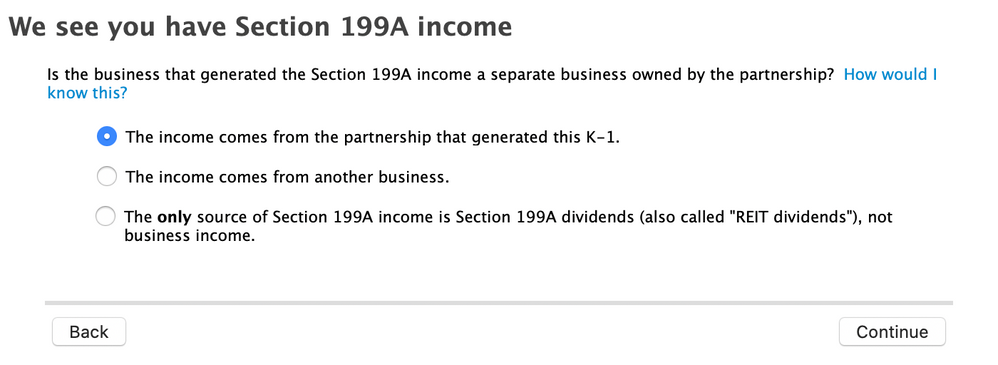

Then in the next step it asks the following questions: How do I determine the answer as it is not obvious to me what the income type is? (and should I answer this Differently for the 2 split entries for this K-1 or answer it the same?)

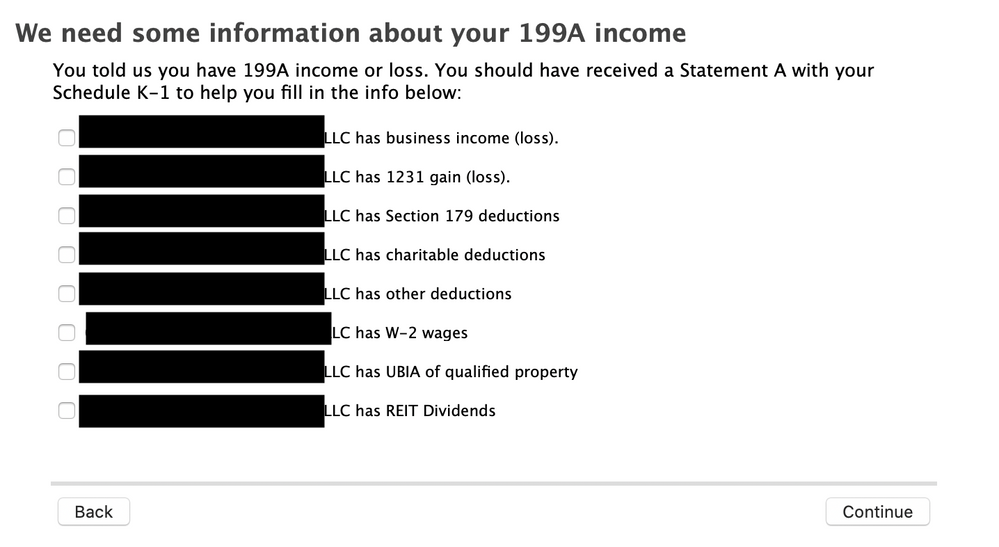

And then in the step after that, I don't understand what to enter for the below:

Thanks!