- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- K-1 and New Form 7203 - Allowed Loss?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

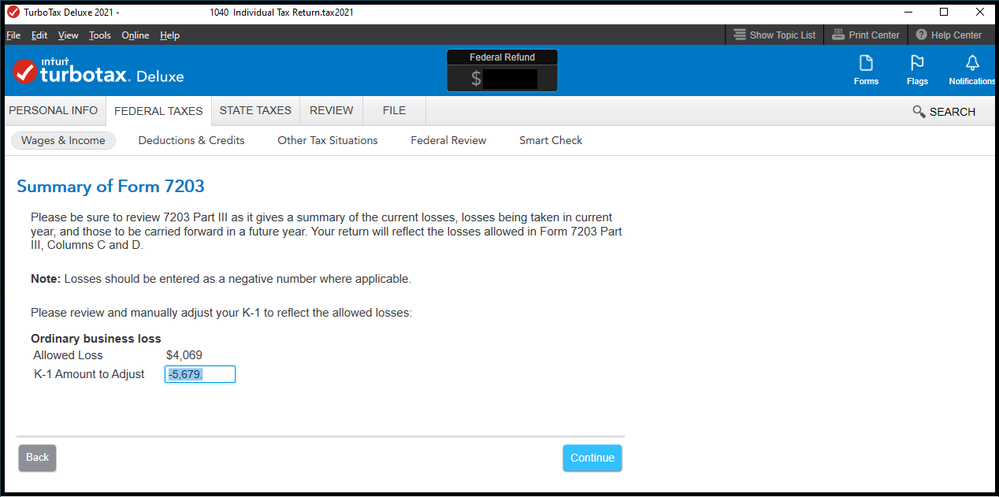

Hi. I'm still reading up on Form 7203. I was surprised to encounter it in TurboTax this year. I think I put in my income and loss correctly from the K-1 but I have not yet figured out how to do all the basis details :( I'm hoping you can help me understand this screen:

It comes near the end of the K-1 review. The value in "Allowed Loss" ($4,069) is the income for my business and the value currently in "K-1 Amount to Adjust" (-5,679) is my expenses. Unfortunately, this year, I had a loss. I don't understand why the "K-1 Amount to Adjust" field is editable. Am I supposed to change it? Is it implying that it should not exceed the "Allowed Loss"? I doesn't make a big difference in the end result but I want to understand it.

Anyone know what's expected?

I'm still researching 7203 so forgive me if it's an obvious question.

Thanks.

Benny

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

Yes, the K-1 number can't be more than the Allowed Loss. If you enter the same number for both, this should be resolved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

Because your allowed losses exceed the reported K-1 losses, you need to enter no more than the allowed losses for this entry. Note this affects Form 7203 only; you are not changing your K-1 entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

Actually, my true expenses in the "K-1 Amount to Adjust" (-5,679) exceed what is listed in "Allowed Loss" ($4,069). So, I should change the "K-1 Amount to Adjust" to equal the "Allowed Loss" (I.e., "-4,069"). Is that what you meant?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

Yes, the K-1 number can't be more than the Allowed Loss. If you enter the same number for both, this should be resolved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

I think that this is the right answer. If someone from TurboTax is reading the community, I would suggest that this screen could be improved. At a minimum, the screen could tell us what we are expected to do.

Even better, it could proactively change the amount and give the user an informational message saying the amount was changed to the maximum allowed amount. It could also inform us that the K-1 itself was not being changed but rather just Form 7203.

Thanks to Patricia for answering.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

@PatriciaV I'm on TT Self-Employed and TT is NOT walking me through the questions...i.e., I don't have screens like the OP shows in their above screenshot. I'm in an actual form 7203...why is my TT edition not walking me through it also?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

The Form 7203 interview is slightly different in TurboTax desktop, but the main entries on the form are made manually using the same format as TurboTax Online. A lot depends on the version you're using. The OP was in TurboTax Deluxe for Desktop, which has limited help for this form. TurboTax Self-Employed is the most fully-featured online version.

Because Form 7203 is new this year, and the IRS has not fully finalized the format, completing the entries can be confusing and time-consuming. You may wish to consider filing an extension of time to file so you can work on this over the summer. Read more here: How do I file an IRS extension (Form 4868) in TurboTax Online?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

When adjusting the allowed loss as instructed and going back into my K1, it has now changed all my entries on Form 7203 Part III changing my ordinary business loss and removing my carry-over amount for next year. Now my form does not match the K1 I received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

Here is what it says on mine

Allowed loss $8

K-1 Amount to adjust $9958

When I enter $8 it changes my ordinary business income to $8 at the beginning

of filling out my K-1 info. And then I go from owing $2700 to getting a $370 refund!

Is this correct?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

IRS form 7203 Shareholder Stock and Debt Basis Limitations determines the amount of the loss in the enterprise that your cost basis allows in the enterprise. The amount allowed could differ from what is reported on the IRS Schedule K-1 (1120S). In the example below, the K-1 Amount to Adjust will be reduced to the Allowed Loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

I see the same thing - I have an allowed loss of 243 and a positive K1 Box 1, and any adjustments in this screen change the K1 box 1. In this case it will essentially remove all income from the business.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JB_Tax

Returning Member

justine626

Level 1

mjtax20

Returning Member

barnabyf

Level 3

aelsayed

New Member