- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 and New Form 7203 - Allowed Loss?

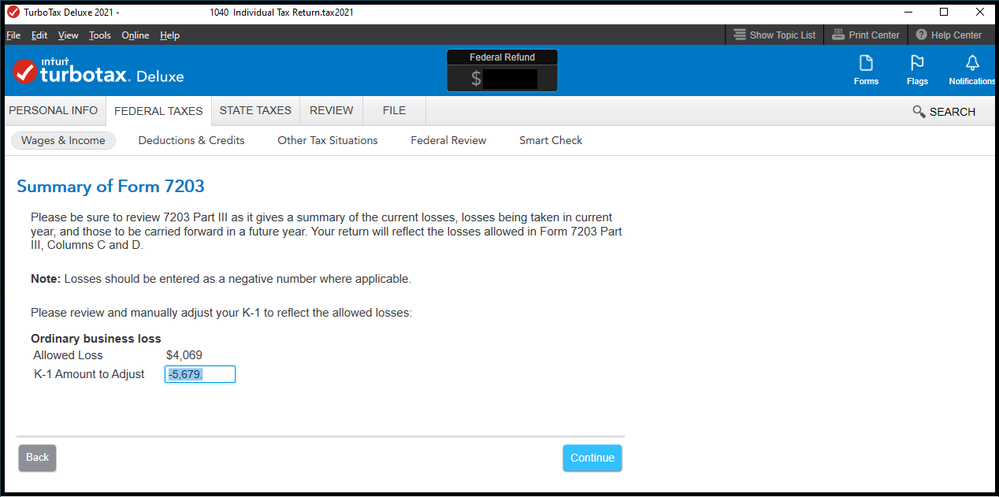

Hi. I'm still reading up on Form 7203. I was surprised to encounter it in TurboTax this year. I think I put in my income and loss correctly from the K-1 but I have not yet figured out how to do all the basis details :( I'm hoping you can help me understand this screen:

It comes near the end of the K-1 review. The value in "Allowed Loss" ($4,069) is the income for my business and the value currently in "K-1 Amount to Adjust" (-5,679) is my expenses. Unfortunately, this year, I had a loss. I don't understand why the "K-1 Amount to Adjust" field is editable. Am I supposed to change it? Is it implying that it should not exceed the "Allowed Loss"? I doesn't make a big difference in the end result but I want to understand it.

Anyone know what's expected?

I'm still researching 7203 so forgive me if it's an obvious question.

Thanks.

Benny