- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Itsdeductible being discontinued.. WHAT???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

Sure, that's understandable, but they could have just left 2021 open. Can't use 2022 data for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

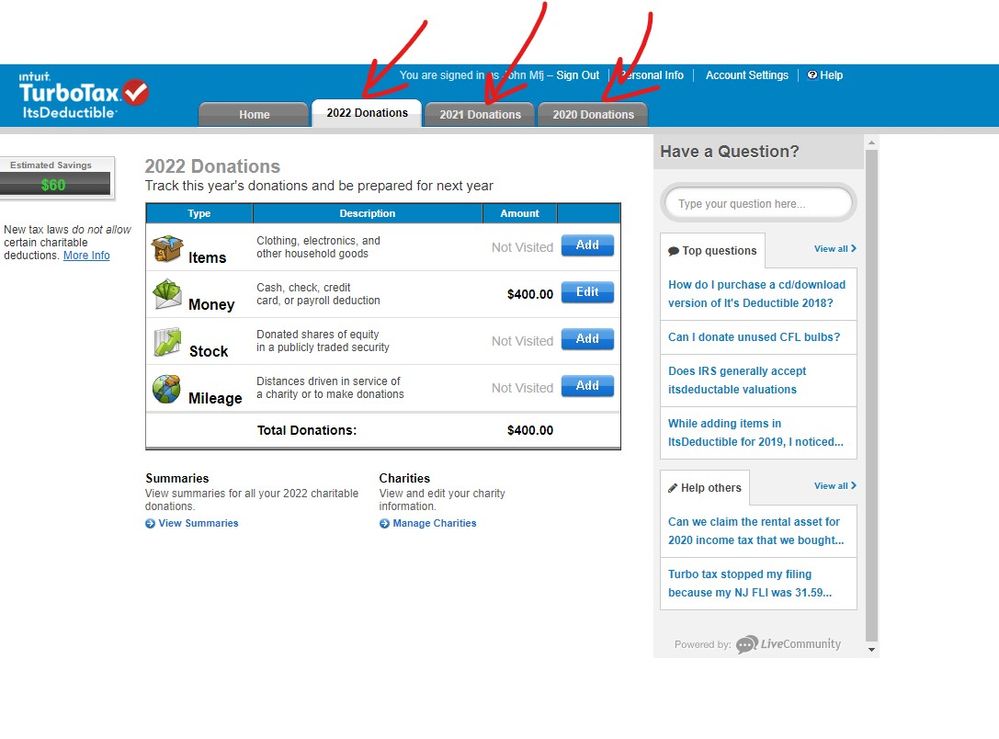

2021 is still functional as well as the 2022 tab until 10/15/22.

https://itsdeductibleonline.intuit.com/Logout.htm

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

The itemizing of donated items is the key feature with the item's value look-up capabilities.

The tracking, of monetary donations, is not very hard to do offline. Mint does help, but it has too many problems categorizing transactions to be truly useful. With Mint, you would have to review all of your transactions to make it work. If you go to that trouble, you can do it offline.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

Amen! to the displeasure with Intuit's nonsensical discontinuation in midyear. Although I understand Intuit's need to prioritize its resources, I would have expected you to provide notice in 2021 if the last tax year for which ItsDeductible could be used for filing would be 2021. I have already entered several item non-cash donations for 2022 and hope Intuit will reconsider supporting the platform through the reminder of 2022 AND for filing 2022 (through at least April 17, 2023)!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

The FAQ mentions "there are several free resources online available from reputable charities" - what are they?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

I have used ItsDeductible since 2007 and am astounded at this irresponsible, abrupt cessation of services with no warning. Unethical is an understatement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

They had to put a stop date so they will support until the end of the 2021 efiling season. So if they kept it running until the end of 2022 then would they also be required to support it thru 10/15/2023 ... so this could be extended forever using this kind of logic. The company had decided to stop support on this FREE TOOL due to lack of usage and the cost to keep it running. Intuit is a for profit company and cannot have parts of the company drain the profits of the other sections. This was not a malicious action but purely a business transaction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

That's helpful - thank you! https://satruck.org/Home/DonationValueGuide

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

Critter3 - I understand making business decisions, but - this "Free" tool, in my book was provided for my Paid (and not cheaply) annual TurboTax product. The fact they didn't integrate the valuation lookup within the software is a moot point (and a pain as well - but definitely worth the effort in that you NEED that information). I don't see this as taking away something that was offered as free - I see it as cutting that TurboTax function - and adding substantial burden to my filing of my taxes, via TurboTax (if in fact I stay with them - this changes the game for me). The 2021 Tax SW was glitchy already, and not all forms were ready for the tax year filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

Just be aware that some IRS auditors are not accepting donation values unless they are specific to your locality.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

It may be a business transaction, but it’s bad business. I guess it’s all about profit and loss. Let’s just throw customer service to the trash heap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

NO.

They issue a notice that December 31, 2022 is the last date for new entries and that only tax year 2022 will be supported into 2023.

No functionality is allowed for 2023 beyond that associated with the tax year.

That is how an ethical, well managed company would deal with customers whom it appreciates.

It is a ridiculous notion that there is no accomodating way to end support without wasting customer effort for six months. I take it you must be employed by this company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

I ami not the only person I know who uses TurboTax because of the It’s Deductible functionality. I hope TurboTax rethinks this because in the end not only is the discontinuation a large inconvenience to its customers, but may very well cost them business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itsdeductible being discontinued.. WHAT???

I use Itsdeductible yearly. I've never had any problems and have been pleased with the product.

Why not offer this program with a fee? Has this even been floated as an idea? I wonder if others share this feeling as well?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sachaaa

Level 1

asrogers

New Member

lwhitmyer

New Member

bobjohnson25

New Member

zzsutton

New Member