- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

You will have to mail your Colorado state return forms to:

When filing a paper return, all W-2s and/or 1099s that show Colorado income tax withholding must be attached to the front of the form where indicated. The Colorado Department of Revenue does not require taxpayers to attach a copy of the federal return to the Colorado return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

I received the same email and I do not know what to mail in. I opted to e-file all my returns. What do I need to mail in if I e-filed the taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

If you e-Filed the returns and received notice they were accepted you should not need to mail any additional forms in.

Does the email indicate that your return was rejected? Or that some other items are required?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

I also have the same issue, can someone help me out please

It says below:

TurboTax Update: State Return Accepted - Extra Form Required

Your 2019 Colorado Personal return was accepted!

Just one more step and you'll be finished filing.

What this means

Congratulations – all that's left to do now is mail in an extra form to your state.

Next steps

First, find your form by locating the .....

Next locate the correct mailing address in the filing instructions, also included with your printed return.

Last but not least, mail in the extra form(s) and celebrate. You'll be finished filing!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

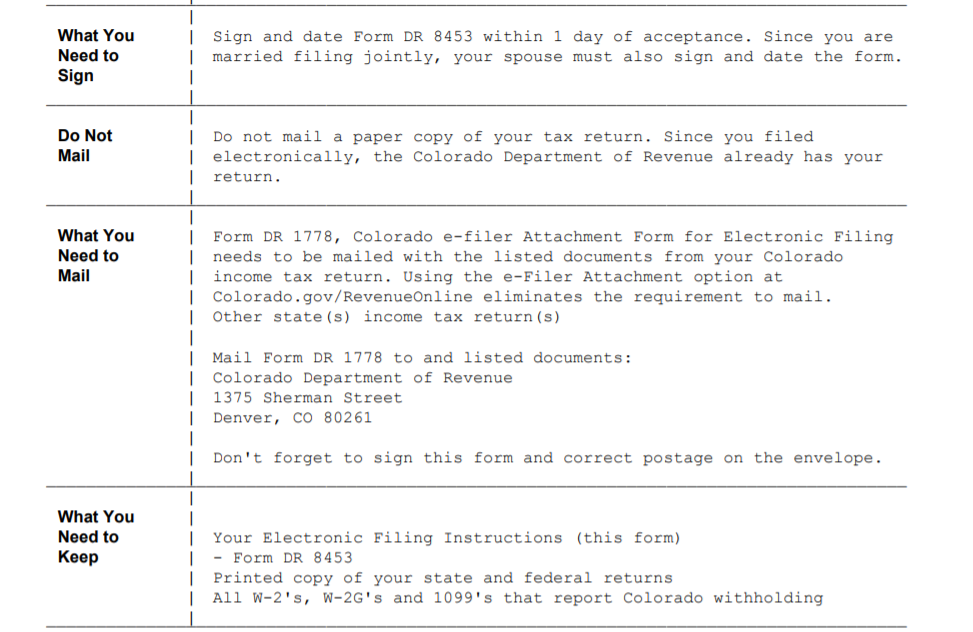

I think I found out what needs to be mailed, it is on the returns but it is soo confusing

What You Need to Mail

Form DR 1778, Colorado e-filer Attachment Form for Electronic Filing needs to be mailed with the listed documents from your Colorado income tax return. Using the e-Filer Attachment option at Colorado.gov/RevenueOnline eliminates the requirement to mail. Other state(s) income tax return(s) Mail Form DR 1778 to and listed documents: Colorado Department of Revenue 1375 Sherman Street Denver, CO 80261 Don't forget to sign this form and correct postage on the envelope.

It also says, what you need to sign

Sign and date Form DR 8453 within 1 day of acceptance. must also sign and date the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

Finally was able to figure it out.

See the first page of your colorado returns, it gives specific instructions on what needs to be done

Eg: there are sections labeled

1. what needs to be mailed

2. what you need to keep

FYI: you do not need to mail, you can submit online as well. see screenshot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

I have the same issue I got email saying need to submit extra form but I file through TurboTax.What should I do now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

There are a handful of situations where you might have to mail a form after e-filing. When you print a copy of your state return, it will tell you which form needs to be mailed and the address to mail it to.

@nbhausb

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

Thank you for your response.my document has been accepted but email says I need to submit extra forms.Should I wait until I get my return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

Some state forms are required to be mailed in as they are unsupported. For further details, please see the Help Article here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

vish9227 thanks for the message. I am pretty sure this is what I need to file as well however where did you see those instructions? I have my entire federal and state tax form and nowhere in there are the instructions like you posted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

@Anonymous Please review the following FAQ: How to print and mail return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

@EbonyA That doesn't answer the question. I have already file electronically and my return has been accepted. The email says I need to send in an additional form but doesn't tell me what form. It then says to look in my printed return for the instructions as to what to file butt here is nothing in my printed return about what to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It says I need to mail in my "forms" for my Colorado taxes. I don't remember doing that last year. What exactly do I have to mail in and where?

Please reach out to TurboTax Customer Support as your issue would be best resolved with one-on-one troubleshooting support. Please visit the Contact Us page and select your product to get you to the right person.

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

godspropy

New Member

HollyP

Employee Tax Expert

rwallner1

New Member

user17621099375

Returning Member

sk8rzmom

New Member