- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Is Form 14039 actually available? THAT is the question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

I need to file a Form 14039, Identify Theft Affidavit.

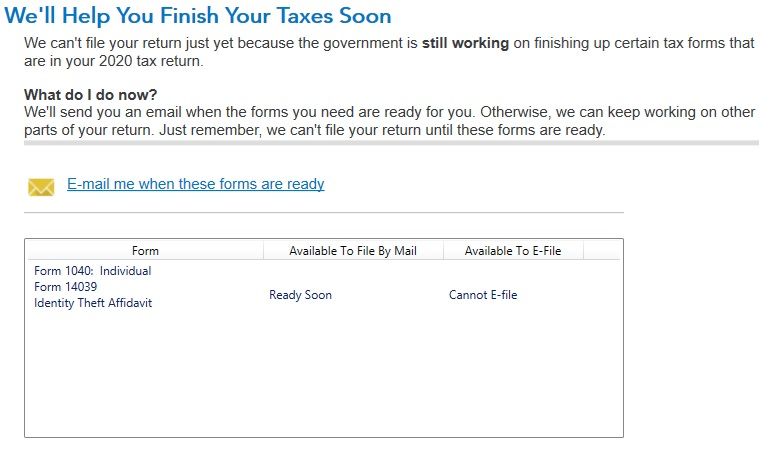

When I have TurboTax "review" everything, it shows this:

So I signed up for the email from Intuit when the form becomes ready. I almost immediately received an email saying:

The wait is over! The tax forms we needed to finish up your taxes are ready.

Form 14039, Identify Theft Affidavit

Open TurboTax on your computer, install the updates when prompted, and your forms will be automatically included.

But when I update TurboTax is just shows me that same "We'll help you finish your taxes soon" again.

What am I supposed to do?

- Will I be able to e-file at all this year?

- Can I file by mail now or do I need to actually wait for something? If so, what exactly am I waiting for?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

Yes, it would. Step #1 and #2 first, as you state above, then wait for confirmation of receipt of the 14039 before completing Step #3. And it truly would be the safest way for you and most "mind-easing" in the short- and long run. Please, do not forget my advice on mailing it in Certified Mail / Return Receipt Requested.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

According to the forms availability chart, Form 14039 is not supported by TurboTax for electronic filing and the print filing version is not yet available. Therefore, you will not be able to file electronically with Form 14039 included in your return and it is too early to file your return by mail with that form.

For your reference, use the following link to see the latest availability information:

IRS forms availability table for TurboTax individual (personal) tax products

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

So does that mean on 2/11/2021 I'll be able to run the online update on TurboTax and at that point I will be able to print to file by mail?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

Yes, unless the timeline is updated between now and 2/11/2021. That is the date it is expected to be complete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

I had the exact same thing happen as the above person...

BUT Do I understand the above answers correctly, that I am ONLY going to be able to file by mail??

Last year I was allowed to efile my forms and then had to send that form via mail. Do you expect this will also be the situation by 2/11 this year as well- OR am I only going to be able to file via snail mail????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

You may be able to e-file your return, without Form 14039, depending on why you want to include the form.

According to the IRS, Form 14039 affidavit should be filed in two cases:

- If the taxpayer attempts to file an electronic tax return and the IRS rejects it because a return bearing the taxpayer’s Social Security number already has been filed; OR

- The IRS instructs the taxpayer to do so.

If you fall under the first scenario, you won't be able to e-file your return. You will have to file your return by mail and attach Form 14039 to the back of it.

If you fall under the second scenario, you can e-file your return and either mail or fax Form 14039 to the IRS, according to the instructions in the letter they sent you.

Please see these articles for additional information:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

I'm confused...

@Irene2805 wrote:You may be able to e-file your return, without Form 14039, depending on why you want to include the form.

According to the IRS, Form 14039 affidavit should be filed in two cases:

- If the taxpayer attempts to file an electronic tax return and the IRS rejects it because a return bearing the taxpayer’s Social Security number already has been filed; OR

- The IRS instructs the taxpayer to do so.

I don't think I fall into either of those categories.

- I haven't attempted to file electronically this year.

- The IRS didn't send me any kind of letter. The only reason I filled out Form 14039 in the first place is because after TurboTax asked if I was a victim of identity theft and I answered yes, it had me fill out that form.

So getting back to @Gingerj's question:

Last year I was allowed to efile my forms and then had to send that form via mail. Do you expect this will also be the situation by 2/11 this year as well- OR am I only going to be able to file via snail mail????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

If no one else has filed a return with your SSN, you should be able to e-file your return. My suggestion is to at least try to e-file, since that is the safest and quickest way of filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

OK, makes sense. Thank you.

But how do I mail a single form to the IRS: just stick it in an envelope by itself and mail it? To any particular address?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

It depends.

According to the instructions for Form 14039, Identity Theft Affidavit, you can submit by either mail or FAX.

Per the instructions, to submit by mail,

- If you checked Box 1 in Section B in response to a notice or letter received from the IRS, return this form and if possible, a copy of the notice or letter to the address contained in the notice or letter.

- If you checked Box 1 in Section B of Form 14039, are unable to file your tax return electronically because the primary and/ or secondary SSN was misused, attach this Form 14039 to the back of your paper tax return and submit to the IRS location where you normally file your tax return.

- If you’ve already filed your paper return, please submit this Form 14039 to the IRS location where you normally file. Refer to the ‘Where Do You File’ section of your return instructions or visit IRS.gov and input the search term ‘Where to File’.

- If you checked Box 2 in Section B of Form 14039 (no current tax-related issue), mail this form to: Department of the Treasury Internal Revenue Service Fresno, CA 93888-0025

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

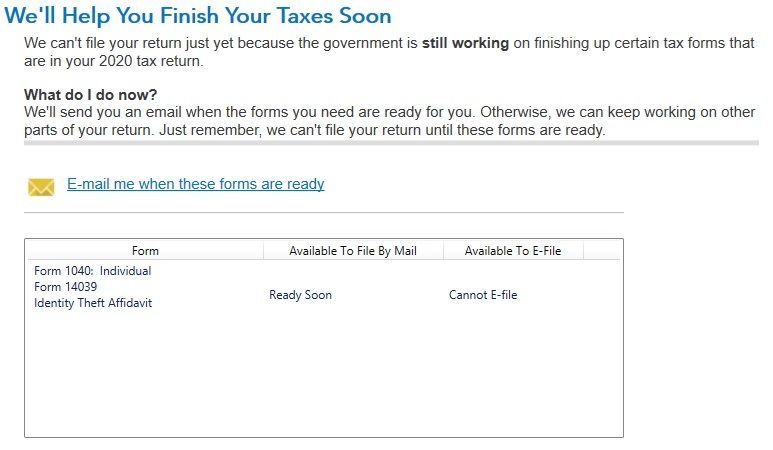

Well I now I'm doubly confused. TurboTax still shows me this:

I requested an email when the form is ready and received one today.

I checked the TurboTax forms availability page:

and see it is available now for file by mail.

I once again updated TurboTax but it still won't let me print for filing because it says it's not ready.

Now what?...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

Yes, you can separately print out this form by going directly to the IRS web site - here is the link:

The IRS is accepting these forms without being accompanied by your e-file return. More importantly, they are advising that you get this form filed prior to filing your 1040.

14039 - When to File - THIS PARAGRAPH applies to what I believe you are experiencing:

:Taxpayers file the Form 14039 to inform the Internal Revenue Service that they think they may be a victim of tax-related identity theft. They are having specific tax-related issues, such as not being able to file electronically because a tax return with their SSN already has been filed. (First make sure there are no other common issues, such as a transposed SSN or a dependent filing a separate tax return.)".

However, definitely read the information on both links as you want to nip this in the bud as soon as possible. I wish you the best of luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

Ok, thank you. So after I mail that form in via USPS, should I remove it from TurboTax (by indicating I wasn't a victim of identity theft) and then e-file? It seems if I don't remove it from TurboTax it won't let me e-file at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

It depends, @Eli923, should the TurboTax system not yet allow you to e-file, I would suggest you do one of three things:

1. Either wait approximately 3-4 weeks (21 days max) to mail in your returns after the date you've mailed in the 14039, or

2. Wait for the "green card" you will receive back from the IRS (which can take a while to get back) before mailing out 14309, or

3. Wait 14-21 days and attempt to e-file again; if the I.R.S. has received it and logged it your "hold" will be cleared.

Now, depending on what State in which you reside (I live in RI so there's an IRS office right up the road), you can always make an online appointment with an IRS agent and hand the 14039 into them in person and you will immediately get receipt of delivery. They will then send you confirmation of recording date - which usually only takes about 2 weeks tops - of your form. It is very unfortunate, I know, of what we need to do after such an awful experience. It is, however, your safest way!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Form 14039 actually available? THAT is the question

The only reason TurboTax isn't letting me e-file is because I indicated I need to fill out the 14039. Would doing the following work?

- Print the 14039 and send it via USPS on its own to the IRS

- Go back into TurboTax to remove where I indicated I was a victim of identity theft

- e-file like normal

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

byag7119

Level 2

Acasta

New Member

gssulte7

Level 3

DORRITO

Level 2

kds66

New Member