- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

Have you tried deleting the form in TurboTaxOnline?

Sign in to TurboTax and open your return by selecting Continue or Pick up where you left off

- From the left menu, select Tax Tools

- Select Tools

- In the Tool Center, choose Delete a form

- Select Delete next to KS-40SVR

- Click YES to confirm the deletion

- Resubmit your tax return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

I'm having the same issue. I've tried deleting KS_40SVR, but it doesn't exist. The state owes me $4,000 and I would like it ASAP. I already paid to file it electronically, but I'm going to hand-deliver my forms. Can I get a reimbursement for the $20 I paid to file electronically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

This is a known issue and it will be fixed with the next TurboTax update. Please try to file your state return again tomorrow, February 11.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

I appreciate that, but earlier this week it said the 9th. Yesterday it said the 10th. And now the 11th? Is it really going to be updated tomorrow or am I just being strung along every day?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

@DawnC These steps do not work. So this proposed solution is not helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

TurboTax is requiring unqualified taxpayer to complete the K-40SVR

There’s currently an issue where TurboTax is showing an error related to Form K-40SVR (Appraised Property Value). TurboTax is requiring unqualified taxpayers to complete the K-40SVR.

TurboTax is working on a fix. As a workaround, you should enter a zero for the appraised value when you see the error.

This will not impact the accuracy of your return. No credit is being calculated and the form is not part of the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

I understand that, however if you put a zero in for appraised property value you then have to put in a value for how much property tax have you paid. If you put a zero in that field, it does not accept as the value has to be greater than zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filling my Kansas state returns and it says I need a KS_40SVR but I dont Qualify for it or have one. How do i get it to go through

This error message should be resolved but perhaps it is hung in this form. Please delete the return for Kansas in the State section by clicking on the trash can icon.

Than Add another state for Kansas again so that it pulls in fresh information from the federal return.

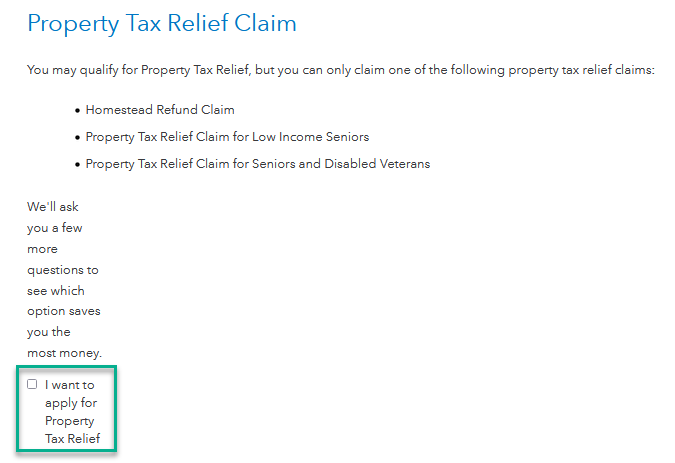

When you get to the page titled Property Tax Relief Claim, please make sure the checkbox near the bottom is unchecked.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AE_1989

New Member

stefaniestiegel

New Member

karliwattles

New Member

davidH_123

New Member

2399139722

New Member