- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

Do you mean you already filed your return as opposed to receiving it? Turbotax software allows you to file an amended tax return. I would recommend that you file an amended return and correct the error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

@NopeUpTwo is correct. Amend your 2020 income tax return to correct the error. One of the reasons you should amend your return is if it affects your refund or amount due, which this probably does. For additional information, see Do I need to amend?

Wait for the IRS to finalize your return before sending in an amended return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

If you put in 137,000 wages instead of 13,700 wages on Line 1,

or for other income with a tax document. IRS has already noticed and corrected your error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

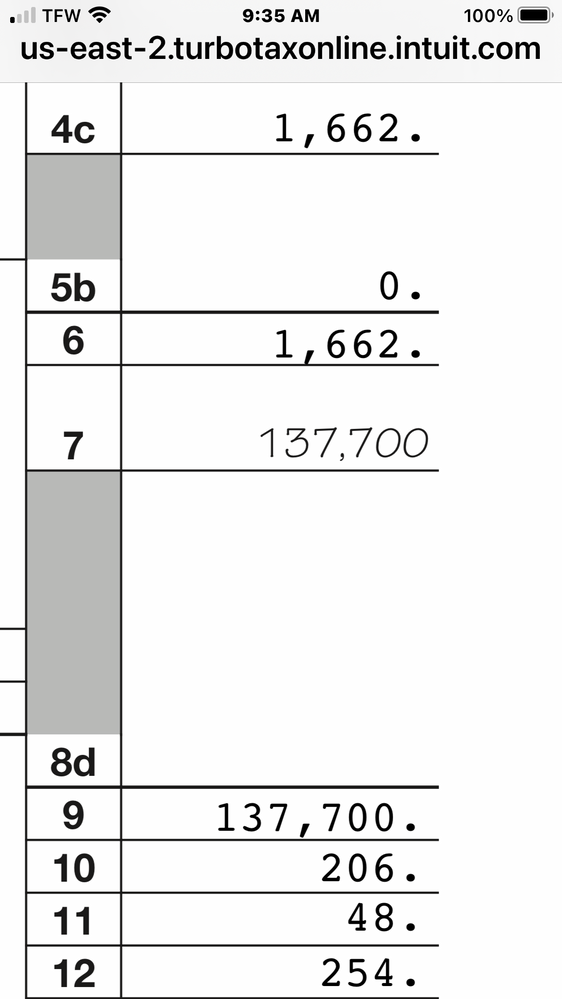

Hi there..Thanks for replying..here’s the thing..I ALREADY received my refund! I tried to amend but it’s not letting me at this time because of that IRS unemployment tax exemption..I was on unemployment 3 quarters of last year, like the rest of the world..I also found that IM NOT the only one with this problem! I’m posting where the 137000 is on the tax form. Idk if I did it or if it was some how added..NOTICE it’s different font from the rest..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

Here’s a little better view of what I mean..did I make this mistake? Or was it added? Others have this as well on their returns too..the EXACT same 137000!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

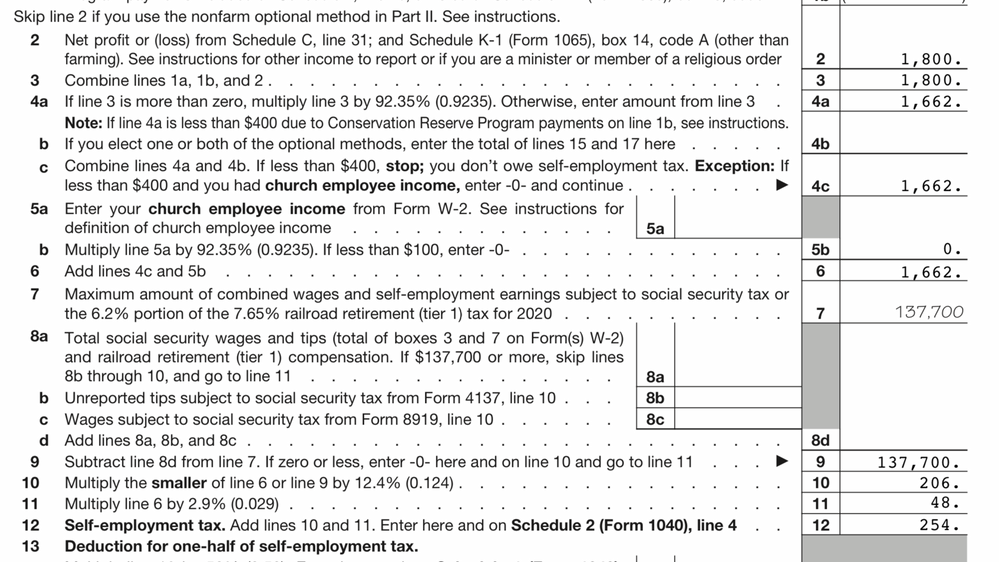

what is the error? the maximum wages that are subject to social security is indeed $137,700.... the form is trying to calculate what is owed for self-employment tax against that maximum.

where are you getting $13,700 from????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

You are looking at the Schedule SE long form to determine the amount of Self-Employment Taxes (Social Security and Medicare) you owe.

The Amount of 137,700 is the maximum earnings subject to Social Security Taxes in 2020. It is included in the worksheet to determine the correct amount of SE taxes. It is entered by the program and is not income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

Thank you so much for clarifying that! I wasn’t sure if it was MY mistake or a program glitch! I 100% understand it now. I went over my numbers from my books and I don’t have 13,700 ANYWHERE! I started to panic thinking WTH did I do! Thank you for helping me see what’s what!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

That is just a prefilled amount for the max amount subject to Social Security Tax. See it's on the blank IRS SE form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

THANK YOU for helping me see what’s what there..I thought I punched in some wrong numbers and started to panic. I went and checked the numbers from my books and I didn’t have anything with 13,700.. it makes sense now as to WHY others would have it as well..my apologies for being an idiot..lol..I feel so dumb now..lol..with things the way they are nowadays, you just never know..THANKS AGAIN so very much! Stay safe and be well!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was looking over my return and noticed there’s an error..it say 137,000 when it’s supposed to be 13,700!! I already received my return..what do I do?

Yes yes..lol..thank you so much..I see this now! 🤦🏼♀️..I feel like such an idiot..lol..

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hickmond38

New Member

az148

Level 3

flyday2022

Level 2

ydarb213

New Member

lisaagomez1

New Member