- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

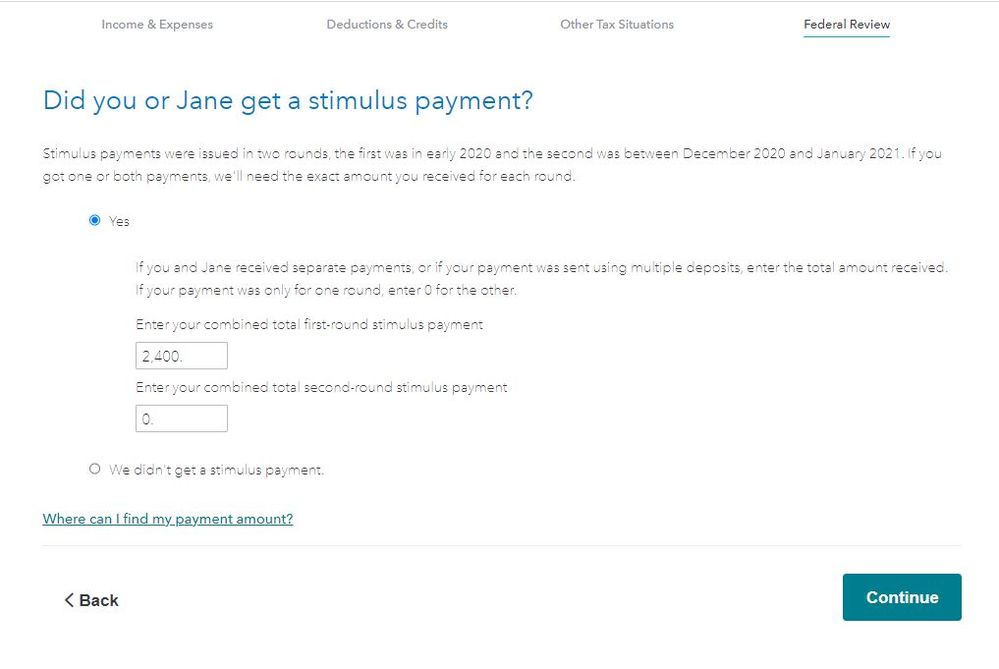

No. This does not mean you are ineligible. Follow the steps below to enter your information for the Rebate Recovery Credit.

In TurboTax Online, to claim the Recovery Rebate credit please do the following:

- Sign into your account and continue from where you left off

- Click on Federal in the left-hand column, then on Federal Review on the top of the screen

- On the next page titled Let's make sure you got the right stimulus amount, click on Continue

- Follow the interview

- TurboTax will determine whether you are entitled to any additional stimulus

- Any stimulus amount remaining due to you will show as a credit on line 30 of your form 1040.

See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

I kept going through the federal review...and I was NEVER prompted for any stimulus related information. Is there something wrong with my account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

You can force the program to trigger the Rebate Recovery Credit like this:

- go to Other Situations

- click Done.

- The next question will ask about payments received.

The program will determine the missing amount and add the Recovery Rebate to your refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

Unfortunately, this tip did not trigger a new option for stimulus.

Across the top I have 4 menu options

[ Wages and Income] [ Deductions and Credit ][ Other Tax Situations ][ Federal Review ]

After clicking the Federal review as requested and then clicking on the 'Other Tax Situation' I still was not prompted for Stimulus / Recover Rebate Credit

Is it possible to just delete my items 2020 tax and just start over? I am sure these corner cases like mine are hard to trouble shoot and repeat which would make resolving these software anomalies quite difficult

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

...as a follow up to my previous post, I re-created my 2020 tax form and I was STILL not prompted for any stimulus related information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

@jaxonpatton wrote:

...as a follow up to my previous post, I re-created my 2020 tax form and I was STILL not prompted for any stimulus related information.

Have you gone through all the sections of the program before accessing Federal Review? Complete the My Info section for your personal information. Complete Wages & Income, Deductions & Credits, Other Tax Situations.

If you are eligible for a stimulus payment the stimulus question page will be the first page displayed in Federal Review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

@DoninGA wrote:

@jaxonpatton wrote:...as a follow up to my previous post, I re-created my 2020 tax form and I was STILL not prompted for any stimulus related information.

Have you gone through all the sections of the program before accessing Federal Review? Complete the My Info section for your personal information. Complete Wages & Income, Deductions & Credits, Other Tax Situations.

If you are eligible for a stimulus payment the stimulus question page will be the first page displayed in Federal Review.

Yes I have, 3x ( including answering YES I have received a stimulus and.... then NO I have not received a stimulus)

Note

The 1st stimulus, I did not receive the correct amount, hence the Recovery Rebate Credit

The 2nd stimulus TurboTax handled the processing/payment and it was accurate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

You got to the stimulus questions.

It asked Did you get a stimulus payment? Select Yes.

Boxes appear and you enter your stimulus payments.

Click continue.

Your refund amount will change by the missed amount of stimulus.

Continue and the next page says Great news! You qualify for the stimulus credit and shows your missing amount. That is the Rebate Recovery Credit.

So, you are saying you can get to the stimulus box but then the continue and credit is missing? If so, you can fill this form out for someone to call you. We need a human to see this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

You missed understood.

At the VERY beginning of the process ( new return ) it asks you some initial questions and one of the questions was...did you receive a stimulus. This was at the very beginning...not at the END as you have mentioned.

Again the prompt for STIMULUS never happened...never and as of now...I have reset/restarted my return 4X and the response is still the same.

You may say...did you qualify? and the ANSWER is yes.

my 1st stimulus was for $1200 when the amount should have been $1700 ( missing $500 )

- Head of household

- 1 dependent

- Salary of $100k

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check in 2020, you can get it when you file your 2020 return in early 2021

The Recovery Rebate Credit will be found in the Federal Review section, If you are eligible it will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

I dont think you read this thread. Please re-read

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

I am also having this issue with it recognizing the Stimulus question needs to be asked. This is the situation, my son who is filing was eligible for both the first and second payments but only ever received the second payment.

We are using the disc version to file although in 2020 he was unemployed and had no income (no unemployment either) so we are filing for the purpose of getting his $1200 first payment only.

However, it goes through the review after going through all the sections (2X now) and never asks for the stimulus payment details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

Is your son your dependent? It appears he would be if he had no income.

Taxpayers who file their own return but are claimed as dependents are not eligible for the Recovery Rebate Credit (stimulus).

- Type stimulus in Search in the upper right

- Select Jump to stimulus

- If you don’t see It looks like you qualified for the stimulus, did you get any payments? Then your son is probably ineligible

You can also click Forms in the upper right and click on Recov Rebate Cr in Forms in My Return and manually fill out the stimulus worksheet. If you don’t see Recov Rebate Cr, click Open Form at the top of the left column and search for Recovery Rebate Credit Worksheet.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm unable to find info for the Recovery Rebate Credit; it isn't popping up under federal credits as I read that it should. Does anyone know why this is?

Last year 2019 taxes when he qualified for the credit based off of his tax filing. He was not claimed and did not qualify as my dependent, because he was working and exceeded the income threshold. He didn't receive the first $1200 payment for (filing separately and single), however he did receive the second $600 payment directly deposited without issue.

This years taxes for 2020 he had no income and does qualify as my dependent (other) with $0 income.

The problem is not a question of if he qualified or should have received the payment, it is with TT not recognizing this so I can enter the value for the payment he received and the $0 for the one he did not.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ed 49

Returning Member

kac42

Level 2

elliottulik

New Member

jesse_garone

New Member

lsfinn

Level 1