- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

The E-file Mandate for NY is for professional tax preparers. Go ahead and mail in your NY State return with a copy of your Federal from 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

The reason that you're experiencing difficultly with e-filing a New York state tax return is almost certainly due to the fact that the TurboTax software won't allow that to happen, where the user has first selected (or was forced into) the paper file option for their federal tax return. There is no way to "fix" this, or to change the software program to accommodate a New York state e-file. For that, we apologize.

The underlying reasons for this, however, are that the New York Department of Taxation and Finance needs a taxpayer's Form 1040 (federal return) in order to process the state return. Where there exists no e-file version of the TurboTax user's federal tax return, it is not possible for the software to create one just for a New York e-file effort. Also, in an effort to combat tax return identity fraud (theft), in cooperation with the state revenue authorities, it is not possible in TurboTax to e-file just a state tax return alone, without an accompanying e-file federal tax return.

Thus, despite New York's mandate for e-filing, you are left with a couple of reasonable choices. We have a Frequently Asked Questions webpage (at the link below), with some helpful details on New York:

https://ttlc.intuit.com/questions/1901383-is-there-a-penalty-if-i-don-t-e-file-my-new-york-return

Probably the easiest thing to do, however, is to simply ignore the New York e-file mandate (for the very good reason that you are unable to comply in TurboTax, having already paper filed a federal tax return), and print and mail your state return to New York, along with signed copies of Pages 1 and 2 of your Form 1040 (or 1040A or 1040EZ). Here is a link to the valid, official, New York mailing addresses that you can use for this paper filing purpose:

https://www.tax.ny.gov/pit/file/return_assembly_mail.htm

Thank you for asking this important question, and once again we apologize for any inconvenience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

Will NYS penalize me if I mail my NYS tax return instead of e-filing it?? I mailed my Federal return.

I prepared my own NYS tax return on Turobtax. There was no tax preparer involved.

Will I be penalized? Should I worry?? HELP!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

The E-file Mandate for NY is for professional tax preparers. Go ahead and mail in your NY State return with a copy of your Federal from 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

Rejecting my efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

Because you sent the federal by mail, TurboTax will not send the state by efile. When you send federal and state separately, the software checks to see if the federal was accepted before it transmits the state. In this case, the state will never efile.

Even though New York state does not want paper-filed returns, they will accept the mailed in return and process it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

I did not get form 1040 after filing. The only forms I have are 1099g, IT-1, IT-1099-R (manually filled), IT-201, IT-360.1, "TAXPAYER/SPOUSE INCOME ALLOCAION WORKSHEET" form, "ADDITIONAL INFORMATION FROM YOUR 2020 NY TAX RETURN". Also, which forms should I send to NEW YORK STATE? On the instructions sheet, it says send IT-1099-R form but I never got it when I printed my documents even though I filled out all the necessary information. Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

When you print your NY state return for mailing, you will get IT-201, followed by all of the required NY state forms and then a copy of your federal 1040 form.

You need to print again and be sure that the forms above are what is in the pdf file before you print the forms. The first page of the printout will have a list of the forms to attach to the return as the mailing address.

New York state does not want printed returns, but will accept and process them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

Hi there, is this still the case for filing tax year 2020? I would send both paper federal 1040 and my NY Resident Income Tax Return to NY?

The TurboTax lingo on the printed versions states: "New York State law requires income tax returns prepared using software to be e-filed. Because this New York State tax return was prepared using software, you MUST file it electronically."

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

@matulevichaa, please reference the above post by @MaryM428. For the year 2020, what is posted still applies for the year 2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

Because I had already e-filed 5 federal returns, when I got to my return, TurboTax would not allow e-filing due to an IRS limitation. Not a problem, I printed the Federal return for filing.

As stated above, this necessitated also filing my NY and NJ returns by mail. You stated that the NY printed return needs to include the Federal 1040 however, TurboTax did not include this in the package for filing to NY and the instruction sheet does not indicate it is needed. The only thing indicated as needed (which it printed) is the Summary of W-2 Statements. Also it included a printout of page 2 of federal Schedule E.

Any thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

If you are a NY resident, there is no requirement for a copy of your Federal return or Forms W2/1099 be attached. The necessary information from these forms to calculate NY income tax is included in NY state forms and schedules.

Instructions for Form IT201 NY Resident Income Tax Return (see page 36)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

I am not a NY resident. This is a non-resident return and TurboTax did not see fit to include any portion of the 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

I'm not sure if the federal return is required, but it wouldn't do any harm do include it. You will see an option to print a PDF copy of your tax return on your home page when you log into TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed Federal return by mail but New York State requires e-filing. How can I change the status of NY state return to efile?

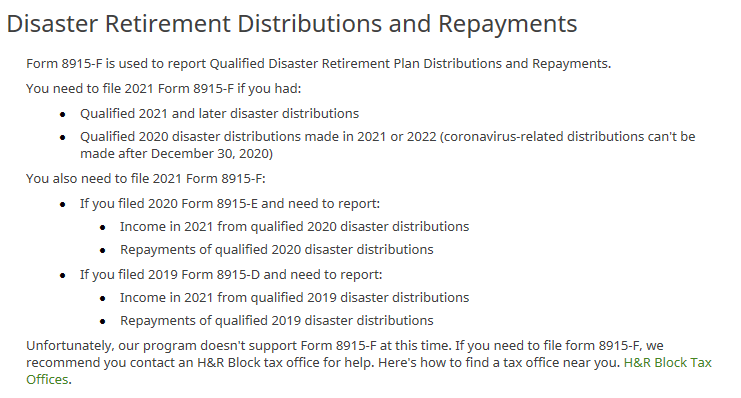

here is how crappy HRBLOCK is handling 8915F

and this is new from a recent update because loads of customers were asking about it...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

invisiblevetslimited

New Member

patrickeric502

New Member

user17638037803

Level 1

stephanieheyroth

New Member

Bill_IV

Returning Member