- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

If you did not start the actual return (just filed the extension) then access to the online program has closed for you ... to complete the return you will need to use the downloaded version instead.

Online preparation and e-filing for 2018, 2019 and 2020 is permanently closed.

To file a return for a prior tax year

If you need to prepare a return for 2018, 2019 and 2020 you can purchase and download desktop software to do it, then print, sign, and mail the return(s)

https://turbotax.intuit.com/personal-taxes/past-years-products/

You may also want to explore purchasing the software from various retailers such as Amazon, Costco, Best Buy, Walmart, Sam’s, etc.

Remember to prepare your state return as well—if you live in a state that has a state income tax.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. It cannot be used on a mobile device.

If you are getting a refund, there is not a penalty for filing past the deadline. If you owe taxes, the interest/penalties will be calculated by the IRS based on how much you owe and when they receive your return and payment. The IRS will bill you for this; it will not be calculated by TurboTax.

Who has to file?

http://www.irs.gov/uac/Do-I-Need-to-File-a-Tax-Return%3F

https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

I did start my return for 2020, so why cant I finish it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

you must log in to the correct account.

I just logged in this morning to an unfinished tax return and was able to continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

You have to sign onto your online account using the exact same User ID you used to create the online account.

Close all TurboTax windows on your web browser (including this one). Copy and paste the account recovery website link onto a new web browser window and run the tool.

Use this TurboTax account recovery website to get a list of all the User ID's for an email address. Run the tool against any email addresses you may have used - https://myturbotax.intuit.com/account-recovery

If none of the user ID's received will access your 2019 account, then use the option shown in blue on the account recovery website, "Try something else"

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

I've been working on my return since august. I got mixed up this year because I rolled over all but one of my IRA's. If you check you'll see I was working on it Oct30th.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

Sorry you are too late. Online is closed. You need to finish in the Desktop program. you have to print and mail it now.

Be sure to attach copies of your W2s and any 1099s that have withholding on them. You have to mail federal and state in separate envelopes because they go to different places. Get a tracking number from the post office when you mail them for proof of filing.

How to finish a prior year online return

If you paid for the Online version you can ask support to give you the Desktop download. Contact Customer Service 5am-5pm Pacific M-F

https://support.turbotax.intuit.com/contact/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

I have been working on my return since August. In fact I was working on it the entire month of October. When I turned it on yesterday no matter what I did I couldn't get it to work. I have used TurboTax for 25yrs. I would have finished it yesterday.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension back in April and now Turbo tax wont let me log in to finish my 2020 taxes

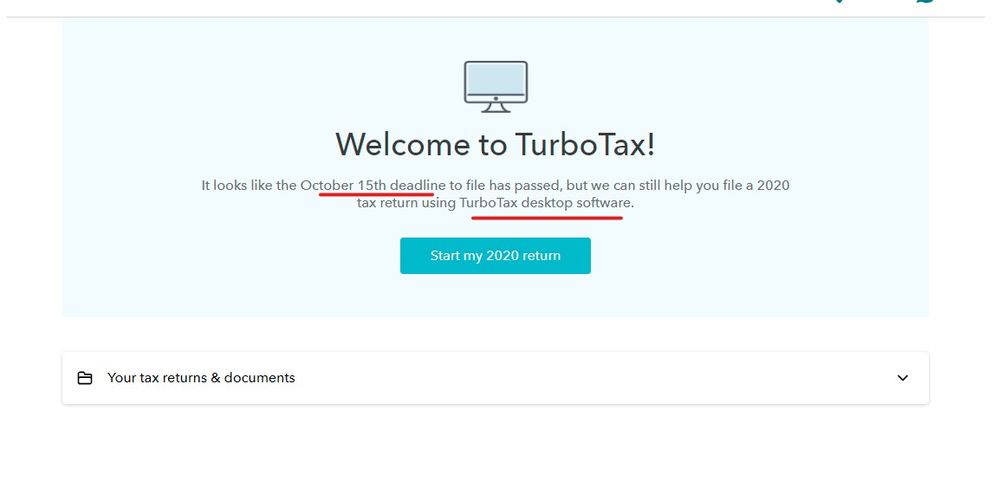

Guess you missed this warning ...

The TurboTax online editions for tax year 2020 have shut down to make way for the 2021 tax year editions which will be available in December.

If you paid for one of the online editions you can contact TurboTax support and they can push a desktop edition to your download account at no charge. The desktop edition can only be installed on either a Windows or Mac personal computer, not on a mobile device.

Support is open from 5am to 5pm Pacific time, Monday thru Friday.

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or -

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

NOTE - Disregard the statement to purchase the software in the following procedure if an online edition was already purchased -

If you started your 2018, 2019, or 2020 return in TurboTax Online but weren't able to file it before the shutdown, you can finish and paper-file it in the TurboTax download software for PC or Mac.

Start by purchasing and downloading the software and install it on your computer. If you're also filing a state, be sure to download and install the corresponding state program (PC instructions | Mac instructions).

- Now sign in at TurboTax.com using the same login you used to prepare your prior-year return.

- If you don't remember it, try account recovery. Still no luck? Then just start over in the TurboTax software you downloaded and skip the rest of these instructions.

- Under Your tax returns & documents, select Download .tax file (not the PDF) for the prior year you want and save it to your computer.

- Back in the CD/download software, select Find a Tax File, and then browse to the tax data file you downloaded in the previous step.

- Select the file and click Open.

- You can now finish up in the software. Your return will need to be paper-filed, as e-filing prior years is no longer available.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jtomeldan

Level 1

edack5150

New Member

pivotresidential

New Member

gerald_hwang

New Member

martelljeanm

New Member