in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How would you report foreign wages earned without the exclusion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would you report foreign wages earned without the exclusion

If you choose not to claim foreign income exclusions, how would you report foreign wages earned without the exclusion, and also be able to claim the EIC and Child Tax Credit?

Reference:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would you report foreign wages earned without the exclusion

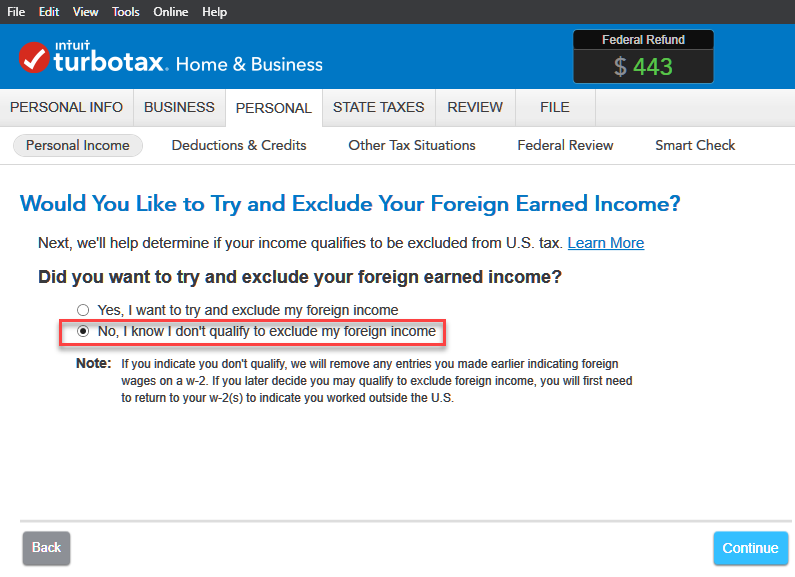

Foreign income AND the foreign earned income exclusion (FEIE) are both in the same section of TurboTax. It’s confusing.

To report foreign income but not claim FEIE, do what @Critter-3 advises in the last entry of the link you mentioned:

- Enter your foreign income.

- Keep going until TurboTax asks whether you qualify for the FEIC.

- Say NO (even if you qualify for FEIE) if you DO NOT want to claim FEIE).

You can find the foreign income section under Personal > Personal Income > Less Common Income > Foreign Earned Income and Exclusion or type foreign income in Search then select Jump to foreign income.

TurboTax will remove Form 2555 but keep your foreign income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would you report foreign wages earned without the exclusion

Foreign income AND the foreign earned income exclusion (FEIE) are both in the same section of TurboTax. It’s confusing.

To report foreign income but not claim FEIE, do what @Critter-3 advises in the last entry of the link you mentioned:

- Enter your foreign income.

- Keep going until TurboTax asks whether you qualify for the FEIC.

- Say NO (even if you qualify for FEIE) if you DO NOT want to claim FEIE).

You can find the foreign income section under Personal > Personal Income > Less Common Income > Foreign Earned Income and Exclusion or type foreign income in Search then select Jump to foreign income.

TurboTax will remove Form 2555 but keep your foreign income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would you report foreign wages earned without the exclusion

Thank you so much for clearification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would you report foreign wages earned without the exclusion

HI,

This helped, thanks. I have one question though.

We are able to successfully follow the step wizard, while we were unable to claim Earn Income Credit.

As per turbo tax EIC can't be claim if you have Foreign Earn income, ( we have only income via foreign salary), while turbo tax allowing child credit.

Is that correct or I we are doing something wrong ??? (no EIC)

Background:

1. US citizen leave abroad for full year.

2. Marriage filling jointly

3. Only income is foreign Earned income (salary) $15000 approx. (under 24k limit)

4. Two kids.

EITC Qualification Assistant. tool on IRS website, showing eligible of EIC.

Some article showing not eligible if not live in USA more then half year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would you report foreign wages earned without the exclusion

Hi syedHarisali,

Check the IRS EITC assistant again. When I ran your situation, it shows you do not qualify for the Earned Income Tax Credit because your children did not live in the US for more than six months.

To be eligible for EITC, your child must live in the same home as you in the United States for more than half of the tax year. The United States includes the 50 states, the District of Columbia and U.S. military bases. It does not include United States possessions such as Guam, the Virgin Islands or Puerto Rico.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would you report foreign wages earned without the exclusion

Perfect, you are the man, you are always to the point & accurate.

My mistake, I missed (fill incorrectly) that part and was thinking why TurboTax not matching with IRS. Read detail under "? "mark after you point out.

Lot of Thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Liangtwn

Level 2

Shamuj02

Level 1

srobinet1

Returning Member

dpa500

Level 2

user17520318787

New Member