- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to enter the reported numbers from Sch k1 footnotes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the reported numbers from Sch k1 footnotes

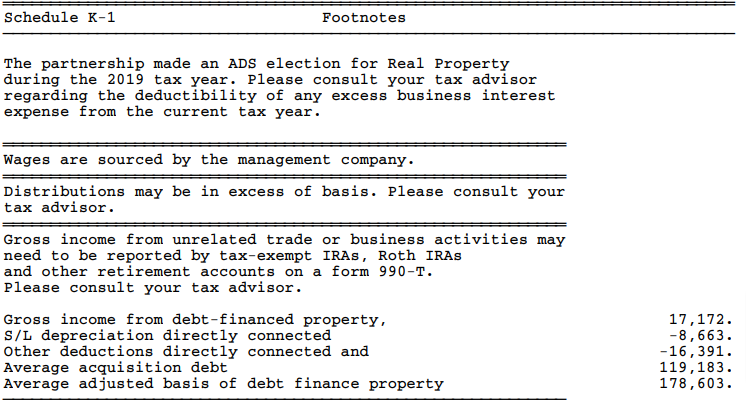

I have these numbers in the Footnotes section of my Sch K1, but I don't know where to report them.

Please help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the reported numbers from Sch k1 footnotes

Sounds like a task for @nexchap

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the reported numbers from Sch k1 footnotes

ADS - nothing needs to be done unless the partnership reports excess business interest. I don't think Turbotax is capable of handling this situation. but it doesn't seem that any EBI has been reported.

wages not sure why this was even reported. has no effect

if distributions exceed your tx basis you have a capital gain. short-term if you've owned the partnership for 1 year or less. long-term otherwise.

the other items are only used to compute unrelated business income which only applies to tax-exempt entities like IRAs, pension plans, 401ks, and the like. so if you own the partnership you can ignore this info.

if the partnership interest is owned by a tax-exempt entity, nothing on the k-1 gets reported on your 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the reported numbers from Sch k1 footnotes

You can enter footnote info on line 20, code AH. However, TT doesn't do anything with that info. On the forms (and maybe in the interview) there's an * stating "Manually enter item here and on appropriate tax form or schedule".

So the real question is whether any of those footnotes affect your tax return. I'm not familiar enough with these entries to offer any opinion there. If they do, you'd have to enter the numbers on the correct forms. If they don't, you don't need to enter them at all.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eric6688

Level 2

johntheretiree

Level 2

jannethu

Level 2

BobTT

Level 2

cassieaitken1

Level 1