- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do you report 1099- Misc box 3? No work was done. it keeps telling me I have to fill out a Schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report 1099- Misc box 3? No work was done. it keeps telling me I have to fill out a Schedule C

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report 1099- Misc box 3? No work was done. it keeps telling me I have to fill out a Schedule C

If the income was not related to performing a service and should not be included as self-employment income, use the following steps to enter it as part of your tax return:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-MISC” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-MISC"

- Click on the blue “Jump to 1099-MISC” link

- Answer Yes you did receive a 1099-MISC

- Fill in the details from your 1099-MISC then click Continue

- Provide a short description for the reason you received the 1099-MISC then click Continue

- On the next screen titled, “Does one of these uncommon situation apply?” choose the last option, None of these apply and then click Continue

- On the next screen asking if the 1099 involved work like your main job, answer No and click Continue

- On the next screen, check the box that you received the income in 2019 and then click Continue

- Finally, choose “No, it didn’t involve an intent to earn money” and click Continue

- Answer the questions on the next couple of screens to finish the process

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report 1099- Misc box 3? No work was done. it keeps telling me I have to fill out a Schedule C

This work around absolutely DOES NOT work for 2020 taxes. My husband gets a Christmas Bonus retirement check every year from a union he worked for, this is always reported on a 1099-Misc. I have entered, deleted, entered this multiple times, there is never the "Finally, choose “No, it didn’t involve an intent to earn money” and click Continue" option. EVER. I have self-employment income of my own on a schedule C, Turbo tax keeps trying to put this Christmas bonus on another schedule C, is charging me self-employment tax on this bonus. WHY WHY WHY did you eliminate the option for us to mark it was not from an intent to earn money. I cannot file my taxes until this is fixed and we need our refund.

Please help? I keep my TT software updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report 1099- Misc box 3? No work was done. it keeps telling me I have to fill out a Schedule C

If bonuses are reported on a 1099-MISC in Box 3, then you will still need to pay the uncollected Social Security and Medicare tax, as well as the income tax. This could be why it keeps populating under a Schedule C and adding self-employment tax (which will end up being your portion of the Social Security and Medicare on this income).

The IRS classifies bonuses as supplemental wages, along with severance pay, taxable fringe benefits, vacation pay, back pay, and overtime. Supplemental wages are anything other than your husband's regular pay.

Typically, bonuses are added to a W-2. However, there are different withholding methods for supplemental wages that the employer can consider, which are discussed in IRS Publication 15.

Per the IRS, regardless of the method employers use to withhold income tax on supplemental wages, supplemental wages are subject to Social Security and Medicare taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report 1099- Misc box 3? No work was done. it keeps telling me I have to fill out a Schedule C

except for as stated, it's not any kind of earned income. It is not a wage of any kind, he performed no work whatsoever to get this money, which is basically a Christmas gift. He is retired, disabled, can barely walk some days. It is merely a Christmas check this union sends out each year from a bonus fund depending on if the fund earns money that year. It's not a bonus for working, it's a bonus paid when the Christmas bonus fund earns money over and above a certain amount , so it's paid out to union members and retirees. The other union he worked for & gets a Christmas check for reported their Christmas bonus checks to retirees on a 1099R (so, problem solved), this union just happens to report it on a 1099 MISC, which is causing problems. When we moved and he stopped working for the union that issued the 1099, he never got another Christmas check. Those Christmas checks only started when he began drawing retirement (early, for disability). But his retirement from them is on a 1099-R. Can I just manually enter this 1099 misc. income that was in no way related to wages as other income on line 8 of Schedule 1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report 1099- Misc box 3? No work was done. it keeps telling me I have to fill out a Schedule C

You are correct. Benefits paid to you as an unemployed member of a union from regular union dues are included in your income on Schedule 1 (Form 1040), line 8. They are not subject to the employee share of social security or Medicare taxes.

Enter the bonus following the instructions below and do not use the 1099-MISC to make your entry.

- Sign into your TurboTax account > Select Wages and Income > Scroll to Less Common Income

- Select Miscellaneous Income, 1099-A, 1099-C, Start or Revisit > Other reportable income, Start or Revisit

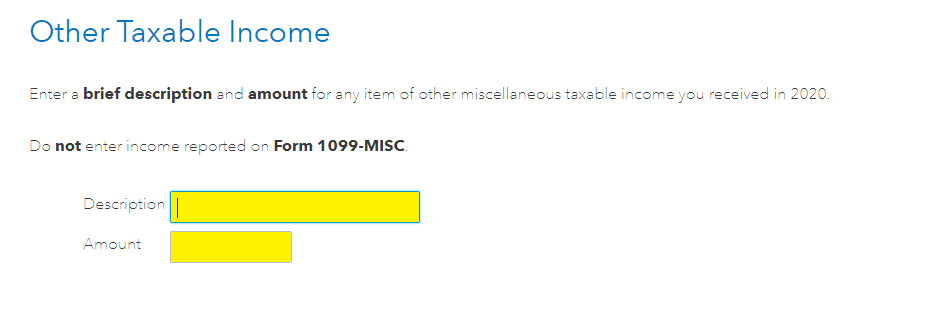

- Any other taxable income answer yes > Enter your description and amount

- See the image below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ponsuke

New Member

Kbird35

Level 2

robert1208

New Member

alexander-fitness26

New Member

elmarcianito666

New Member