- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You are correct. Benefits paid to you as an unemployed member of a union from regular union dues are included in your income on Schedule 1 (Form 1040), line 8. They are not subject to the employee share of social security or Medicare taxes.

Enter the bonus following the instructions below and do not use the 1099-MISC to make your entry.

- Sign into your TurboTax account > Select Wages and Income > Scroll to Less Common Income

- Select Miscellaneous Income, 1099-A, 1099-C, Start or Revisit > Other reportable income, Start or Revisit

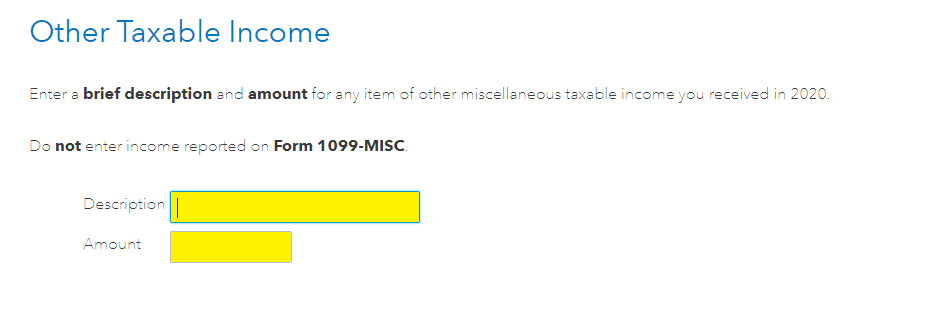

- Any other taxable income answer yes > Enter your description and amount

- See the image below

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 22, 2021

2:02 PM