- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I fix this TT Calculation problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

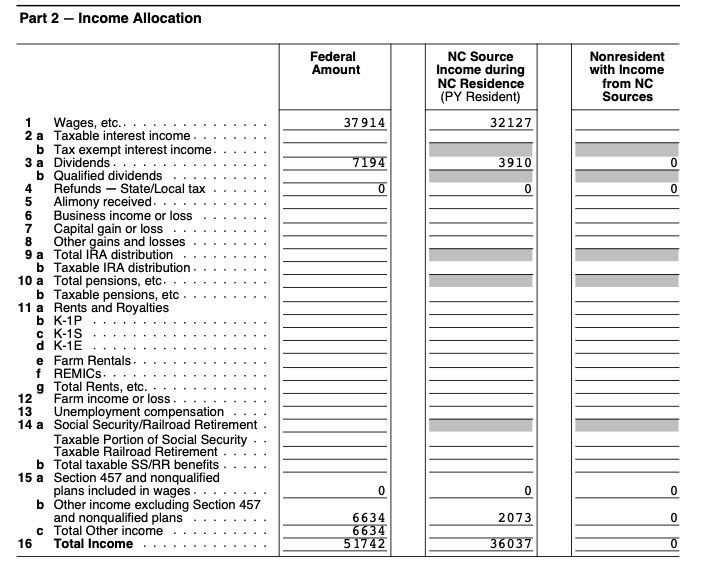

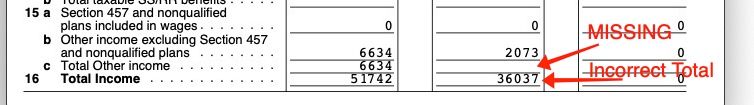

I was a part year resident in NC with $2073 of taxable ESA Coverdell income specifically allocated to NC. The problem is my Total Income for NC on line 16 in the worksheet below is not adding up correctly, it should be $38,110 which is $2073 more than what TT calculates.

There is also a missing entry on this worksheet on line 15C Total Other Income for NC which I believe should be 2073. I know this is a problem since the entry filled in by TT for the NC D400 Sch PN line 15 “Other Income” should be 2073 but its BLANK. TT is flowing $2073 into the state return as shown in the worksheet but the math is messed up and the $2073 is MISSING from D400 Sch PN.

I have deleted the NC state return several times and re-imported from Federal with the same result. The other State Return (MA Part Year) which TT completed is being handled properly for ESA distributions. I tried deleting the NC state forms but it won’t let me I think because it would require deleting Federal forms which I HATE to do since there is so much interaction calculating scholarship/education credit/taxable ESA income and I don’t want to go thru all that again when its finally correct in the Federal and MA returns.

I changed some of the numbers so its not my actual return but you get the idea.

Help please :(

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

I updated my computer for the second time today. I am following along with the same issue except my tax liability is changing when I add the missing information on the PY allocation and it is adding correctly. It is carrying over to the D-400 line 12b. Are you seeing the correct income on the D400 or is your income incorrect? If the actual tax form being sent in is correct, we don't need to worry about a worksheet.

Please update your computer, select online, check for updates, then go back to NC. You may have to do this several times.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

Sorry I'm not sure what you mean by "update my computer". I am using TT Online which I thought was always updated and a desktop mac which has all updates installed for the current operating system. How do I update it ?

My D-400 Line 12b generated by TT is correct but that number only takes into account Federal AGI, Exempted US Debt Obligations and the NC Standard Deduction. It should not include the $2073 ESA distribution.

The NC return is a bit confusing, the NC taxable income (D400 Line 14) is found by first calculating a ratio (D-400 line 13) and then multiplying it by line12b.

In my case, the D-400 Line 13 ratio is Total NC Income/(Federal AGI minus Interest from Federal Obligations.

My "Total NC Income after adjustments" (Line 33 of the previously attached worksheet, Line 33 not shown) is INCORRECT in the worksheet and is being used to calculate the line 13 ratio.

I ran a different online tax program and everything made sense, line 12 b agreed with TT but the Line 13 ratio was different. Their Line 13 calculated my Total NC income which properly included the $2073. TT Line 13 did not.

The problem is that TT is not calculating the proper Total NC income, it's ignoring the $2073 even though it shows up on the worksheet, but only in the rows leading up to the totaled amount, its not included in the TOTAL OTHER INCOME field.

Line 16 is then used to calculate Line 33 of the same worksheet which simply excludes US Govt. Obligations allocated for NC. Line 33 then becomes the true Total NC income after all adjustments and is used to calculate the D400 line 13 ratio.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

Are you still experiencing this problem?

Make sure you have ran all updates.

If using TurboTax Online: Clear your cache and cookies. See this FAQ, for your particular browser.

If using TurboTax Desktop: Please see this FAQ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

Yes I am still having this problem

I've tried three different browsers and cleared cauche/cookies.

This is a turbo tax calculation screw up and the worst part is i've payed for useless software.

TURBO TAX IS NOT HANDLING PART YEAR STATE RETURNS PROPERLY! MA for excluded income and NC for allocated Coverdell income.

I've used TT products for decades but I am severely disappointed in the state products this year. I had problems w/ both MA and NC and made numerous posts on both issues. Spent hours on the phone with support. I ran other tax software that cost 1/4 the price of TT and got the CORRECT TAX for both state returns. TT is majorly under-reporting my income because of these two different TURBO TAX errors. I plan to move again next year so will be forced NOT to use TT since Part Year state returns are inaccurate.

Per TT refund policy, to get a TT product refund I have to try Desktop first which is A. going to force me to PAY to efile the two states (2x$25 = $50) B. There NO guarantee it will fix the problems C. Waste more time even if it works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

It seems the easiest and quickest solution for you would be to use TurboTax Desktop. Then you can manually make your entries directly on the forms wherever you want them.

You would pay to Efile the states either way.

Here's How to Transfer from TurboTax Online to TurboTax Desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

I don't pay to efile state returns when I use TT Online, its part of the price. If I convert to Desktop i will have to pay to efile and what happens if I force a Form entry? Doesn't that invalidate TT accuracy guarantee?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

If you override an entry, it will void the accuracy guarantee. You have done all of the data troubleshooting that makes sense. There is a clear and start over but that would be a lot to do. Another option is to sign up for someone to call you. They can see your screen and may be able to help with the technical side or have a solution to your download issue. See contact support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

I did sign up and had a phone call. They said they could not help me because they couldn't see enough of my screen to confirm the problem. Evidently they could only view the TT screen and not the TT Print Center outputs. They suggested that I Upgrade for an addtional $127 to get an agent who could view more detail.

It's infuriating, I would never have known I had this problem if I did not print the return with worksheets, but TT's refund policy says once you print you can't get a refund!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

richardm75

New Member

1099erGirl

Level 3

Melissa-cooks7

New Member

Kathyyy

Returning Member

mcr12121212

New Member