- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Sorry I'm not sure what you mean by "update my computer". I am using TT Online which I thought was always updated and a desktop mac which has all updates installed for the current operating system. How do I update it ?

My D-400 Line 12b generated by TT is correct but that number only takes into account Federal AGI, Exempted US Debt Obligations and the NC Standard Deduction. It should not include the $2073 ESA distribution.

The NC return is a bit confusing, the NC taxable income (D400 Line 14) is found by first calculating a ratio (D-400 line 13) and then multiplying it by line12b.

In my case, the D-400 Line 13 ratio is Total NC Income/(Federal AGI minus Interest from Federal Obligations.

My "Total NC Income after adjustments" (Line 33 of the previously attached worksheet, Line 33 not shown) is INCORRECT in the worksheet and is being used to calculate the line 13 ratio.

I ran a different online tax program and everything made sense, line 12 b agreed with TT but the Line 13 ratio was different. Their Line 13 calculated my Total NC income which properly included the $2073. TT Line 13 did not.

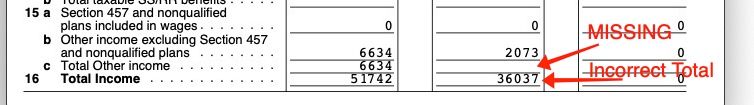

The problem is that TT is not calculating the proper Total NC income, it's ignoring the $2073 even though it shows up on the worksheet, but only in the rows leading up to the totaled amount, its not included in the TOTAL OTHER INCOME field.

Line 16 is then used to calculate Line 33 of the same worksheet which simply excludes US Govt. Obligations allocated for NC. Line 33 then becomes the true Total NC income after all adjustments and is used to calculate the D400 line 13 ratio.