- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fix this TT Calculation problem?

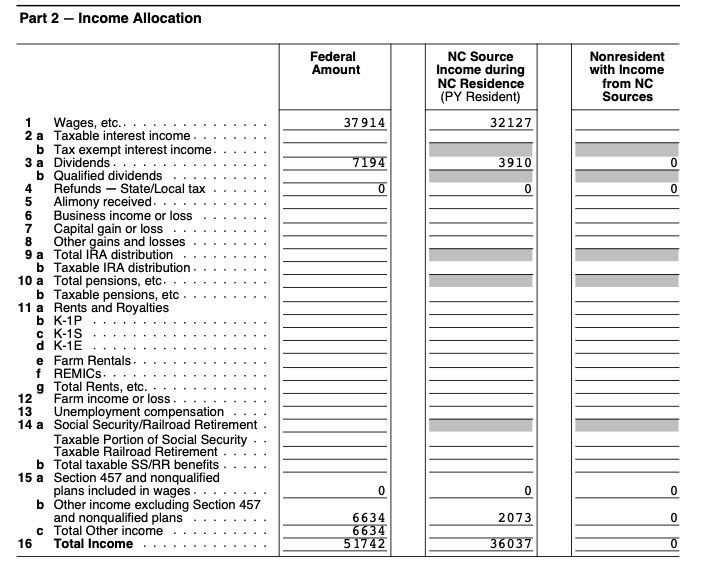

I was a part year resident in NC with $2073 of taxable ESA Coverdell income specifically allocated to NC. The problem is my Total Income for NC on line 16 in the worksheet below is not adding up correctly, it should be $38,110 which is $2073 more than what TT calculates.

There is also a missing entry on this worksheet on line 15C Total Other Income for NC which I believe should be 2073. I know this is a problem since the entry filled in by TT for the NC D400 Sch PN line 15 “Other Income” should be 2073 but its BLANK. TT is flowing $2073 into the state return as shown in the worksheet but the math is messed up and the $2073 is MISSING from D400 Sch PN.

I have deleted the NC state return several times and re-imported from Federal with the same result. The other State Return (MA Part Year) which TT completed is being handled properly for ESA distributions. I tried deleting the NC state forms but it won’t let me I think because it would require deleting Federal forms which I HATE to do since there is so much interaction calculating scholarship/education credit/taxable ESA income and I don’t want to go thru all that again when its finally correct in the Federal and MA returns.

I changed some of the numbers so its not my actual return but you get the idea.

Help please :(