- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I file nys quarterly estimated taxes with turbotax home pc electronically? NYS says the software will do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file nys quarterly estimated taxes with turbotax home pc electronically? NYS says the software will do it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file nys quarterly estimated taxes with turbotax home pc electronically? NYS says the software will do it?

TurboTax cannot electronically file federal or state estimated tax payments.

See this TurboTax support FAQ for state estimated taxes - https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-payments/turbotax-calculate-estimate...

New York website for paying state estimated taxes online - https://www.tax.ny.gov/pay/ind/pay-estimated-tax.htm

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file nys quarterly estimated taxes with turbotax home pc electronically? NYS says the software will do it?

NY is a bit special for those....most states don't allow you to set up those estimated payments thru the software.

Several years ago, the NY software, it did allow you to "arrange" the setup of NY quarterly estimated tax payments (but that was back for 2017, don't know if they still do).

However, this would be done at the time you e-filed the original NY tax return.....and I kind-of doubt the software allows it to be done separately later. Even if done thru the software at the time you filed your original tax return....TTX would only transmit the data to NY, and then NY would actually do the debit according to how you set it up.

______________

At this time of year....Just paying it thru the NY website (using the NY weblink @DoninGA indicated) is probably easiest and avoids any potential software complications and finger-pointing as to who is responsible for getting it done.

___________________________________

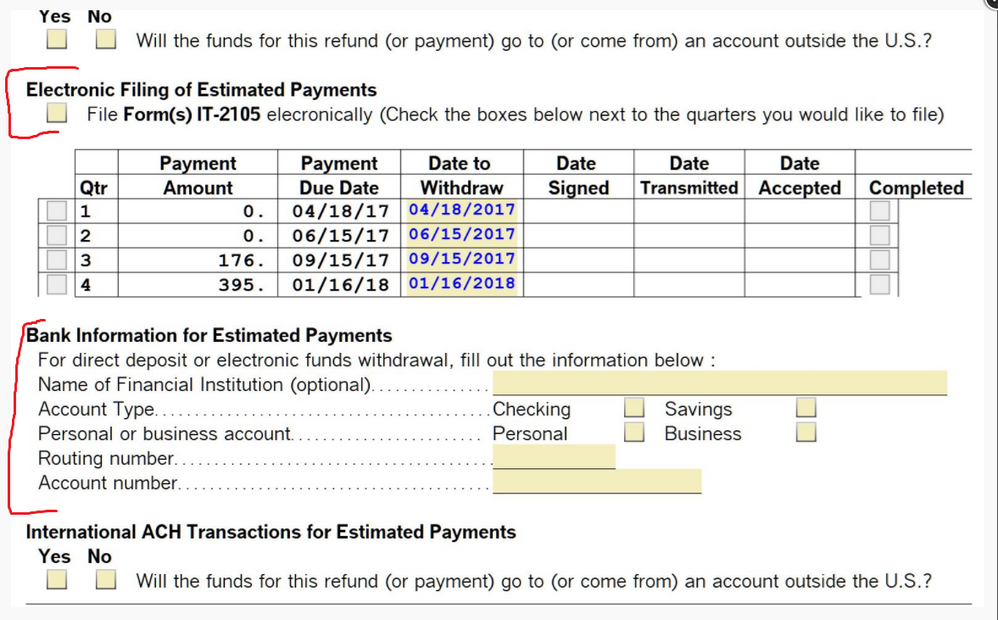

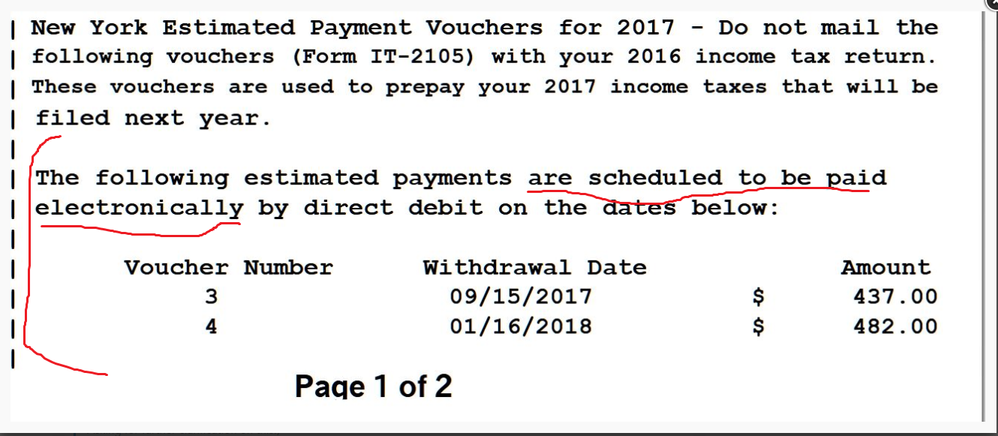

Here's some pictures from several years ago where the NY payments were set up with the desktop software at time of filing:

1) Part of the NY Information Worksheet in Forms Mode

2) Section of the Electronic Filing instructions sheet when filed (different $$ amounts though)

______________________________

_____________________________

____________________________

______________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

johntheretiree

Level 2

doug-sue98

New Member

CI Guy

Level 2

KenC2917

New Member