- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Got stuck at 1065 form filing using Turbotax Business. Please help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

Your partnership is filing the Georgia state return, so use that name and entity number. TurboTax should correctly complete this for you on GA 700.

If there is any question at the state level (unlikely), you will receive an inquiry letter that you can respond to with additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

Thank you. We are done with Federal 1065 and K-1s. Now for individual 1040, how to "dispose" the previous information on rentals? I got the following screenshot. It seems we can check "convert from personal to rental in 2022"? I assume the software will import K-1 information and not duplicate it on sch E of 1040, right?

I am not sure if we should delete the entries completely and it may cause problems for turbotax home&business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

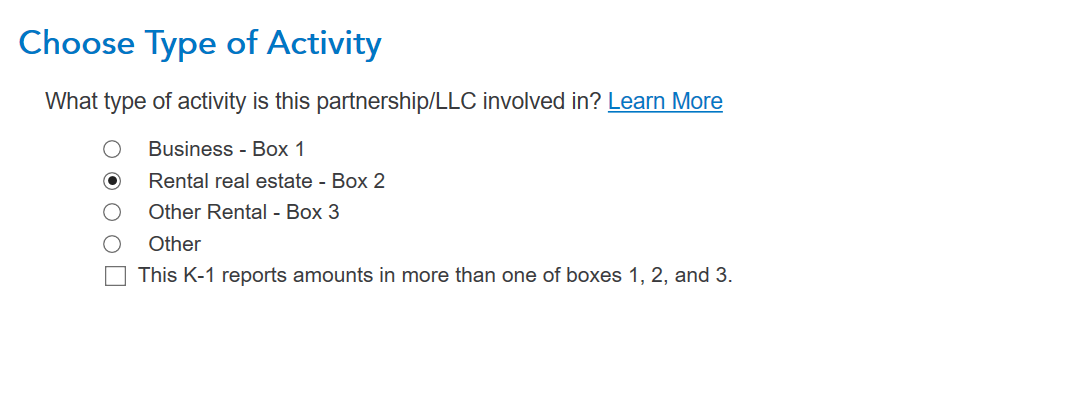

You don't have to go on this screen at all. Here's what you do. Enter the rental activity through the partnership's K-1 in here

On top, Personal Income/ Sch K-1/Partnerships. Enter all your partnership information till you get to this screen

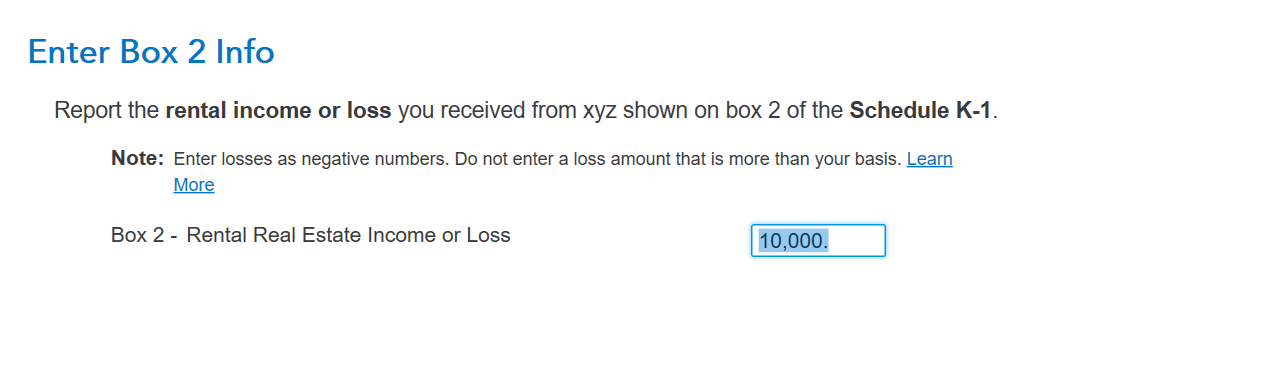

then enter your rental activity here

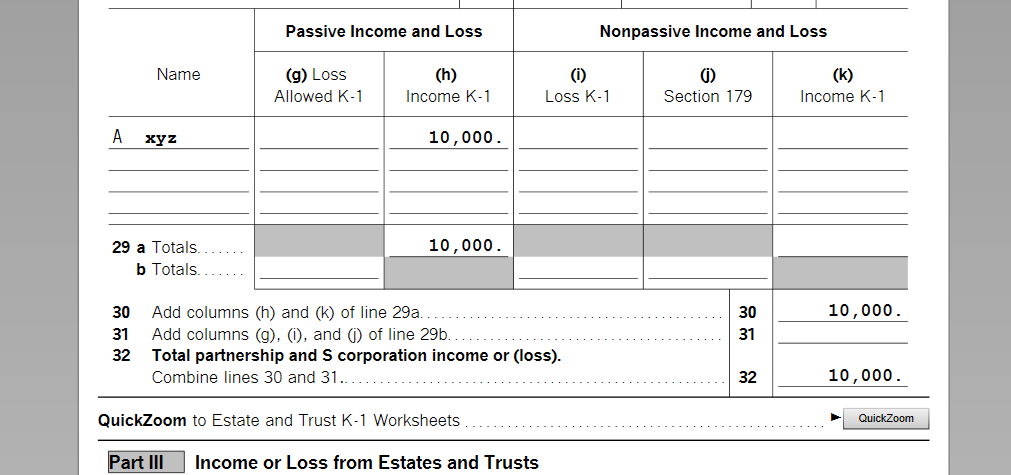

This will flow through to Sch E , pg 2. and recorded as income there. Depending if you qualify as a real estate professional or not your activity in the llc will make you income to subject to the passive or nonpassive rules. See here Sch E, pg. 2

Also check out form 8582, pg. 1 and 2.

For more information on passive activity rules re; rental activity . See HERE under the Section Rental Activities

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

Appreciate it. I did what you said (imported K-1 under personal income). Two questions:

1. Turbotax still carried over from previous year (2021) rental properties information such as depreciation and automatically populated another sch E under "Business income and expenses" of "business". Now I have two versions of Schedule Es that obviously overlap with each other. In "Forms" format, I can see copy 1/ copy 2 of Schedule Es that shows both K-1's inputs as well as individual rental property info. How do I get rid of 2021's carried over Schedule E? Can I simply click delete in the list of rental properties under old "schedule E" (screen shot below)?

2. In one of the answers here to similar situation as mine:

https://www.justanswer.com/tax/00v3x-transferring-rental-property-partnership.html

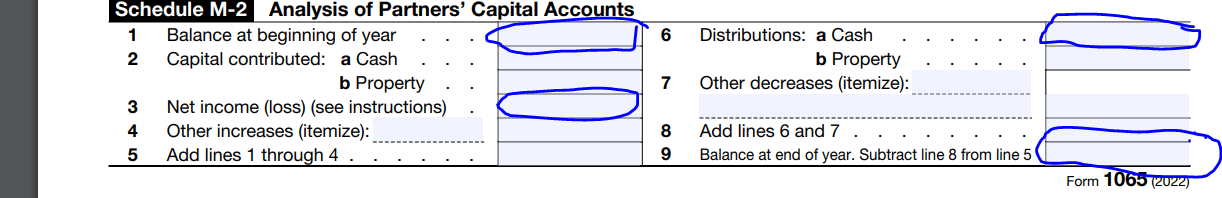

It mentioned "There is an area on page 4 of the 1065 (Schedule M-2, line 2B for property contributed) where the capital contributions are reflected.".

That "capital contribution" in my K-1 is 0 because I didn't know these properties should be considered as contribution. Should I correct this? I somehow get the balance sheet balanced without having this number filled (which theoretically should be the total rental property asset minus liabilities at the start date of holding LLC?)

Appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

Yes, you need to fix that.

Assuming you set the holding company up in 2022, you need to "dispose" of the properties on your personal return as of the date the holding company took over. You will dispose of the property at your basis (or value - so no gain or loss) and contribute it to the holding company at the same basis. This should give you 2 pages of Schedule E (since rentals are reported on a different page than K-1 income) and not 2 actual Schedule Es.

If you set the holding company up prior to 2022, you will need to go back and amend 2021 returns to reflect the holding company setup and ownership of the properties correctly. Also, if this is the case, you may want to seek help from a tax professional in your area to assure yourself you get it all set right.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

Thank you. I did it in 2022 so it should be the first year. Do I check the one below (convert from rental to personal) to dispose it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

Yes, that's correct.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

Many thanks for the quick response! For 1065 sch M-2 line 2b "property contributed", should it be equal to schedule L's line 21 d (end of year capital account)? 2022 was the first year for this LLC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

It would be the beginning capital plus any income added less distributions. See here

Good luck.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got stuck at 1065 form filing using Turbotax Business. Please help!

9/3/24

I have similar LLCs structure for my rental business, ie. WY holding partnership LLC with disregarded single member Maryland LLC and Arkansas LLC. Do I need to file WY state return or Arkansas return besides the Form 1065, SchK1 for WY LLC? Many thanks!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

noodles8843

New Member

asrogers

New Member

qmanivan

New Member

4md

New Member

mread6153

New Member