- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You don't have to go on this screen at all. Here's what you do. Enter the rental activity through the partnership's K-1 in here

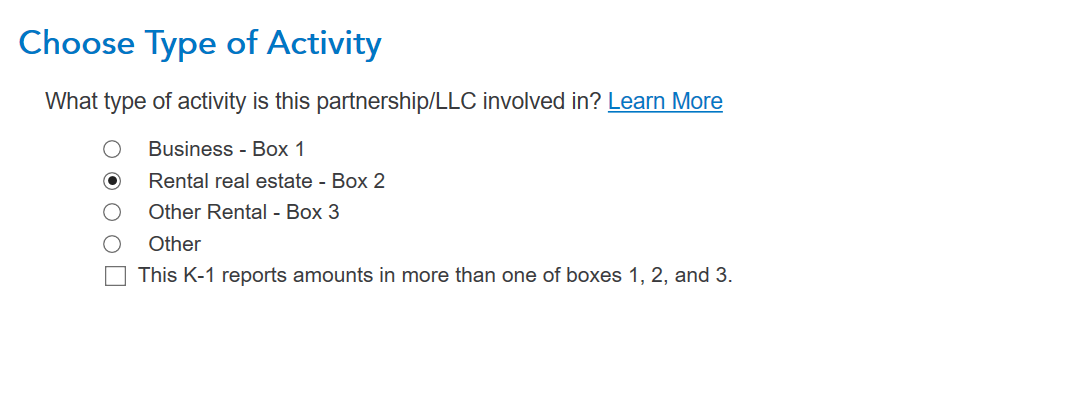

On top, Personal Income/ Sch K-1/Partnerships. Enter all your partnership information till you get to this screen

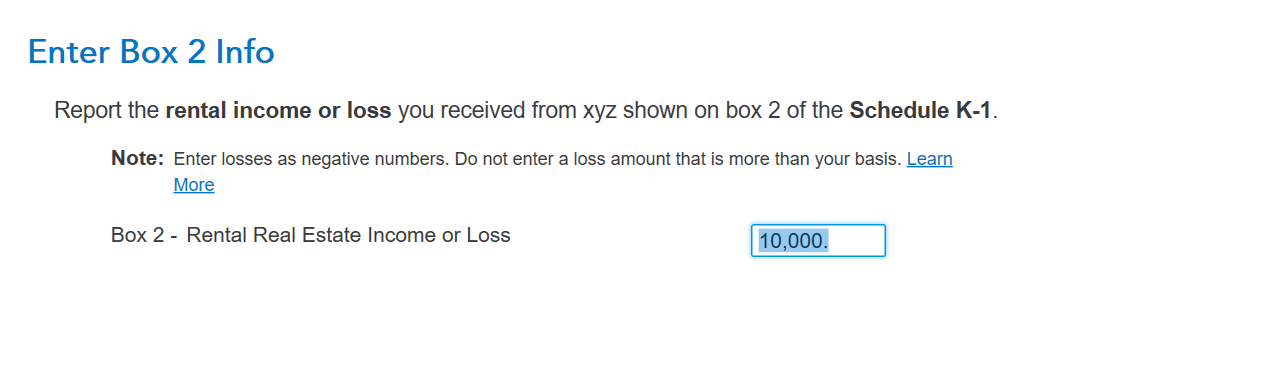

then enter your rental activity here

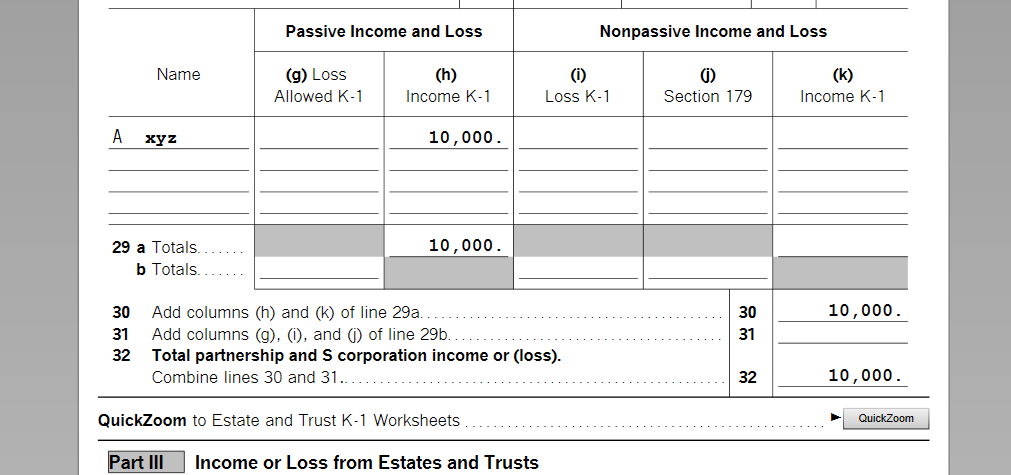

This will flow through to Sch E , pg 2. and recorded as income there. Depending if you qualify as a real estate professional or not your activity in the llc will make you income to subject to the passive or nonpassive rules. See here Sch E, pg. 2

Also check out form 8582, pg. 1 and 2.

For more information on passive activity rules re; rental activity . See HERE under the Section Rental Activities

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 21, 2023

9:41 AM