- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 1099B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

How do I add Prepaid Federal Taxes from Form 1099-B, Block 4, into Turbo Tax?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

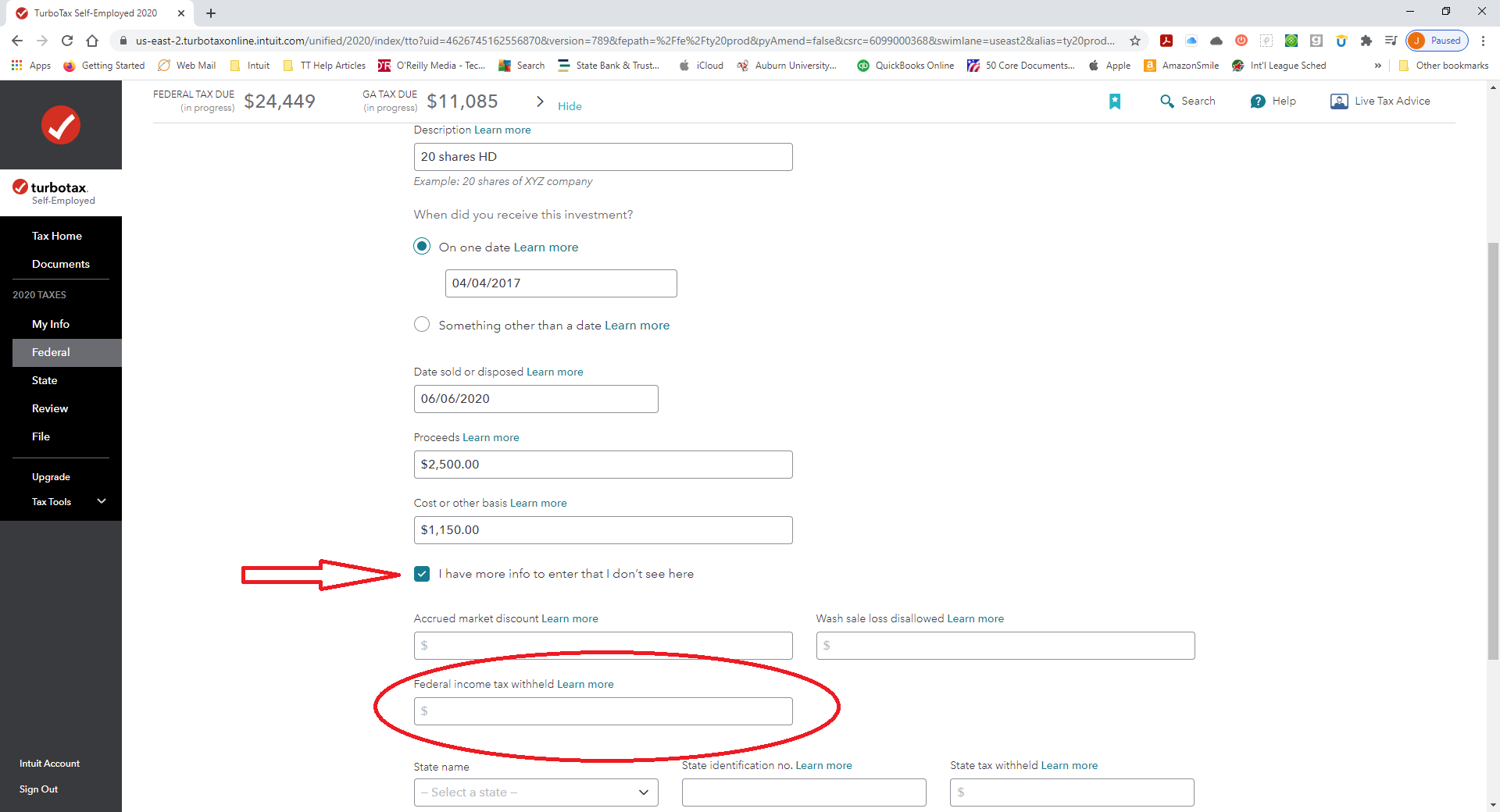

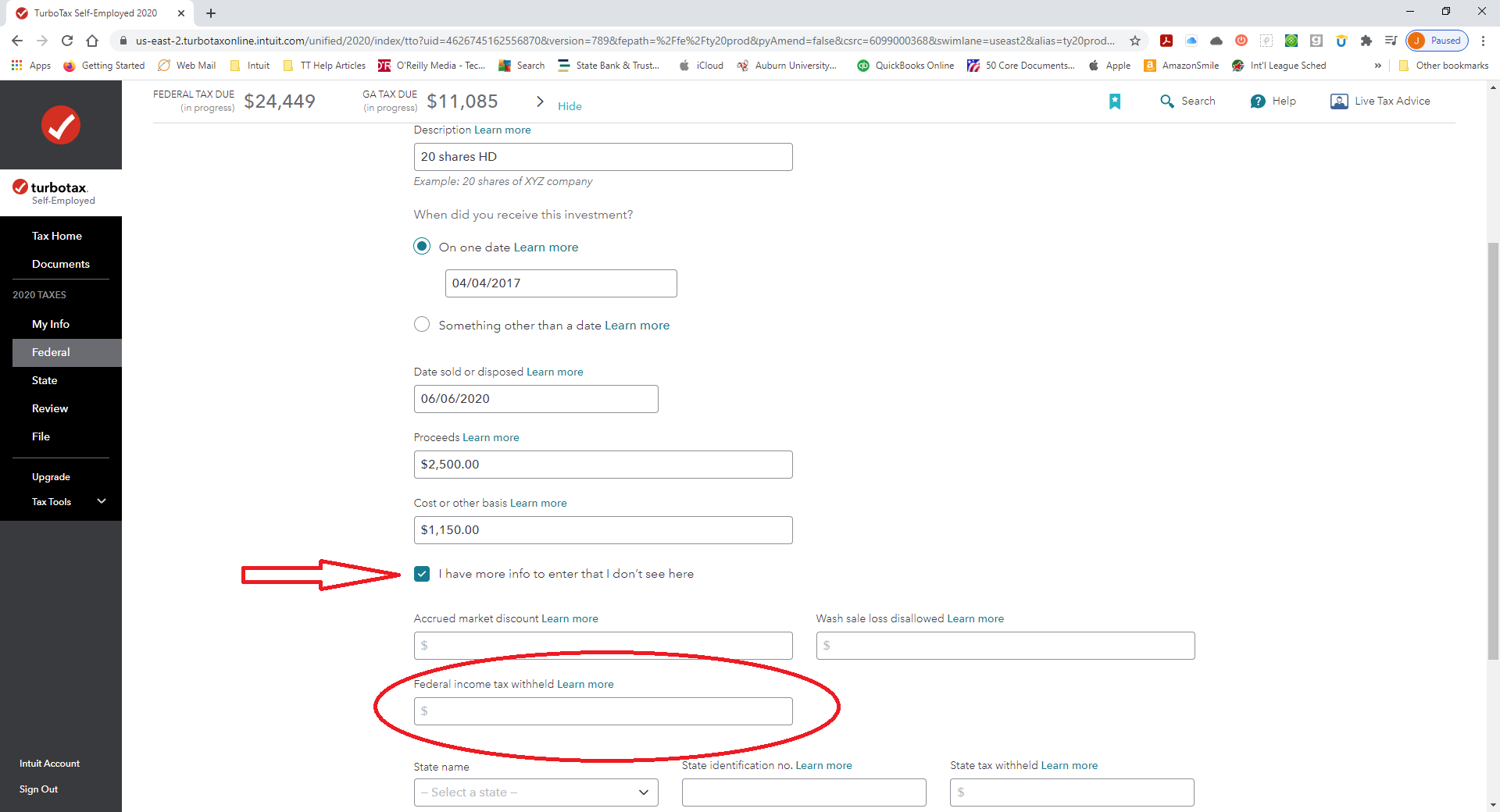

The screen where you enter investment sales reported on Form 1099-B, has an entry box for tax withheld. To display that entry box. you have to check the box to indicate "I have more info to enter that I don't see here". When you check that, it triggers the program to display more entry boxes, including taxes withheld. See screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

in Turbotax there is a tax payment worksheet where there's a place to enter withholding reported on 1099-B

alternatively, the 1099-B worksheet also has lines for federal withholding

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

The screen where you enter investment sales reported on Form 1099-B, has an entry box for tax withheld. To display that entry box. you have to check the box to indicate "I have more info to enter that I don't see here". When you check that, it triggers the program to display more entry boxes, including taxes withheld. See screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

I DONT have a DATE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

I DONT have that FORM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

A Date for what? You have added on to a post about 1099B withholding.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099B

If you do not have a "DATE" for when you acquired the investment (stock, mutual fund, bond or other), then you will have to select one that accurately reflects your holding period.

If you held the investment for at least one year, then you can select any date that is a year or more before the date you sold the investment. The program will then report this as a long-term (> or = 1 year) gain or loss.

If you held the investment for less than one year, then you can enter 01/01/2020 as the date acquired. For any sale later in 2020, the program will report this as a short-term (< 1 year) gain or loss.

If you do not have a "DATE" for when you sold the investment (stock, mutual fund, bond or other), then enter 12/31/2020.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kherder1

Returning Member

tbs7184

New Member

DAVE1610

Level 2

starkyfubbs

Level 4

thompson-jared-79

New Member