- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Foreign Earned Income Exclusion Help (Advice Please)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Help (Advice Please)

I have asked this (and many other questions) already. I hope this to be the last time or else I will do what I think is right from the prompts that TurboTax shows.

Question 1:

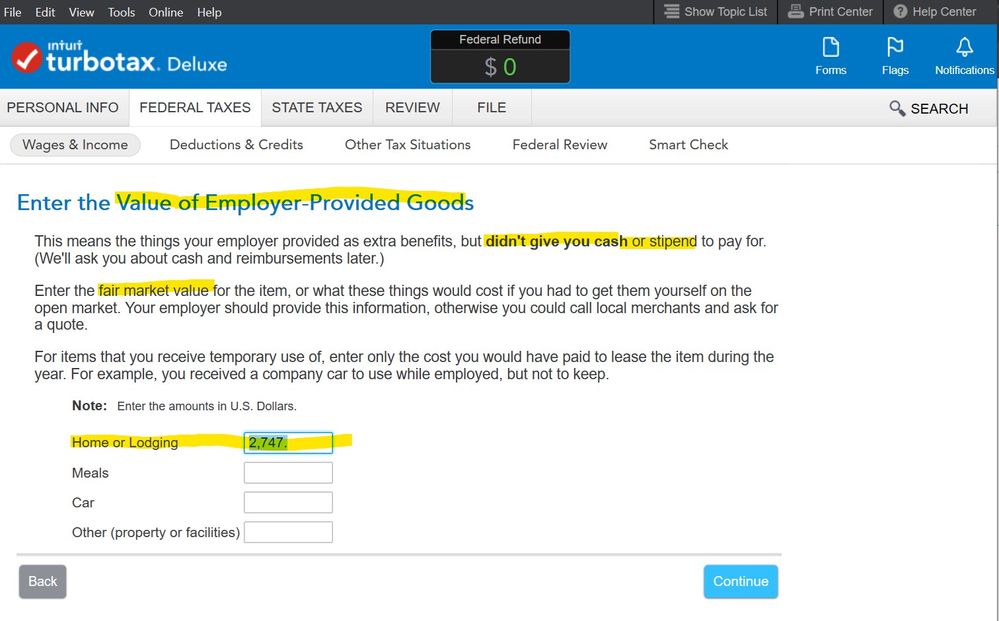

For the first part of the 2022 year, I had foreign employer-provided housing which I inputted the amount on a previous page that said the fair value of the housing.

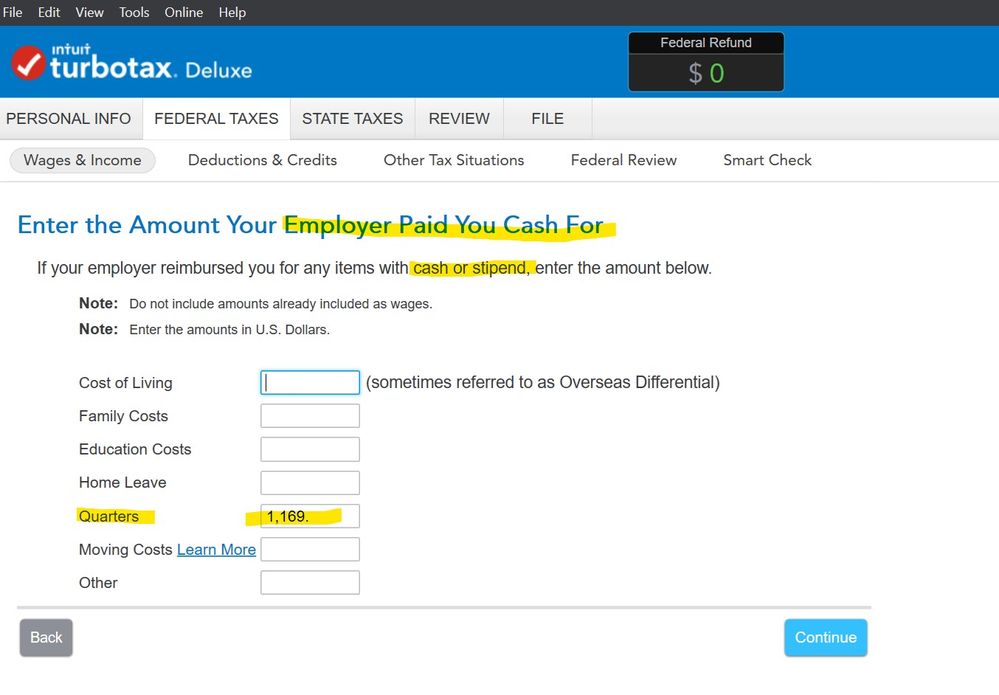

For the second part of 2022, I received a HOUSING ALLOWANCE (CASH STIPEND) in lieu of housing. I inputted this on another page which showed money paid in cash for "Quarters" by the foreign employee.

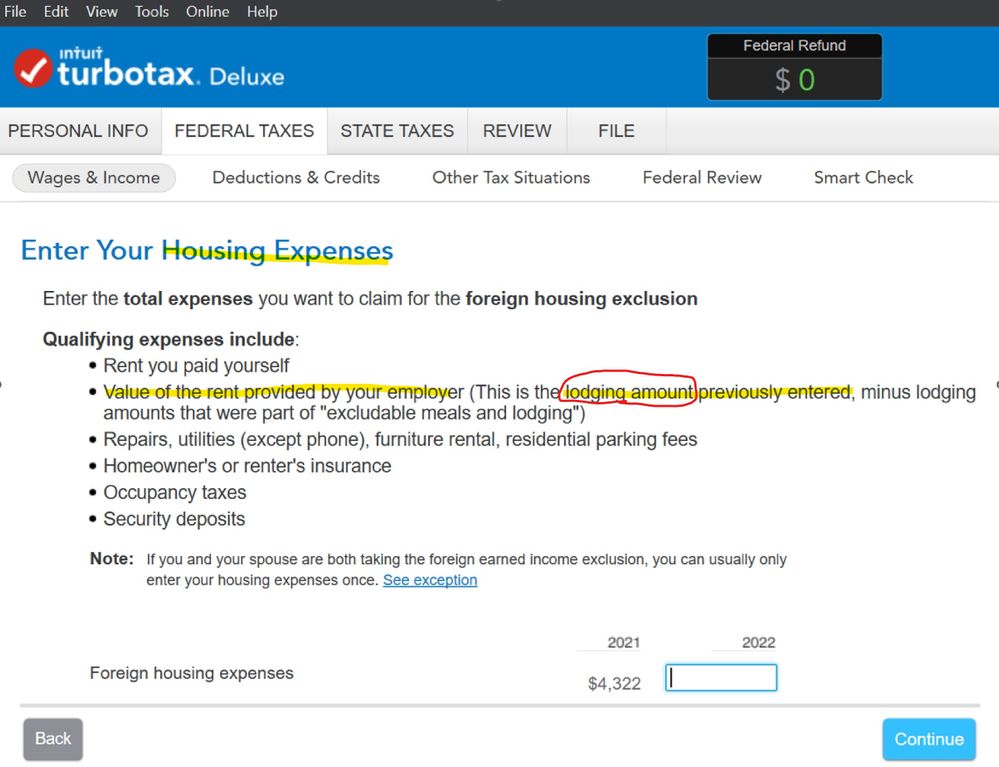

For the Foreign housing expenses, do I only include the first part (value of the foreign employer-provided housing)? Or the combination of both the employer-provided housing market value AND the CASH provided in the housing allowance (cash stipend)? I didn't fully use the cash stipend directly towards rent and I don't want to itemize all of the other things on there (utilities, taxes, etc.).

For now, I just put the foreign employer-provided housing only ($2746.54). But, if I need to add the housing allowance (cash stipend $1,168.80) to it, I can.

TurboTax has 3 screens related to this.

The 1st one asks for FMV of lodging provided by the employer, the 2nd one is this where it asks for CASH provided for things like moving or quarters (so, housing/lodging stipend goes here). [Screenshots below]

The 3rd part asks me what the value is for the Foreign Housing Exclusion and I was confused if I put in just the amount from the 1st one, or 1st+2nd combined. With the way it's worded (in the 3rd part), I think, I should just put the 1st value... [TurboTax just says it as "Value of the rent provided by your employer (This is the lodging amount previously entered...)" Sometimes when I read it, it sounds like only the first part (FMV of employer provided housing)]

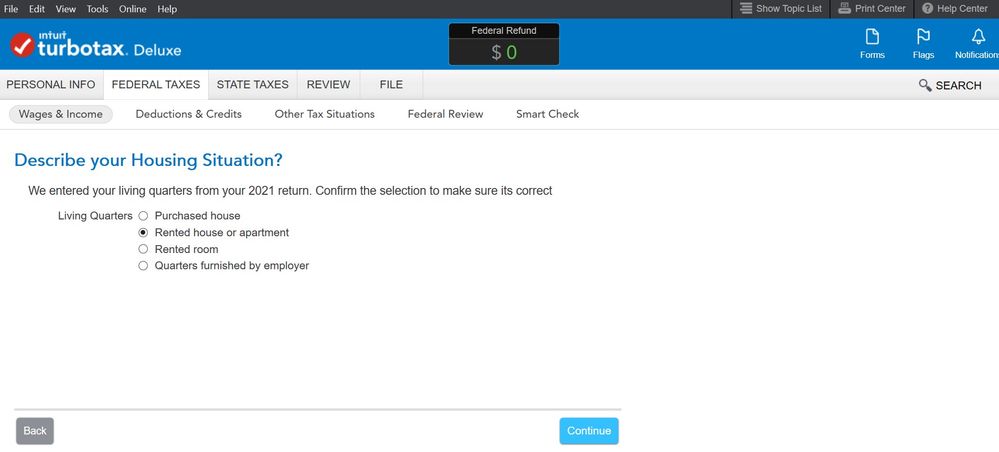

Quick secondary question: Since I lived at BOTH employer-provided housing (at the beginning of year for 7 months) and then moved to an unrelated apartment with an extra cash stipend from the employer (for the last 5 months of the year). How do I answer this question? I was going to pick "rented house or apartment" as that was the condition at the end of the tax year. Does this matter? I technically was at employer-provided housing for longer, but at the end of the year, I was at an unrelated house getting the stipend. As you can see, I inputted values for BOTH employer-provided housing (lodging) AND for cash stipends for housing allowance (quarters) on previous pages.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Help (Advice Please)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Help (Advice Please)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Help (Advice Please)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Help (Advice Please)

Don't duplicate posts.

See my response to your original post.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Help (Advice Please)

Sorry. I edited this one to include everything and see if I could get a reply. I think you're right because I always had a TurboTax person or someone reply really fast when I asked in March or April... but I applied for the extension this time. I just have an irrational fear of making a mistake with the IRS. I don't even owe anything or get a refund since I'm an expat who qualifies for the FEIE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Help (Advice Please)

Hi Shanesnh,

I was away for a long weekend.

To answer your questions, when the questions ask for the Value of employer provided goods, when the employer didn't give you a stipend or cash, it is referring to the Fair Market Value (the going rate) say for rent for example. In other words what you would have paid for those items had you had to pay for those employer provided goods yourself.

The second screen asks for the cash you received from your employer to cover your expenses. This is self explanatory. What did you receive from your employer to cover the costs of those items lists.

If you paid for expenses (rent, etc,) yourself and you want to claim those expenses for the FEIE you enter the amount of money you spent for those qualifying expenses.

I hope this helps. You are always welcome to call us at 1-800-446-8848.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tonyaboukhalil

New Member

malvinchip

New Member

Charliepdl2

New Member

Meloniek74

Level 1

santoayani

New Member