in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Fees

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fees

I just submitted my federal and state tax returns through TurboTax e-file. I have the Deluxe Version of TurboTax that had one free federal e-file and $20 to e-file with NC in 2022. However, this year they are charging $40 to submit your federal return and $25 to file your state return. There was no information about this fee until just before you e-file the returns. This information should be disclosed at the beginning of creating a return not just before you file. I feel this is a very deceptive practice and should be reported to the IRS.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fees

Using the TurboTax desktop editions you have 5 free federal tax return e-files included with the program,

There is a state e-file charge which is currently $25 after the March 1 price increase to the standard fee from early filing fee of $20.

The reason you see the $40 charge is that you selected to have the TurboTax fees, which would be the state e-file charge, paid from your federal tax refund instead of paying the fee with a credit or debit card.

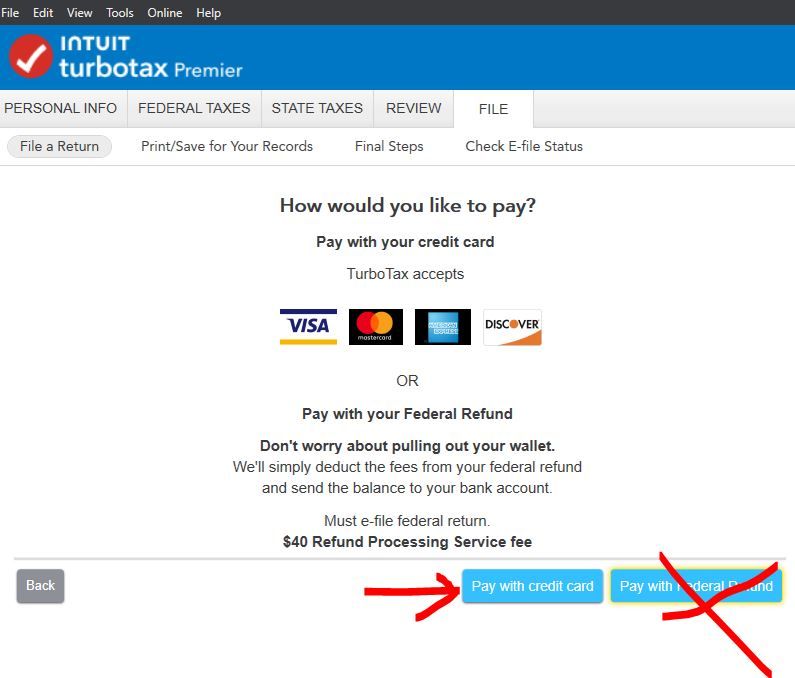

You were shown this screen -

Go back and start the File section again and you will come to a screen detailing your charges. Select to remove the pay with refund fee. Then pay the $25 state e-file fee with a credit card.

Or if you do not want to pay the fee then select to print and mail the state tax return to avoid the fee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fees

1) The state e-file fee is $20 before March 1 and $25 after. This is disclosed in some of the ** squint print about filing state before 1 March for the $20 to be used.....but seeing that notice may depend on exactly where and how you bought your software.....form TTX, at the store..or on Amazon etc. BUT, that $20-$25 date change has been in effect every year, for at least 15 years now.

2) I suspect the $40 was because somehow you added Audit protection....[[OK: apparently not Audit Protect...that may have been bumped to $45 now.]]

______Added Later

OR

3) Oh yeah, as @DoninGA noted, always the fee to pay the software fee with your federal refund !!

SO IT COSTS YOU $40 MORE TO PAY THE $25 state efile fee. NEVER select That !!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fees

@SteamTrain Just was going through a test return using desktop and noticed the Audit Defense charge has bumped up to $45. And the return was not a California return. Looks like the March 1 price increase also affected Audit Defense.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

berlinbarb

New Member

tifftash888

New Member

siufilm

New Member

user17729594904

New Member

markgilsey

New Member