- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Employer stock sales on both W-2 and 1099 are double counted and taxed

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Thanks Tom for the quick response and for sharing the screenshots. Yes they are NQSOs; they were exercised and sold on the same day, so I believe they are cashless transactions. TT uploaded my etrade account info automatically so I didn't see any screen resembling the "Enter Your Purchase (Exercise) Information" you pasted into your response.

Instead, I chose to edit and then adjust my cost basis for each transaction, by checking the box: "The cost basis is incorrect or missing on my 1099-B." That takes me to a screen that allows me to say who the shares belonged to, select the employer listed in our W2s, and the number of shares sold. The next screen is where I entered details from each trade confirm: Date options were granted, Exercise price (per share), Number of shares exercised and Exercise commissions or fees paid.

I followed the above steps for all 12 transactions. Side note, yes the compensation is included in the W2, both in box 1 and separately as "V" in box 12a. For each trade, I have an exercise confirmation that shows grant date/number/type/price, sale price, exercise market value, share exercised, total gain, taxable gain, gross proceeds, total price, commission fee, taxes withheld, and net proceeds (nothing that specifically spells out cost basis).

Interestingly, TT is flagging my line 18 as an error because Column E is more than Column G. In the screenshot you sent, you have the same situation (e=90, while g=89.9). When I get to the Federal Review on TT, the Employer Stock Worksheet shows my first trade column e value is $191.42, and column g's value is listed as 191.32. I can't find that 191.32 value on any etrade document. Where is it coming from? On my first trade confirm, the "sale price" which I presume goes in column (e) is $191.42 and the "Exercise Market Value," presumably column (g), is $191.58. I just don't see that field you shared "Market Price on Date Options Were Exercised (per share)" anywhere on my TT screens.

Could this be my problem: I started my return using the self-employed version of Turbo Tax. Should/Can I switch to Premier to find the right questions for stock option sales? Will that solve my issue??

thanks again for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

That will not solve your issue since all Turbo Tax Products are upwardly compatible. What works in Premier should work in TT Self-Employed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

"That takes me to a screen that allows me to say who the shares belonged to, select the employer listed in our W2s, and the number of shares sold. The next screen is where I entered details from each trade confirm: Date options were granted, Exercise price (per share), Number of shares exercised and Exercise commissions or fees paid."

Somehow, and I don't know how, you've stumbled into the "guided" interview, and have entered something incorrectly. The questions you've mentioned can only come from those interviews.

The "normal" way of entering a stock sale, i.e., not guided, is to enter the sale exactly as it reads on the 1099-B, click the "I'll enter additional info on my own" button and on the next page enter the correct basis in the box titled "Corrected cost basis", and that's it. There's nothing else to do, no other questions to answer.

It appears that you entered the wrong exercise price for the option, maybe the stated per share selling price, and TurboTax has calculated a per share FMV based on the net proceeds;that would put you in the error position that's being reported.

You can either go back through the interviews and fix the exercise price figure or delete the trades completely and just use the regular interview, correcting the basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

@TomYoung Well, something is just not adding up. I see what you're saying and I think "TurboTax has calculated a per share FMV based on the net proceeds" is a likely culprit because I don't even have a box to enter a FMV figure. So I deleted the entire section and started over. This is what I see (note, I'm using the online version of TT Self Employed).

On the Income & Expenses section, I chose: Investment Income (1099-B or broker statements), then, "Stocks, Mutual Funds, Bonds, Other." Here are the interview questions that come up:

- Did you sell stocks, mutual funds, bonds, or other investments in 2019? My answer: "Yes"

- Did or will you receive a 1099-B form or brokerage statement for these sales? My answer: "Yes"

- Let's get your tax info...This time, I skipped the auto import and clicked "I'll Type it in Myself"

- Which bank or brokerage sent you this form? I typed in ETrade + my account number

- Do these sales include any employee stock? (This includes ESPP, RSU, RS, NQSO, and ISO) My answer: "Yes"

- How many sales are on your 1099-B form? My answer: "More than a few (4+)"

- We strongly recommend entering your sales from your broker one at a time. I chose "continue" instead of I'll enter a summary instead

- Now we'll walk you through entering the info on your 1099-B:

- What type of investment did you sell? My answer: "Nonqualified stock options (NQSO)

- What is the sales category? My answer: "Box A - Short term covered" (per my 1099B)

- Box 1a - Description. My answer: "210 Shares Company Class A Stock" (per my 1099B)

- Box 1b -The date this investment was acquired. My answer: "04/17/2019" (Per my 1099B)

- Box 1c - Date sold or disposed. My answer: "04/17/2019" (Per my 1099B)

- Box 1d - Proceeds. My answer: "$40,177.43" (Per my 1099B)

- Box 1e - Cost or other basis. My answer "$36,138.90" (Per my 1099B)

From here, I have 2 options. If I just hit "Continue" the next screen says:

"Let us know if you'd like to make any changes to the cost basis"

Alternately, there is a box I can check that says: "The cost basis is incorrect or missing on my 1099-B" If I check that box and then hit continue, the next screen says:

- Next, we'll help you figure out your cost basis. Since you’re unsure about your cost basis, we're going to walk you through figuring out your cost basis to make sure it's reported correctly.

- Tell us about your NQSO sale. Who did the stock belong to? I chose the correct person listed

- Which employer is this for? I chose: "It's for an employer that has an existing W-2 on this return," and then I selected that employer from the drop down box

- Number of shares sold. My answer: 210

- Was this a cashless exercise (also known as a same-day sale)? My answer: Yes

- Next, we'll get some details about the NQSO shares you sold. To accurately report your NQSO sale, you'll have to enter info that you should have received in a statement from your brokerage. Let's get some purchase (exercise) info about this NQSO sale:

- Date options were granted. My answer: "04/21/2017" (per the etrade exercise confirmation)

- Exercise price (per share). My answer: "$191.42" (listed as the "Sale Price" on the etrade exercise confirmation)

- Number of shares exercised. My answer: "210" (listed as "Shares Exercised" on the etrade exercise confirmation)

- Exercise commissions or fees paid. My answer: "20.79" (listed as Commission/Fee on the etrade exercise confirmation)

The next screen is a review screen/summary of trades entered, titled "Review your purchase info for the shares you sold." I hit "Done"

Last 2 screens/questions are (1) Does the cost basis need to be adjusted as result of a stock split or reverse split? (I chose No) and (2) Does the cost basis need to be adjusted as result of reinvested dividends? (I again chose No)

At this point TT gives a summary that says: We've adjusted your cost basis for you to be $40,218.99.

The next screen says: Here are your E-Trade sales

| Description | Date Sold or Disposed | Sales Category | Proceeds | Cost Basis | Adjustment | Gain/Loss |

| Company Class A 210 Shares | 04/17/2019 | Box A | $40,177.43 | $36,138.90 | -$4,080.09 | -$41.56 |

If I stop there and head to the federal review, I already have the same line 18 error. Box e shows $191.42, box g (which I did not enter anywhere) shows $191.3211

Is there some other "normal" way of entering stock sale info? I never see a button called: "I'll enter additional info on my own." Maybe I can avoid this if I can learn how to calculate the basis on my own and can just enter it on the "I know my cost basis and need to make an adjustment" screen. OR, is there something strange going on with TT and I should call a rep to see if they can help me figure out why I don't get the screen you're referencing?

Sorry to be taking up so much of your time on this. I really appreciate your answers/help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

When Intuit switched from the "SuperUser" program to the "Champions" program I opted not to transitions so it's clear that I'm out of the loop to a certain extent.

I use the desktop program exclusively and have never used the online program. (I'd guess that 95% of the former SuperUsers also used the desktop program instead of the online one. The desktop program has some distinct advantages over the online program, one of the most important being that all the Forms, Schedules and Worksheets are always available to you and access to those can be invaluable to you if you're confused about the program or if you want to see if you can make sense of the program output.)

The 1099-B interview you've listed out for the online program mimics the desktop version until you hit this question: "Do these sales include any employee stock? (This includes ESPP, RSU, RS, NQSO, and ISO)". That question simply does not exist in the desktop program so now we know where the disconnect in understanding between us is occurring, and that's the question that's shunting you off to the "guided" interviews.

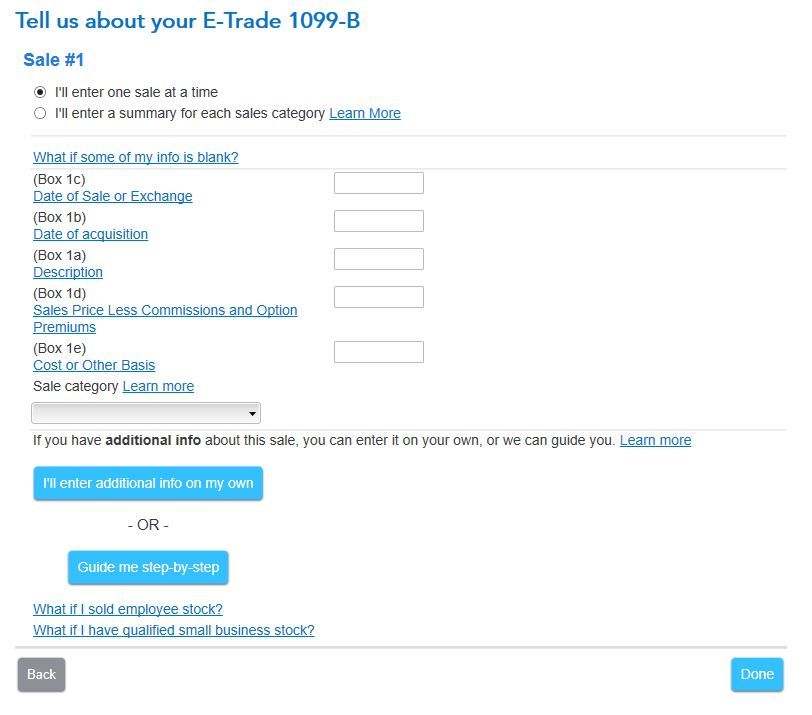

In the desktop program, after entering the brokerage information, you're then asked if you want to enter trades one at a time or in summary fashion, and if you answer "one at a time" you're presented with the basic 1099-B entry page:

I worked through your detail and can see where the numbers are coming from and I can also see that the program has, apparently, doubled your loss.

Do you know your basis? Per share, your basis is what you paid to exercise the option, (probably $36,138.90/210 = $172.09) plus the per share "fair market value" used by your employer to calculate the spread between what the stock cost you and what it was worth at exercise. That works out to your per share basis being the same as the per share FMV used by your employer. Your big mistake is telling the program that your exercise price is $191.42, and it's not; that's the per share selling price.

If you know your basis, and you should, then delete the trade, (TurboTax sometimes is "sticky" with information if your simply try to change things), answer "No" to the "Employee stock?" question and use the "standard" stock sale process. Enter the 1099-B information as it reads, click the "I'll enter additional info on my own" button, and on the next page enter the correct basis to use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Just found your response now...thank you so much for sticking with me and confirming that I'm not crazy for not seeing what you're seeing! I'm going to get there eventually.

Okay, I deleted my trade and started again. This time, instead of marking "YES" to Do these sales include any employee stock? This includes ESPP, RSU, RS, NQSO, and ISO, I chose "NO". I then had to say "YES" to "Did you purchase all of these investments?Any inherited or gifted investments are not considered purchased."

Next I chose to enter my sales one by one and I got to the screen that says: Now we'll walk you through entering the info on your etrade 1099-B.

- What type of investment did you sell? My answer: Stock (non-employee)

- After that, same questions as before (Boxes 1a-1e)

- I marked the box that says: The cost basis is incorrect or missing on my 1099-B

- The next screen is: Let us know if any of these situations apply to this saleSelect all that apply.I paid sales expenses that aren't included in the sale proceeds reported on the formBox 2 of my 1099-B has "ordinary" checkedI need to correct the holding periodThis was a small business stockThis was a worthless securityThis was a stock to an employment stock ownership plan (ESOP) or eligible worker–owned cooperative (EWOC).None of these apply (this is what I checked)The next screen has a slightly different heading, but the same interview questions:We noticed there's an issue with your cost basis...Let us know if you'd like to make any changesBecause the cost basis was incorrect or missing on your 1099-B, we recommend reviewing your cost basis to make sure it's reported correctly.We've got your back and can help you figure out the correct cost basis so that you don't pay more taxes than you should.I need help figuring out my cost basisI know my cost basis and need to make an adjustmentI don't want to make any changes to my cost basis right nowI'm asked to input the number of shares (210), Price per share ($191.42) and Commissions and fees ($20.79). Everything's the same with one giant exception, after entering all my info and going through the Federal Review - I no longer get an error on line 18! This seems like a plus, but I still don't have confidence that I'm doing it correctly.To answer the last question you asked me (Do you know your basis?); outside of Box 1c Cost or Other Basis on my 1099B (listed as $36,138.90) I don't see a specific line item that says cost basis on my trade confirm, so I'm unsure what number to use. Here is the info on my trade confirmation as it's listed (unfortunately, the terminology in TT doesn't match up exactly with the confirm so I'm sure it's all here, and I just don't know which figures to use.)Employee Stock Plan Exercise Confirmation:Exercise date: 04/17/2019Grant date: 04/21/2017Grant type: NonqualGrant price: $172.09Sale price: $191.42Exercise market value: $191.58Shares exercised: 210Shares sold: 210Total gain: $4,059.32Taxable gain: $4,059.32Gross proceeds: $40,198.22Total price: $36,138.90Commission/fee: $20.79Taxes withheld: $1,659.45 - this figure is further broken down bt federal/medicare/social security etc.Net proceeds: $2,379.08Entering in the cost basis on my own seems like the smart thing to do; I just need to make sure I know how to calculate it for each trade. You wrote: Your big mistake is telling the program that your exercise price is $191.42, and it's not; that's the per share selling price. Given the options on my confirm, should I instead use the "exercise market value" $191.58 for the exercise price? Or is it the grant price?? $172.09.Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Unfortunately I can't follow along with the interview you're listing out since I don't use the online version. As far as I know the online version of the 1099-B interview and the desktop version have always been pretty much the same - thank makes sense, doesn't it? - so why TurboTax would make the interviews completely different boggles the mind. But nothing in the actual tax code in this area has changed recently so I can confidently say that the cost basis for the stock is the sum of what you paid to exercise plus the compensation created by the exercise. And that ultimately means that your per share basis is the same as the per share fair market value used by your employer to calculate the compensation.

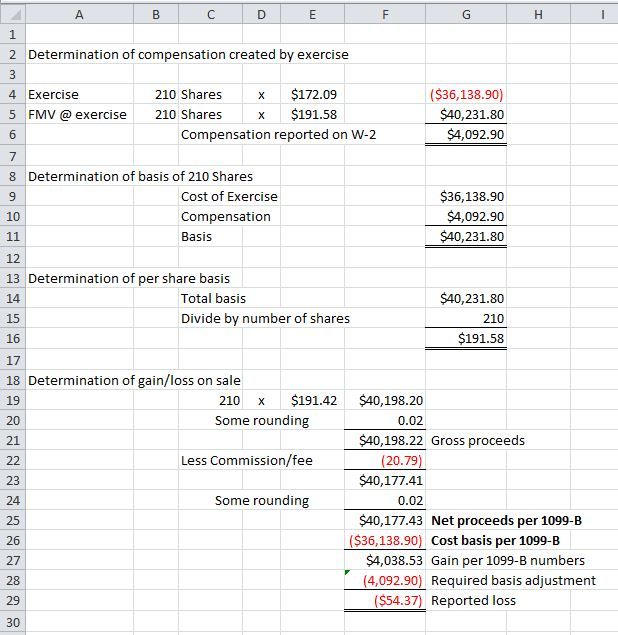

Looking at the Employee Stock Plan Exercise Confirmation you posted and taking the raw information from it here's the way I see it:

The loss makes logical sense: You sold at a per share price of $191.42 vs. a per share cost basis of $191.58 so that resulted in a loss of $.16 x 210 = $33.60, plus commissions and fees of $20.79, for a total loss of $54.39.

In so far as the interview goes I think that you need to select the option of "I know my cost basis and need to make an adjustment" and then either stick in the adjustment or the correct cost basis, however the next interview page shows up.

Two things:

- You must know how to calculate your basis in these situations, that's the only way you can be confident of the results. Somewhere, somehow, your employer has to be telling you the compensation created by your exercises and that's the key to getting the correct per share basis figure. Since this particular sale was for the whole grant it really wasn't necessary to deal with "per share" figures, but if you have a sale of less than the whole grant you do need the per share basis figures to make your adjustments.

- I'd stay away from the guided interviews. Once you know your basis numbers it's much easier to simply enter the 1099-B as it reads and then make your adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Well, I really can't thank you enough for sharing your spreadsheet with me and explaining exactly how to calculate the basis.

I replicated your process in Excel for that first trade and in TT, said, "I know my basis" then entered $40,231.80. TT then calculated my reported loss as -$54.37, which matches your calculation (yay!)

I did the same thing for all 12 trades; ignoring the NQSO question in TT and entering them all as normal stock trades with the adjusted cost basis calculated in my spreadsheet. All trades were for the full grant amounts. (No longer with that employer so it was use it or lose it)

My grand total in adjustments is about $1400 less than the total income reported in Box 12a Code V on the W2. Shouldn't they match? I will go back and double check all my numbers to make sure I didn't type something in wrong.

I will also go back to the employer to find out what they reported as compensation for each trade.

Thank you again for taking so much time to help me. I really, really appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

If the basis reported on the 1099-B form is off by the same amount as the income reported on your W-2 form, and if all the shares were acquired and sold in the same year, then your adjustment to basis would agree with the income reported on the W-2 form.

However, it is possible the basis reported on the 1099-B form is simply wrong. Also, you may have acquired some of the shares in a previous year, so the discount would be more that the amount reported on this year's W-2.

So, there may be reasons the adjustment to cost basis would not agree with the amount in box 12 on your W-2 form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

"My grand total in adjustments is about $1400 less than the total income reported in Box 12a Code V on the W2. Shouldn't they match? I will go back and double check all my numbers to make sure I didn't type something in wrong."

If all the exercises took place in 2019 then I'd expect that the compensation figures would match. But if you exercised in 2018 or 2020 that could be the reason for the difference. It's the exercise, not the sale, that creates the compensation.

Or, of course, you might have made an error somewhere along the way. Most same day sales (exercise/sale occurring simultaneously) result in a small loss due to selling commissions and fees, so I'd scan for any sales that had large gains or large losses and investigate those first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

That seems like good news?

I don't follow this statement: If the basis reported on the 1099-B form is off by the same amount as the income reported on your W-2 form...

- The total cost basis (box 1e) on my 1099B is way different than either box 1 of the W2 or Box 12a, code V.

- Many of my shares were granted in prior years, but all of the NQSO's were bought/sold on the same day, and all in 2019

I guess I need to wait to hear back from the employer to confirm the compensation and therefore cost basis to make sure my adjustment is accurate...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Thank you so much for this information! Saved myself almost $4,000.

Using the Step-by-Step guidance fixed it for me. I'm confused as to why the other guidance gives an incorrect result, but I probably answered a question incorrectly in an early step.

I need t go back and check my 2018 return now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Hi.

I've been reading the messages on how to correct the cost basis and was hoping someone (hoping for the same person who helped @TomYoung can help me. I am getting the same error message in TT that Tom was getting and I was on the phone with TT for 2 hours and they couldn't help me. Argh. I was using the guided interview but inputting it myself may be the way to go but I need to know how to correctly calculate the cost basis. Help please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Actually, I think I need @TomYoung 's help. Please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Hi.

I need help please.

I'm going to delete what I have entered and start over.

I'm going to Investment Income because I sold stock options.

The first question asked is "Did you sell stocks, mutual bonds, bonds or other investments in 2019." My answer "Yes".

Then it asks what type of investments did you sell? I clicked on Stocks, Bonds, Mutual Funds (options, index funds, ETFs).

The it wants to import my tax info but I click on "I'll type it in myself".

Next question is "Which bank or brokerage sent you a 1099-B for these sales?" My brokerage is Merrill, A Bank of America Company, and I entered my account number.

Next is "Do these sales include any employee stock, which includes ESPP, RSU, NQSO and ISO?"

I answered yes because mine are Cashless Sell of a Non-Qualified Stock Option.

Then it asks how many sales are on your 1099-B form. I clicked on "more than a few sales (4+) because there are 5 under Short Term Capital Gains and Losses - Covered Transactions and 1 under Long Term - Covered.

Then it recommends entering the sales one by one.

So my question to you, the community, is should I enter one by one or the sales total instead?

I had entered them before one by one and that's what I think I should do but want to make sure I'm doing it correctly and to ensure the best outcome for me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JJoli

Level 2

JJoli

Level 2

user17670721801

Returning Member

debraalbert

New Member

sethness

Returning Member