- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

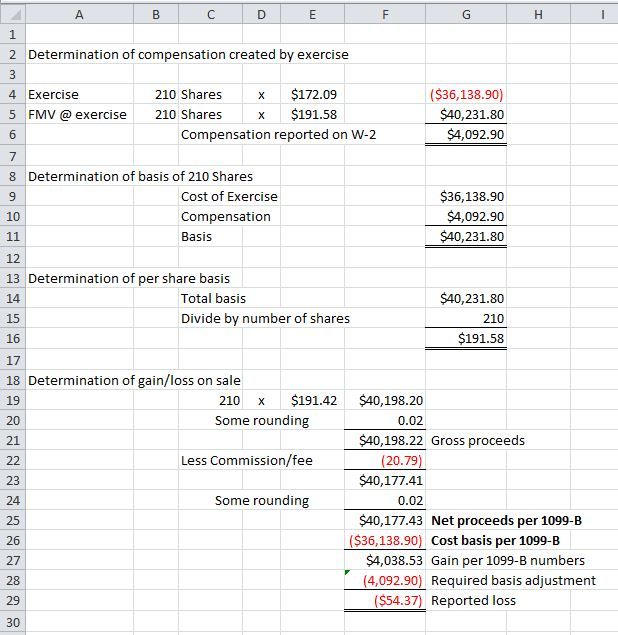

Unfortunately I can't follow along with the interview you're listing out since I don't use the online version. As far as I know the online version of the 1099-B interview and the desktop version have always been pretty much the same - thank makes sense, doesn't it? - so why TurboTax would make the interviews completely different boggles the mind. But nothing in the actual tax code in this area has changed recently so I can confidently say that the cost basis for the stock is the sum of what you paid to exercise plus the compensation created by the exercise. And that ultimately means that your per share basis is the same as the per share fair market value used by your employer to calculate the compensation.

Looking at the Employee Stock Plan Exercise Confirmation you posted and taking the raw information from it here's the way I see it:

The loss makes logical sense: You sold at a per share price of $191.42 vs. a per share cost basis of $191.58 so that resulted in a loss of $.16 x 210 = $33.60, plus commissions and fees of $20.79, for a total loss of $54.39.

In so far as the interview goes I think that you need to select the option of "I know my cost basis and need to make an adjustment" and then either stick in the adjustment or the correct cost basis, however the next interview page shows up.

Two things:

- You must know how to calculate your basis in these situations, that's the only way you can be confident of the results. Somewhere, somehow, your employer has to be telling you the compensation created by your exercises and that's the key to getting the correct per share basis figure. Since this particular sale was for the whole grant it really wasn't necessary to deal with "per share" figures, but if you have a sale of less than the whole grant you do need the per share basis figures to make your adjustments.

- I'd stay away from the guided interviews. Once you know your basis numbers it's much easier to simply enter the 1099-B as it reads and then make your adjustment.