- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

When Intuit switched from the "SuperUser" program to the "Champions" program I opted not to transitions so it's clear that I'm out of the loop to a certain extent.

I use the desktop program exclusively and have never used the online program. (I'd guess that 95% of the former SuperUsers also used the desktop program instead of the online one. The desktop program has some distinct advantages over the online program, one of the most important being that all the Forms, Schedules and Worksheets are always available to you and access to those can be invaluable to you if you're confused about the program or if you want to see if you can make sense of the program output.)

The 1099-B interview you've listed out for the online program mimics the desktop version until you hit this question: "Do these sales include any employee stock? (This includes ESPP, RSU, RS, NQSO, and ISO)". That question simply does not exist in the desktop program so now we know where the disconnect in understanding between us is occurring, and that's the question that's shunting you off to the "guided" interviews.

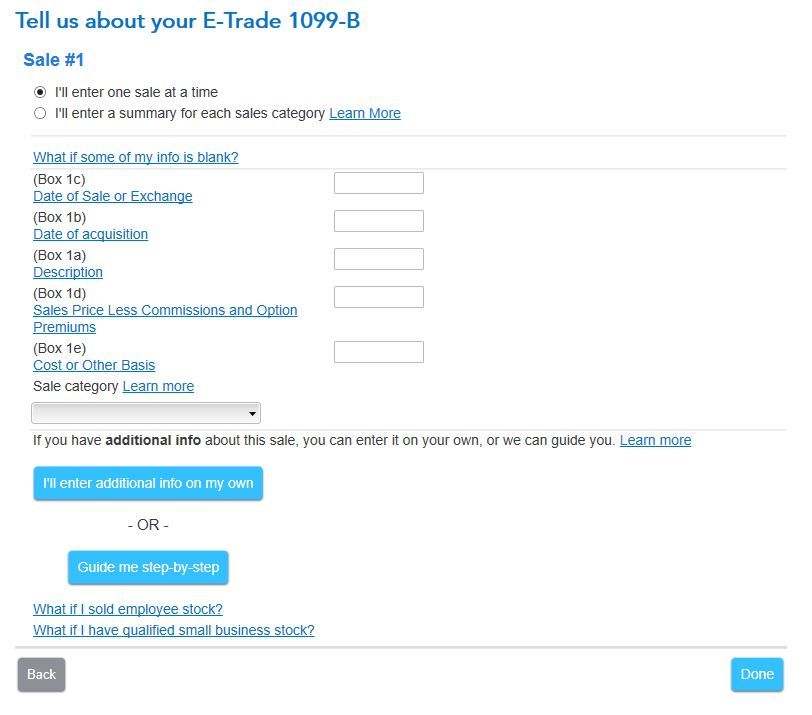

In the desktop program, after entering the brokerage information, you're then asked if you want to enter trades one at a time or in summary fashion, and if you answer "one at a time" you're presented with the basic 1099-B entry page:

I worked through your detail and can see where the numbers are coming from and I can also see that the program has, apparently, doubled your loss.

Do you know your basis? Per share, your basis is what you paid to exercise the option, (probably $36,138.90/210 = $172.09) plus the per share "fair market value" used by your employer to calculate the spread between what the stock cost you and what it was worth at exercise. That works out to your per share basis being the same as the per share FMV used by your employer. Your big mistake is telling the program that your exercise price is $191.42, and it's not; that's the per share selling price.

If you know your basis, and you should, then delete the trade, (TurboTax sometimes is "sticky" with information if your simply try to change things), answer "No" to the "Employee stock?" question and use the "standard" stock sale process. Enter the 1099-B information as it reads, click the "I'll enter additional info on my own" button, and on the next page enter the correct basis to use.