- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

On my W-2, my employer reported income from the sale of stock options, non-qualified stock, and restricted stock units. Separately, I received 1099s and entered information for the these sales into TurboTax. Now my income looks higher that it really is and I am getting taxed on these sales twice. How do I fix this while still following instructions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

ANSWER IS CORRECT FROM AN INCOME TAX STANDPOINT BUT STEP BY STEP INSTRUCTIONS ARE ONLY APPLICABLE TO THE 2014 PROGRAM AS THE DEVELOPERS CHANGE THE INTERVIEW FLOW EVERY SINGLE YEAR.

The problem is that you are using the WRONG BASIS to report the sale. That's why you are getting a "double income" effect.

When you sell stock acquired via an employer stock incentive program your basis for the sale is the sum of:

Any amount you paid to receive the stock, which might be $0, plus

Compensation income created either by the acquisition or sale of the stock

If the sale is "covered" - broker reports basis to IRS - then in 2014 brokers are only required to report the "purchase price" element of the sale. The basis reported omits the "compensation" element of the sale and therefore the "compensation" gets reported twice: once via the W-2 and then again as profit on the sale of the stock.

Clearly the "fix" here is to add back the compensation element to the basis of the stock being sold. Of course if the sale is not for ALL of the stock received under an employer stock incentive plan award, you then you need to convert the compensation element to a "per-share" figure which you use in reporting the sale.

If the 1099-B is reporting the basis to the IRS and is not using the correct basis, (maybe only the amount you paid for the stock), then enter the 1099-B as it reads but then click on the "Add More Details" box (or maybe "Edit Details"), and the "Start" button, (or maybe "Edit.)

On the next page select the first option which is "I need to add or fix info about this sale that's on my Form 1099-B." Tell TurboTax that the 1099-B is reporting the wrong basis. That's the interview you want and that's where you can fix things. Tell TurboTax that the 1099-B is reporting the wrong basis and then enter the "missing" compensation to get to the correct basis.

TurboTax will report the sale on Form 8949 "as reported by the broker" but will put an adjustment figure into column (g) of the Form, a code "B" into column (f) of the Form, and the correct amount of gain or loss which includes the adjustment.

Tom Young

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

ANSWER IS CORRECT FROM AN INCOME TAX STANDPOINT BUT STEP BY STEP INSTRUCTIONS ARE ONLY APPLICABLE TO THE 2014 PROGRAM AS THE DEVELOPERS CHANGE THE INTERVIEW FLOW EVERY SINGLE YEAR.

The problem is that you are using the WRONG BASIS to report the sale. That's why you are getting a "double income" effect.

When you sell stock acquired via an employer stock incentive program your basis for the sale is the sum of:

Any amount you paid to receive the stock, which might be $0, plus

Compensation income created either by the acquisition or sale of the stock

If the sale is "covered" - broker reports basis to IRS - then in 2014 brokers are only required to report the "purchase price" element of the sale. The basis reported omits the "compensation" element of the sale and therefore the "compensation" gets reported twice: once via the W-2 and then again as profit on the sale of the stock.

Clearly the "fix" here is to add back the compensation element to the basis of the stock being sold. Of course if the sale is not for ALL of the stock received under an employer stock incentive plan award, you then you need to convert the compensation element to a "per-share" figure which you use in reporting the sale.

If the 1099-B is reporting the basis to the IRS and is not using the correct basis, (maybe only the amount you paid for the stock), then enter the 1099-B as it reads but then click on the "Add More Details" box (or maybe "Edit Details"), and the "Start" button, (or maybe "Edit.)

On the next page select the first option which is "I need to add or fix info about this sale that's on my Form 1099-B." Tell TurboTax that the 1099-B is reporting the wrong basis. That's the interview you want and that's where you can fix things. Tell TurboTax that the 1099-B is reporting the wrong basis and then enter the "missing" compensation to get to the correct basis.

TurboTax will report the sale on Form 8949 "as reported by the broker" but will put an adjustment figure into column (g) of the Form, a code "B" into column (f) of the Form, and the correct amount of gain or loss which includes the adjustment.

Tom Young

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

BUT, if you are seeing a page titled "Your Employer Stock Plan Results" then it's clear that at some point you selected the SECOND option on the page that you get to when you click "Add More Details", that is, the option that reads "This sale may require special handling" because that's the ONLY WAY that page will ever come up.

If you've go the correct answer on your income tax return, great. You certainly can go the second route and get the correct answer. If you're not getting the correct answer then DELETE THE TRADE, don't attempt to just modify it, and try again following the above instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Thanks for your advice on this subject. I followed your instructions; however, it's only letting me enter 'C', 'W', or 'D' in section (f). I put in 'B' anyways, but TurboTax flags me at the end. Any additional tips for resolving this? I appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

Hi Tom - your name keeps popping up as I research how to complete my Employee Stock Plan Exercise income details. I'm hoping you can help. I was able to adjust my cost basis using the interview steps you pointed me toward, thank you! I thought I had it all correct, but when I get to the Federal Review step, I'm getting an error.

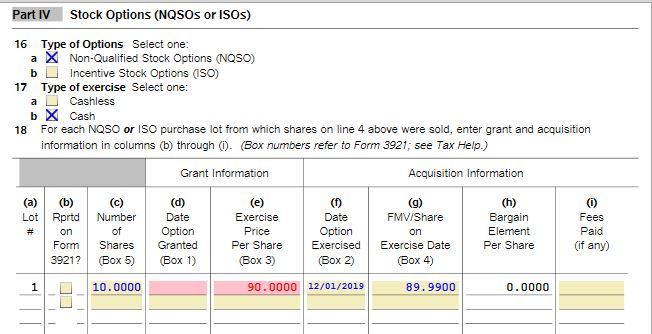

TT is telling me on the employer stock worksheet I need to review line 18. Column e (exercise price) can't be more than column g (FMV/share on Exercise date). I'm pulling the column e data from my eTrade trade confirmations. Column g seems to be self-populated through Turbo Tax. I'm not sure how to resolve it. For example on my first trade, column e shows an exercise price of $191.42, but column g shows a Fair Market Value price of $191.32. I have 12 trades that are similar. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer stock sales on both W-2 and 1099 are double counted and taxed

I take it the shares were acquired via a NQSO or ISO? That's what line 18 involves so I just want to make sure that's how you acquired the stock.

I usually advise people to stay away from the "guided" interviews for the sale of employee stock if at all possible because it's easy to get confused with these interviews and, most of the time, it's simply not necessary to use them. It's simpler and easier to just use the normal "stock" interview, correcting the basis using the method provided by TurboTax.

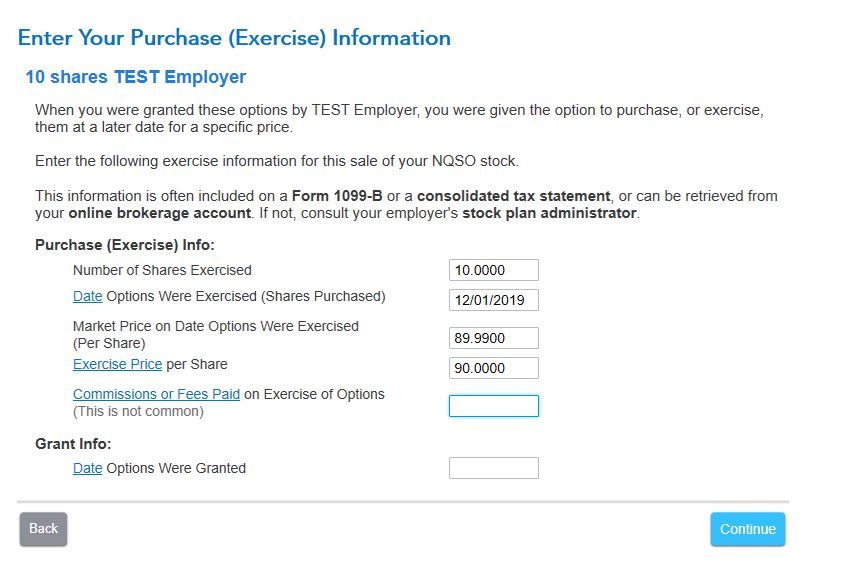

The column g data comes right off the number you must have entered on the page "Enter Your Purchase (Exercise) Information":

If you don't need to use the guided interview here, and there's only two legitimate reasons to do so:

- The compensation element didn't show up on your W-2, or

- You don't know the correct per share basis

then I'd say delete the trade, enter the 1099-B information exactly as it reads, and then correct the basis (if necessary) by clicking the "I'll enter additional info on my own" button.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ohjoohyun1969

New Member

anth_edwards

New Member

mason-jennifer-a

New Member

hijyoon

New Member

george1550

Returning Member