- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

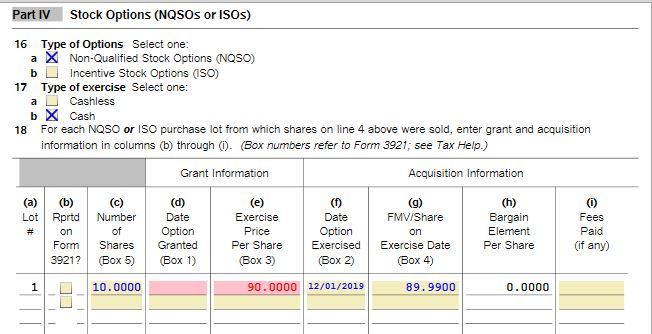

I take it the shares were acquired via a NQSO or ISO? That's what line 18 involves so I just want to make sure that's how you acquired the stock.

I usually advise people to stay away from the "guided" interviews for the sale of employee stock if at all possible because it's easy to get confused with these interviews and, most of the time, it's simply not necessary to use them. It's simpler and easier to just use the normal "stock" interview, correcting the basis using the method provided by TurboTax.

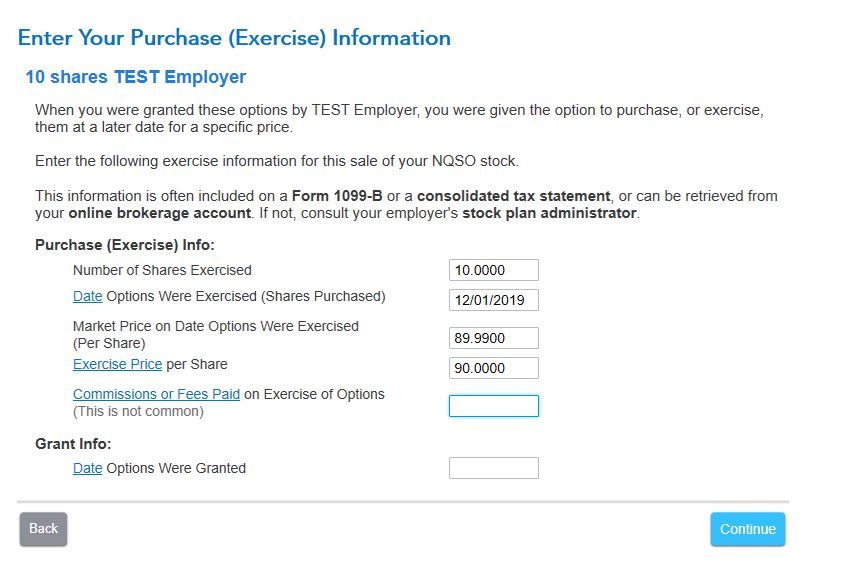

The column g data comes right off the number you must have entered on the page "Enter Your Purchase (Exercise) Information":

If you don't need to use the guided interview here, and there's only two legitimate reasons to do so:

- The compensation element didn't show up on your W-2, or

- You don't know the correct per share basis

then I'd say delete the trade, enter the 1099-B information exactly as it reads, and then correct the basis (if necessary) by clicking the "I'll enter additional info on my own" button.