- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

No. Only mail in the Forms and schedules that support your return. There is a print option to just print the form that the government needs. If you have already filed your return, you may need to reopen your return first.

- Sign in to your TurboTax Online account

- Select My TurboTax, View My Tax Timeline

- In the Some things you can do section, click 'Add a State' (you aren't really adding a state this is just a way to reopen your return)

After you reopen your return, you should see print/save my documents icon. Select the icon, and then select 'Print/save/preview this year's return. If you don't see the icon, select My Account, then Print Center.

From your printing options drop down box, select the printing option 'Forms filed with the government'. See attached example.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

Do you e-file to IRS without postmark signature and user consent ? I had incomplete form prepared and never given e-sign or postmark dates, but when I go after 4 years and see previous tax returns in online account, I can see incomplete forms, along with "amend my tax" link --> but I never filed using given account through turbotax ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

@mhnpdl wrote:

Do you e-file to IRS without postmark signature and user consent ? I had incomplete form prepared and never given e-sign or postmark dates, but when I go after 4 years and see previous tax returns in online account, I can see incomplete forms, along with "amend my tax" link --> but I never filed using given account through turbotax ?

Only the user of the program software can initiate the transmission of a tax return or print the tax return for mailing. Amended tax returns can only be printed, signed, dated and mailed by the user.

Your accounts for prior tax years are how you left them. Either filed or not filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

Awesome, Thanks. That clears my doubt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

What if it's an amended return? Do I need to print and include the electronic postmark page when mailing the amended return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

2019 and 2020 Amended returns can be e-filed.

You can amend e-filed returns if they've been accepted; paper-filed returns may be amended once they've been mailed.

If your e-file is still pending, you won't be able to make changes until the IRS either accepts or rejects it. Don't know your e-file status? Here's how to look it up.

Select your tax year for amending instructions:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

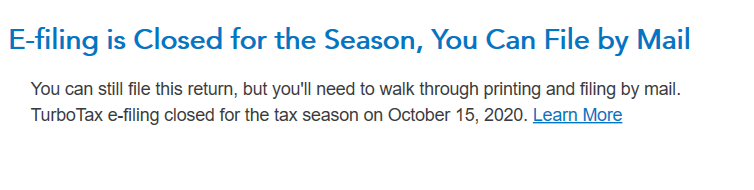

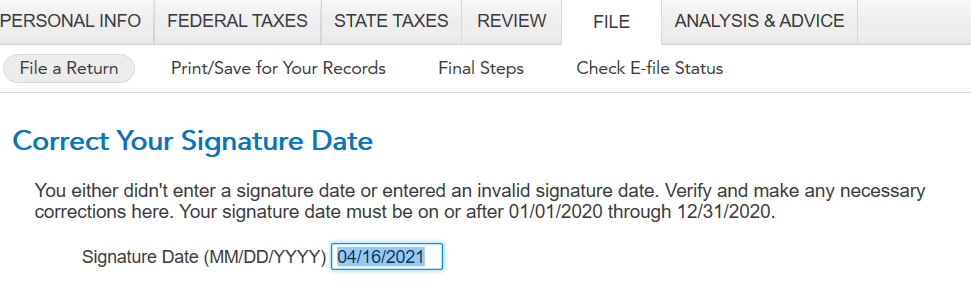

I'm amending the 2019 return. The CD version doesn't allow to e-file.

If I proceed anyway it gives this error:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to include the "Electronic Postmark - Certification of Electronic Filing" and "We need your consent" pages when I am mailing my tax return?

@Taxpayer31337 The IRS is no longer accepting e-file of 2019 tax returns. Go back and change to File by mail. TurboTax will automatically enter a date and not ask you to put one in.

The IRS is backed up. Consider sending your tax return by certified mail with return receipt so you will have proof that the IRS received your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dbarnello

Level 2

ogstuffdamighty

New Member

Luna_Tax

Level 3

rikagg3

Level 2

Vrmenditto

New Member