- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Do I need to file the 1099 NEC section as a self-employed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file the 1099 NEC section as a self-employed?

Hi,

I'm a graphic designer and I 'm struggling to enter my income.

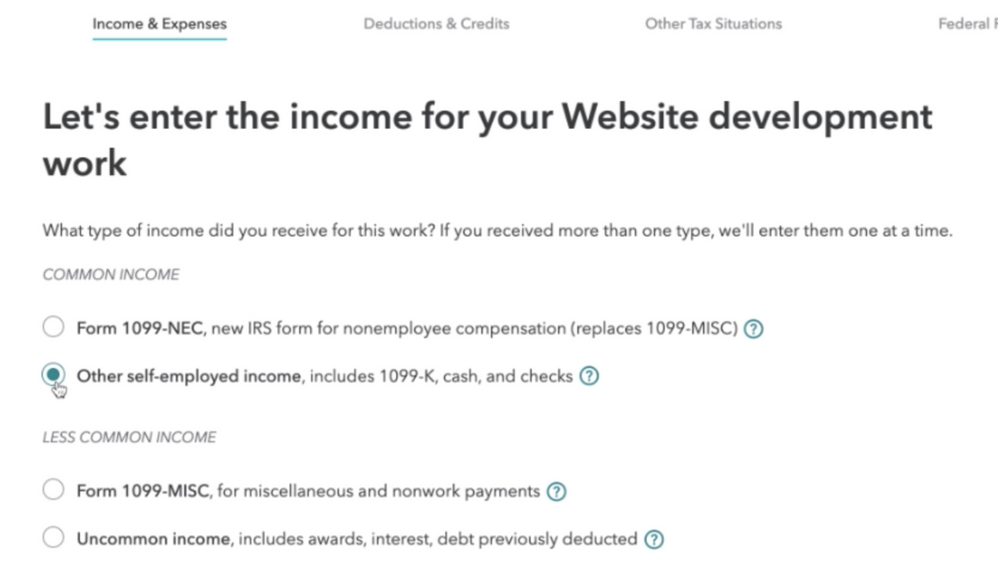

I didn't receive any 1099 NEC the past year but I earned more than $600 each time. Can I fill all my income into "Other self-employed income"? Or there is a risk to do that?

Thanks !

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file the 1099 NEC section as a self-employed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file the 1099 NEC section as a self-employed?

Yes, you can just enter it as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099Misc or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

How to enter income from Self Employment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file the 1099 NEC section as a self-employed?

You are required to report all your income, even if you don't receive tax paperwork from your clients. The IRS won't have any problem with you reporting income without a 1099.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

derrickbarth

Level 2

MeeshkaDiane

Level 2

ramster_2010

New Member

robglobal

New Member