- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- did you have any financial interest in digital asset--want to be 100% sure

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

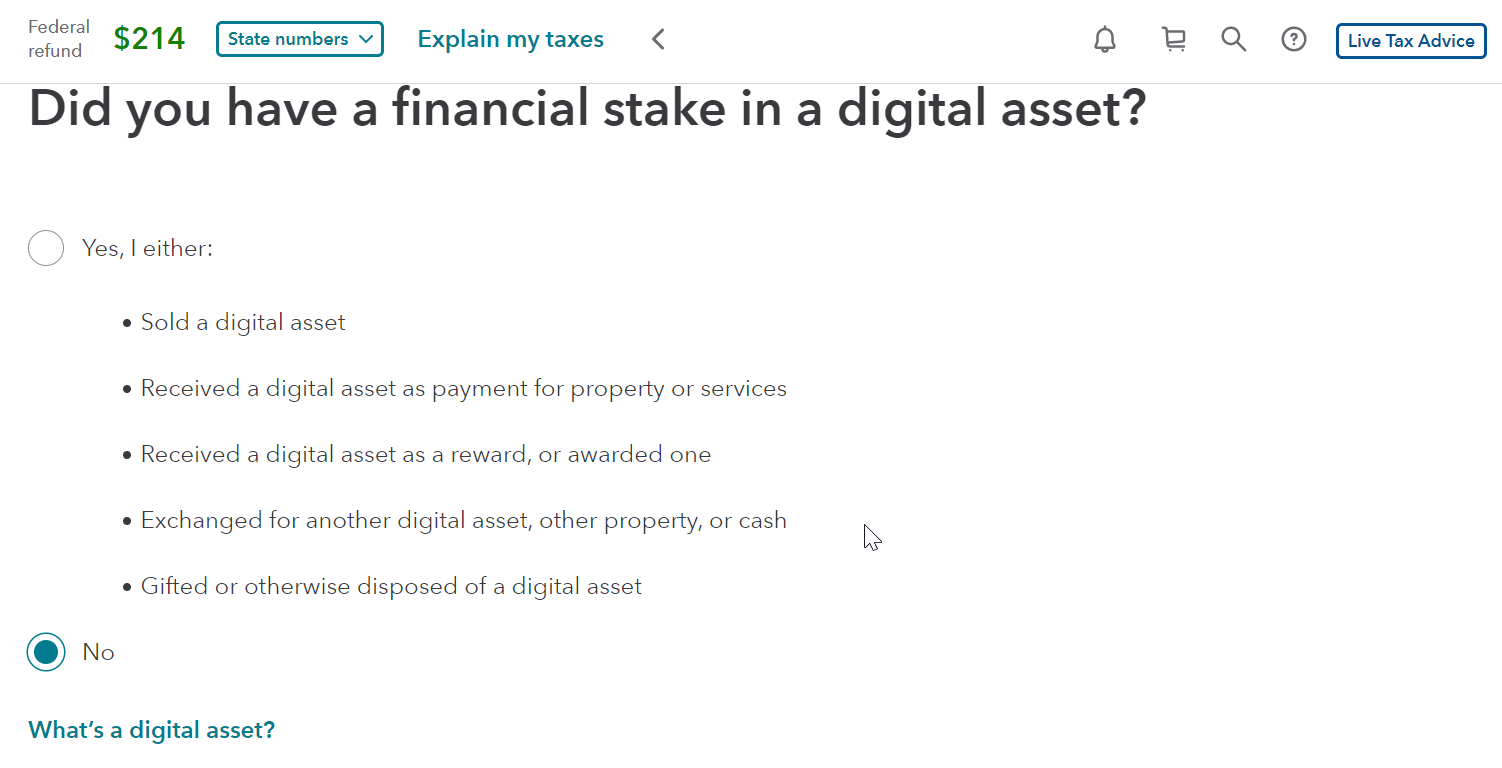

did you have any financial interest in digital asset--want to be 100% sure

From what the help menu explains

1. If I only purchased digital assets

2. Didn't sell them

3. Did NOT earn from staking

I should answer NO to this question.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

did you have any financial interest in digital asset--want to be 100% sure

That is correct, you would answer "NO".

According to the IRS:

“Normally, a taxpayer who merely owned digital assets during 2022 can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. They can also check the "No" box if their activities were limited to one or more of the following:

- Holding digital assets in a wallet or account;

- Transferring digital assets from one wallet or account they own or control to another wallet or account they own or control; or

- Purchasing digital assets using U.S. or other real currency, including through electronic platforms such as PayPal and Venmo.”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

did you have any financial interest in digital asset--want to be 100% sure

That is correct, you would answer "NO".

According to the IRS:

“Normally, a taxpayer who merely owned digital assets during 2022 can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. They can also check the "No" box if their activities were limited to one or more of the following:

- Holding digital assets in a wallet or account;

- Transferring digital assets from one wallet or account they own or control to another wallet or account they own or control; or

- Purchasing digital assets using U.S. or other real currency, including through electronic platforms such as PayPal and Venmo.”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

did you have any financial interest in digital asset--want to be 100% sure

Can someone tell me, in what section would I find this prompt?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

did you have any financial interest in digital asset--want to be 100% sure

There is no section for the digital asset question. It comes up after you complete Wages & Income. Depending on what's on your return, you may see several screens before the question pops up.

Tap Wages & Income in the left column, then Continue at the bottom.

If you somehow missed it, TurboTax will ask you during Federal Review.

@JayKepps

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ramseym

New Member

mburback8

New Member

mgc6288

Level 4

Long52

New Member

DallasHoosFan

New Member