- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

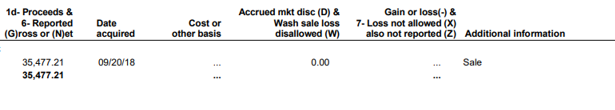

I have looked in the community site, and cannot find this example. I bought 400 shares of a REIT in 2011 for $25,000. In 2020, this REIT was sold for $35,477.21. My 1099-B lists the date acquired as 2018, this is when my new financial advisor took over this account. There is not a “Cost or other basis”, or no other information. Other than I bought 400 shares and when it was sold.

2020 1099-B for the REIT:

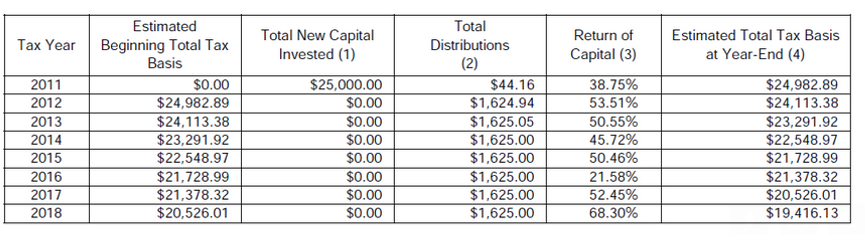

I contacted the REIT company and they gave me this information:

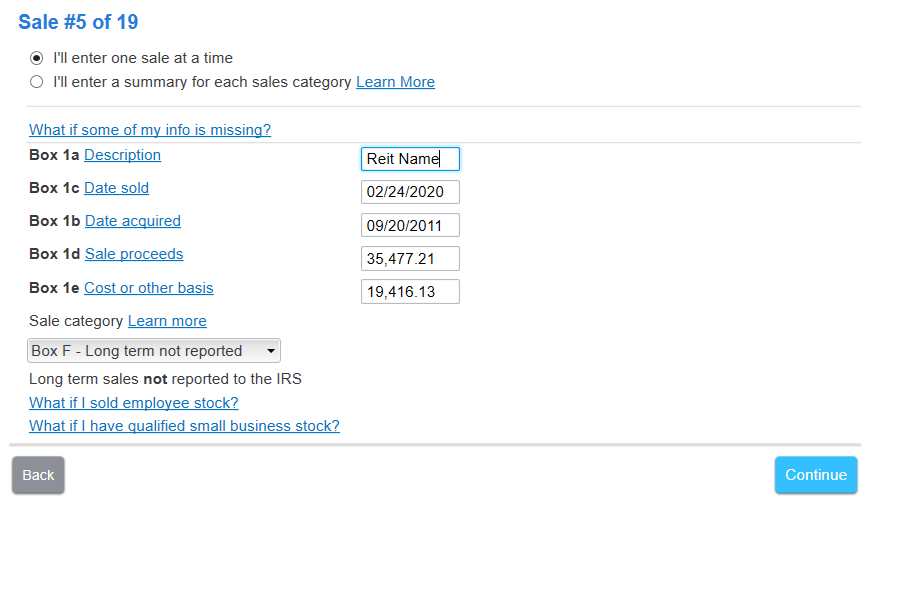

On Turbotax PC version, I have these options.

Here is what I think I should do:

- Change “Description” to the name of the REIT

- Change the “Date Acquired” to 2011, it was 2018.

- Put the “Cost or Other Basis” at $19,416.13. I get this from the spreadsheet the REIT company sent me.

- I selected Box E – “Long term not reported” – because it is more than one year old, and not reported on the 1099-B.

- I have been paying tax on the distributions on Schedule-B each year, not sure how that works, or if it changes the Cost Basis.

Does this sound correct?

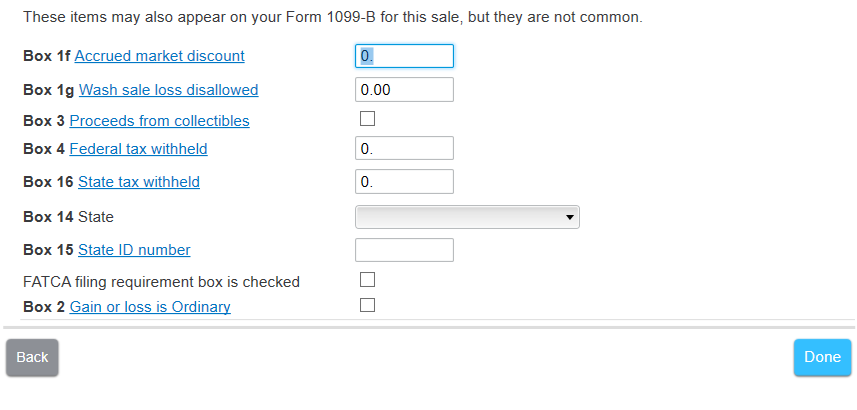

I think I leave this screen blank:

Thanks for looking at this. I have spent hours trying to figure it out, watching videos etc.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

Great job figuring this out. Everything is done correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

Here is what I think I should do:

- Change “Description” to the name of the REIT

- Change the “Date Acquired” to 2011, it was 2018.

- Put the “Cost or Other Basis” at $19,416.13. I get this from the spreadsheet the REIT company sent me.

- I selected Box E – “Long term not reported” – because it is more than one year old, and not reported on the 1099-B.

- I have been paying tax on the distributions (actually only on the portion that was not reported as a return of capital) on Schedule-B each year, not sure how that works, or if it changes the Cost Basis.

Does this sound correct? absolutely correct. the distributions you received were either taxable (reported on Schedule B) and thus have no effect on your cost basis or return of capital which reduced your cost basis - you paid no taxes on them in the past. you've computed your revised cost so that's what you enter.

the only strange thing about what you show is that there are no ROC dividends in 2019. or 2020 (if you received any dividends those years)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

Were the dividend distributions each year sent to you or were they reinvested and bought more shares? If they were reinvested that increases your cost. Did you sell all the shares? The original number of shares or did you have more?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

Were the dividend distributions each year sent to you or were they reinvested and bought more shares?

* Sent to me and I did not reinvest

If they were reinvested that increases your cost.

Did you sell all the shares?

* yes sold all the shares in 2020

The original number of shares or did you have more?

* Same as original number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

Thanks, for your reply.

I looked at my 2019 tax record, and found info on my 1099-DIV.

"Qualified Dividend", "Section 119A Dividend", "Long Term Gain", "Section 1 250 Gain", and "Return of Capital"

Non-1099 Distributions - Deferred Payments" sections. This was all on my return, and maybe that is why the REIT company did not have information. I will ask them about 2019 and 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

The non taxable distributions (capital returned) reduced your basis each and every year which is why the $25K basis got reduced to $19K. Ask the broker if you have more questions on this matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

Thanks for your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g456nb

Level 1

jcrouser

New Member

Wisco920

New Member

hung05

Level 2

whnyda

New Member