- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost or Other Basis missing on 1099-B for REIT how to put on TurboTax 2020 PC version

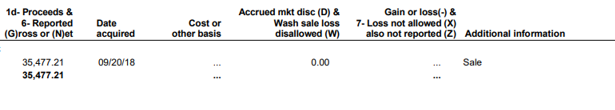

I have looked in the community site, and cannot find this example. I bought 400 shares of a REIT in 2011 for $25,000. In 2020, this REIT was sold for $35,477.21. My 1099-B lists the date acquired as 2018, this is when my new financial advisor took over this account. There is not a “Cost or other basis”, or no other information. Other than I bought 400 shares and when it was sold.

2020 1099-B for the REIT:

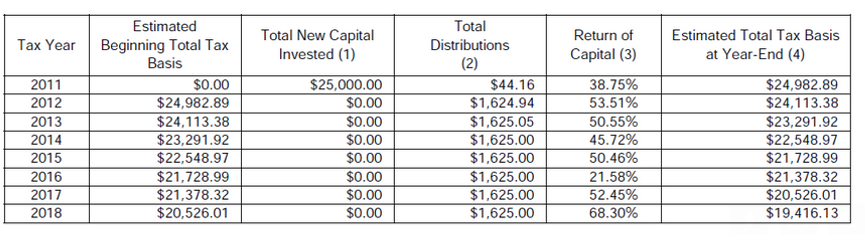

I contacted the REIT company and they gave me this information:

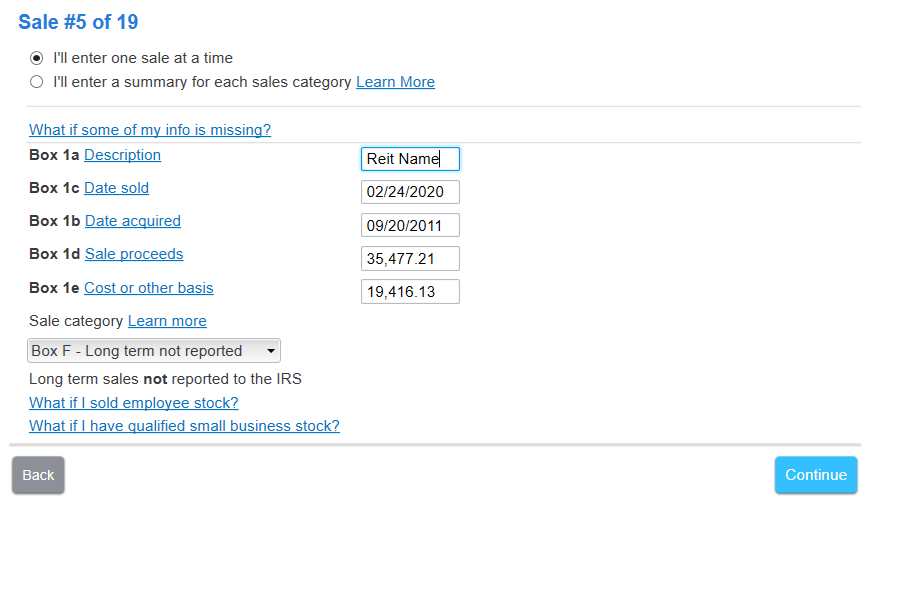

On Turbotax PC version, I have these options.

Here is what I think I should do:

- Change “Description” to the name of the REIT

- Change the “Date Acquired” to 2011, it was 2018.

- Put the “Cost or Other Basis” at $19,416.13. I get this from the spreadsheet the REIT company sent me.

- I selected Box E – “Long term not reported” – because it is more than one year old, and not reported on the 1099-B.

- I have been paying tax on the distributions on Schedule-B each year, not sure how that works, or if it changes the Cost Basis.

Does this sound correct?

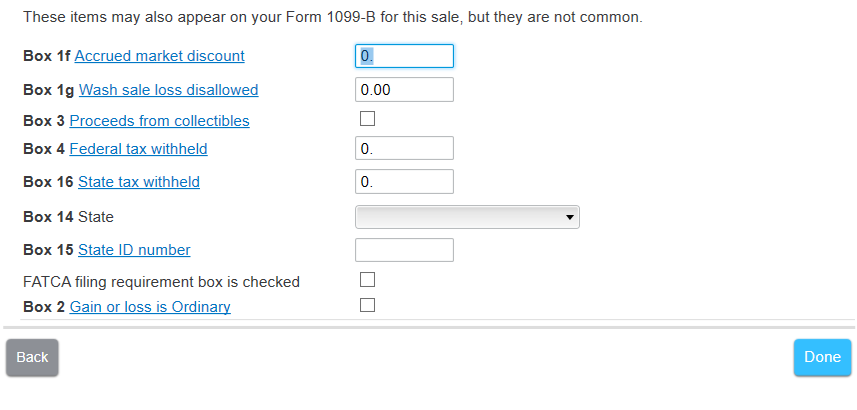

I think I leave this screen blank:

Thanks for looking at this. I have spent hours trying to figure it out, watching videos etc.

Topics:

September 20, 2021

9:50 AM