- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can I attach a copy of schedule K-1 to my PA state taxes and then e-file? I am getting prompted to mail my taxes by TurboTax & I want to know if there is a way around it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I attach a copy of schedule K-1 to my PA state taxes and then e-file? I am getting prompted to mail my taxes by TurboTax & I want to know if there is a way around it?

If I have to file by mail, I want to know if I send the copy of my entire tax return to both locations? Or if I only send the K-1 and PA40 to the Bureau of Corporation Taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I attach a copy of schedule K-1 to my PA state taxes and then e-file? I am getting prompted to mail my taxes by TurboTax & I want to know if there is a way around it?

I see no reason for you to file with the PA Corporation Bureau as you are not filing a return with them. You would enter the information from the Form K-1 in the federal section, note any differences between the federal K-1 and the RK-1 and enter them as needed in the PA section of your personal return. The PA Educational Improvement Tax Credit is entered in the PA RK-1 section which will then flow to the PA-40 OC.

The actual form line entry on the PA-40 OC is line 8 when the return is printed or viewed via pdf when finalized. If you still must print and mail your PA return, be sure to include your Form RK-1 as part of the necessary backup documents. Printing and mailing a PA return, while not the best solution, is vastly smaller and easier than printing and mailing your 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I attach a copy of schedule K-1 to my PA state taxes and then e-file? I am getting prompted to mail my taxes by TurboTax & I want to know if there is a way around it?

Please clarify and expand upon your question. If you only received a K-1 there is no need to send to the Bureau of Corporation Taxes. The K-1 would be included as part of your personal return and for which you can prepare in TurboTax, whether the online version or the desktop version.

You would only have to submit paperwork to the Bureau of Corporation Taxes if you were also preparing the PA-65 or PA-20S. Generally they are filed on the same form but with different pages included and different boxes checked. It is there you would also submit copies of the RK-1's or NRK-1's.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I attach a copy of schedule K-1 to my PA state taxes and then e-file? I am getting prompted to mail my taxes by TurboTax & I want to know if there is a way around it?

Thank you so much for your response, JosephS1!

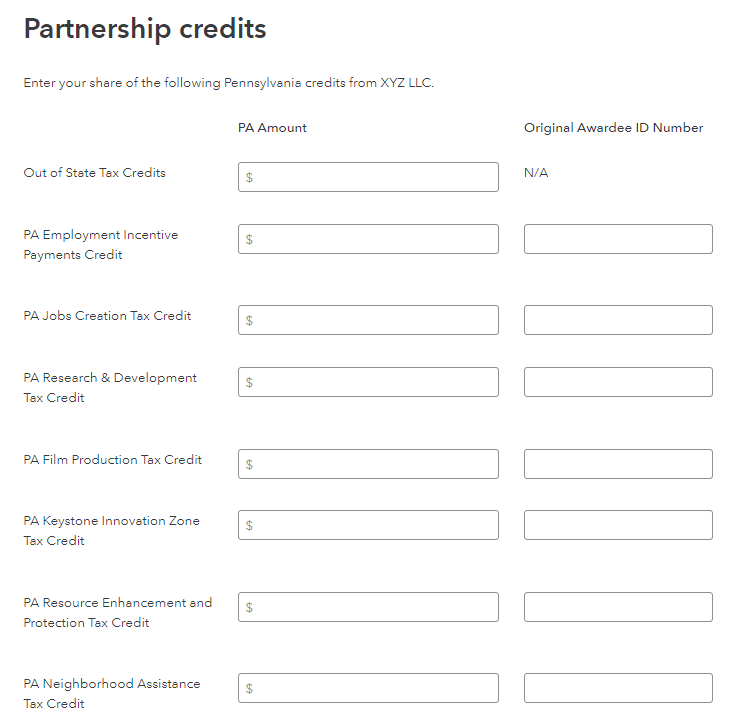

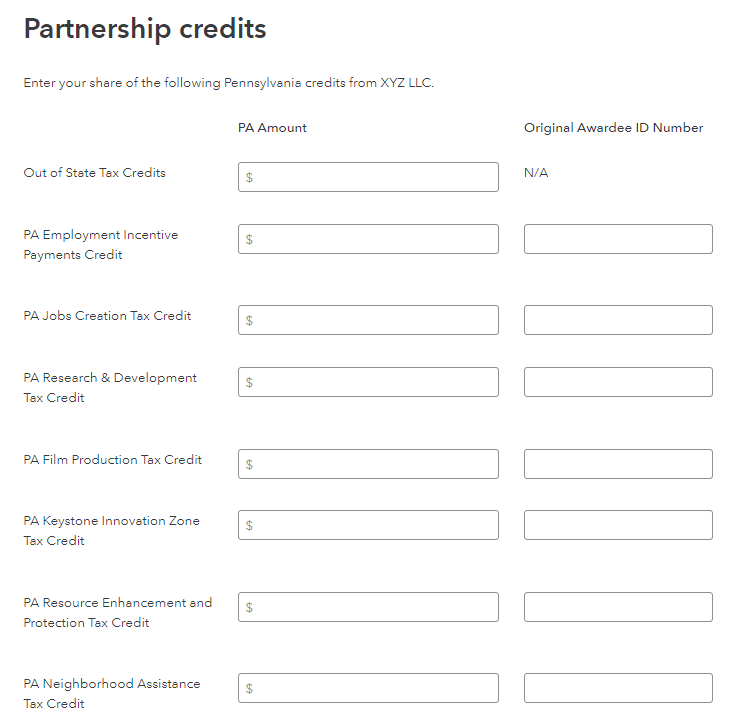

I had the PA Schedule OC ("other credits") (is that PA-40/PA-41 OC?) for the PA Educational Improvement Tax Credit. There are 4 related Partnership K-1 Worksheet pages. I also received Schedule K-1 and PA Schedule RK-1 from the LLC through which I made the contribution.

I am using TurboTax Desktop and it prevented me from e-filing the PA taxes (Federal was fine). It said I had to mail the return and it said on TurboTax's cover sheet on my completed taxes that I had to send to the Bureau of Corporation Taxes. Should I still send anything to the Bureau of Corporation Taxes, given my exact situation? Would I send them my whole return (with the RK-1/NRK-1)? Would I need to send any of the documents that I received from the LLC (I think that information is already captured in my own return)?

Finally, is my only option to mail the taxes in PA? TurboTax online was preventing me from e-filing for PA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I attach a copy of schedule K-1 to my PA state taxes and then e-file? I am getting prompted to mail my taxes by TurboTax & I want to know if there is a way around it?

I see no reason for you to file with the PA Corporation Bureau as you are not filing a return with them. You would enter the information from the Form K-1 in the federal section, note any differences between the federal K-1 and the RK-1 and enter them as needed in the PA section of your personal return. The PA Educational Improvement Tax Credit is entered in the PA RK-1 section which will then flow to the PA-40 OC.

The actual form line entry on the PA-40 OC is line 8 when the return is printed or viewed via pdf when finalized. If you still must print and mail your PA return, be sure to include your Form RK-1 as part of the necessary backup documents. Printing and mailing a PA return, while not the best solution, is vastly smaller and easier than printing and mailing your 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17548719818

New Member

botin_bo

New Member

user17545861291

Level 1

DennisK1986

Level 2

gtchen66

Level 2