- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

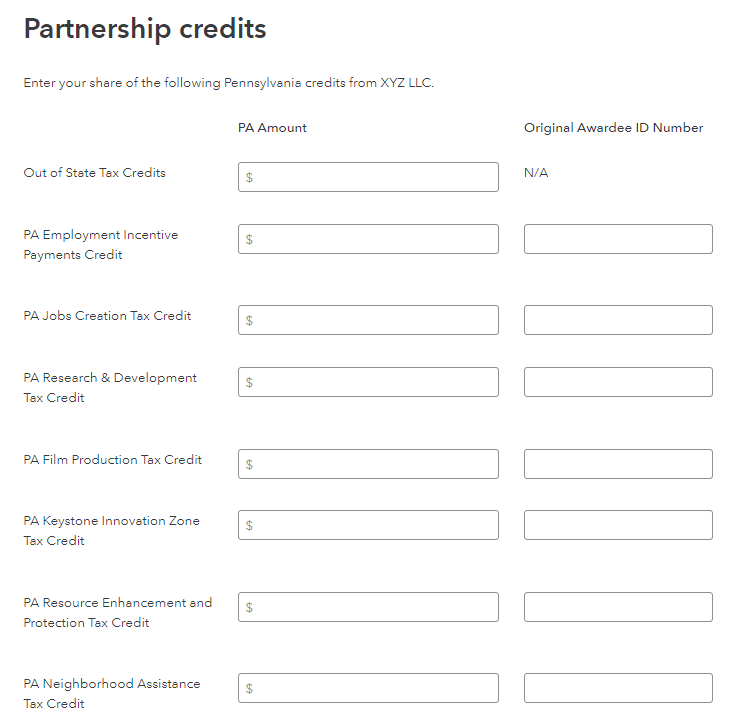

I see no reason for you to file with the PA Corporation Bureau as you are not filing a return with them. You would enter the information from the Form K-1 in the federal section, note any differences between the federal K-1 and the RK-1 and enter them as needed in the PA section of your personal return. The PA Educational Improvement Tax Credit is entered in the PA RK-1 section which will then flow to the PA-40 OC.

The actual form line entry on the PA-40 OC is line 8 when the return is printed or viewed via pdf when finalized. If you still must print and mail your PA return, be sure to include your Form RK-1 as part of the necessary backup documents. Printing and mailing a PA return, while not the best solution, is vastly smaller and easier than printing and mailing your 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"