- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Book vs Tax Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book vs Tax Return

Why is Turbo Tax telling me my book income is different from what in inputted?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book vs Tax Return

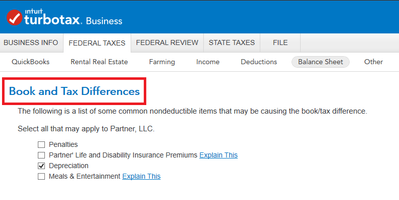

I can only presume that you are using TurboTax Business and are in the process of preparing an income tax return for an entity (e.g., 1120, 1120-S, 1065).

Regardless, you need to reconcile the book and tax differences, for which there is a screen in the program.

Also, review the On Demand Tax Guidance (reproduced below).

Book income or loss is usually derived from a profit and loss statement for the company. If the company does not prepare a profit and loss statement, the book income and loss is a summary of all of the book income and expense accounts.

Book income and or loss is reduced or increased by a federal income tax expense accrual.

Book income and expense accounts do not include asset and liability accounts. Those accounts are referred to as Balance Sheet accounts.

Books refers to anything used to track accounting information using your accounting method, to make entries for and complete the company's tax return.

Some common books are:

- QuickBooks or other accounting software

- Excel spreadsheet

- General ledger and trial balance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book vs Tax Return

What "book income?" Did you write a book? Are you receiving royalties? We cannot see your screen, your tax return or your account. Please explain your question in more detail so we know how to help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book vs Tax Return

Look at your actual 1040 tax return. Which line looks wrong or you don't understand?

Before filing, You can preview the 1040 or print the whole return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book vs Tax Return

I can only presume that you are using TurboTax Business and are in the process of preparing an income tax return for an entity (e.g., 1120, 1120-S, 1065).

Regardless, you need to reconcile the book and tax differences, for which there is a screen in the program.

Also, review the On Demand Tax Guidance (reproduced below).

Book income or loss is usually derived from a profit and loss statement for the company. If the company does not prepare a profit and loss statement, the book income and loss is a summary of all of the book income and expense accounts.

Book income and or loss is reduced or increased by a federal income tax expense accrual.

Book income and expense accounts do not include asset and liability accounts. Those accounts are referred to as Balance Sheet accounts.

Books refers to anything used to track accounting information using your accounting method, to make entries for and complete the company's tax return.

Some common books are:

- QuickBooks or other accounting software

- Excel spreadsheet

- General ledger and trial balance

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

shamkt24-

New Member

8854b329183d

New Member

rbwitcher2

New Member

Budman7226

Level 1

needtaxhelp808

New Member