- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Hi! Me, my spouse and kids are resident aliens at the end of 2023 through the green card test. The first 8 months of 2023 we lived in a foreign country. At the end of August 2023 we moved to the US and lived here for the last 4 months of the year. My spouse and I are 40 years old, kids are below 17 and they lived with us for the whole year, and all of us have SSN. Our AGI is below $40,000, including foreign and US earned income, and we don't have an investment income.

We are considering to choose to be treated as resident aliens for the entire year ("Choosing Resident Alien Status" of Pub.519) and file a joint return. In this case, are we eligible for standard deduction and earned income credit?

-----------------------------------------------

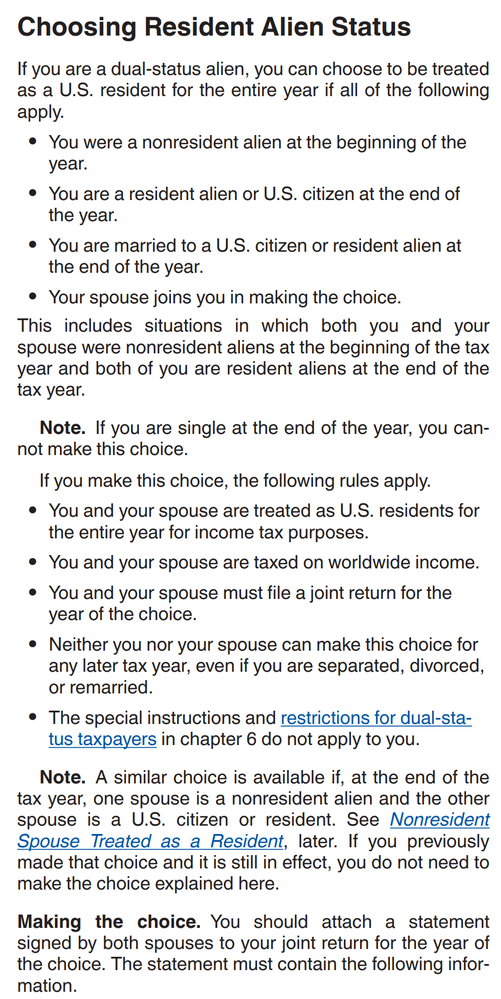

Choosing Resident Alien Status (Pub.519)

If you are a dual-status alien, you can choose to be treated as a U.S. resident for the entire year if all of the following apply.

You were a nonresident alien at the beginning of the year. (YES)

You are a resident alien or U.S. citizen at the end of the year. (YES)

You are married to a U.S. citizen or resident alien at the end of the year. (YES)

Your spouse joins you in making the choice. (YES)

This includes situations in which both you and your spouse were nonresident aliens at the beginning of the tax year and both of you are resident aliens at the end of the tax year. (YES)

If you make this choice, the following rules apply.

You and your spouse are treated as U.S. residents for the entire year for income tax purposes.

You and your spouse are taxed on worldwide income.

You and your spouse must file a joint return for the year of the choice.

Neither you nor your spouse can make this choice for any later tax year, even if you are separated, divorced, or remarried.

The special instructions and restrictions for dual-status taxpayers in chapter 6 do not apply to you.

--------------------------------

Rule 4—You Must Be a U.S. Citizen or Resident Alien All Year (Pub.596 EIC)

If you were a nonresident alien for any part of the year, you can’t claim the EIC unless your filing status is married filing jointly. You can use that filing status only if your spouse is a U.S. citizen or resident alien and you choose to be treated as a U.S. resident. If you make this choice, you and your spouse are taxed on your worldwide income. If you need more information on making this choice, get Pub. 519, U.S. Tax Guide for Aliens. If you were a nonresident alien for any part of the year and your filing status isn't married filing jointly, enter “No” on the dotted line next to line 27 (Form 1040 or 1040-SR).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Yes, if you were granted green-card status during the year, you are treated as a citizen for the entire year. You will be eligible for the standard deduction as well as the EIC. Just remember, you must include all of your world-wide income earned in 2023 You also have FATCA and FBAR reporting requirements for 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Yes, if you were granted green-card status during the year, you are treated as a citizen for the entire year. You will be eligible for the standard deduction as well as the EIC. Just remember, you must include all of your world-wide income earned in 2023 You also have FATCA and FBAR reporting requirements for 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Thank you DaveF1006 for your answer, I appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

No, once the the green card status is attained, it is good for the calendar year and you will be able for the standard deduction and EIC. If you are claiming EIC for your dependents though, each much have a valid SSN for you to claim the credit.. If you are claiming EIC for yourself though, you will be able to claim the credit with no restrictions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Hi - thanks for this information. Is the same true for dual-status aliens who meet the substantial presence test for the year? I’m trying to help a humanitarian parolee family who arrived in April 2023. They were dual-status aliens in 2023. Can they elect to be treated as resident aliens all year (despite having arrived in April 2023) and get the benefit of the 2033 standard deduction? This married couple made a total of $18,000. I’m trying to figure out if they can get all the taxes they paid back, plus get the refundable Earned Income Credit, and child tax credit. Any help figuring that out would be appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Hi - thanks for this information. Is the same true for dual-status aliens who meet the substantial presence test for the year? I’m trying to help a humanitarian parolee family who arrived in April 2023. They were dual-status aliens in 2023. Can they elect to be treated as resident aliens all year (despite having arrived in April 2023) and get the benefit of the 2023 standard deduction? This married couple made a total of $18,000. I’m trying to figure out if they can get all the taxes they paid back, plus get the refundable Earned Income Credit, and child tax credit. Any help figuring that out would be appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Yes, if they arrived in April, they can be treated as a resident alien under the terms of the Substantial Presence Test because they were here for 183 days in 2023. They should be able to get all taxes back because their income does not exceed their filing threshold of $27,700.

Now my question is, do each member of the family have a valid Social Security Number, including the children? if not, they would not be eligible for the EIC or the child tax credit. An ITIN would not be valid to claim these credits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Hi DaveF1006,

I did not find anyone asking this on the Internet, but I was curious about this situation.

Me and my spouse were nonresident aliens on F-1 status in 2023 till October 2, 2023, when we changed our status to H-1B and H-4 respectively. We can both claim the First-Year Choice to become resident aliens for tax purposes from October 2, 2023. However, to do this, we need to become resident aliens in 2024, which will happen somewhere in May, so we can both file form 4868 to postpone the federal tax filing deadline. It means that both of us can be dual-status aliens for 2023, right?

So, is it possible to claim Full-Year Resident status for both of us and file jointly? Conditions state that "You are married to a U.S. citizen or resident alien at the end of the year" and "You are a resident alien or U.S. citizen at the end of the year.", so can I treat my spouse (or vice versa) as a resident alien at the end of the year if we're dual-status aliens?

Also, another question, my employer started to pay FICA taxes from October 2, 2023. If we become full-year residents in 2023, will both of us owe FICA taxes for the income that we have previously earned as non-residents?

Thank you so much! I would appreciate any advice!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Yes, you can file as dual citizens for 2023 because you made the first year choice and your residency begins Oct 2, 2023. The may file jointly with your spouse also. You may not file as full year residents however because you did not satisfy the terms of the Substantial Presence Test for 2023.

You will not be expected to repay FICA taxes during the time you were a non-resident alien. You may also file form 4868, which gives you an extension to file your resident tax return, until you have satisfied the requirements of the Substantial Presence Test.

Please read this document issued by the IRS regarding making the first year choice and this conditions that apply. Reach out to us if you have additional questions.

[Edited 02/08/24|9:15 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Hi DaveF1006,

Thank you so much for your response!

I wonder if it's still possible to choose resident status for 2023, based on the information from the screenshot. If I and my wife will both become dual-status aliens for 2023 with the first year choice, do you think we can use this rule to claim resident status for the whole year? This rule mentions that if my spouse was also a nonresident at the beginning of the 2023 year but became a resident at the end, I can claim the resident status for the whole year. Do you think it implies that both of us with dual-status resident status who did not pass the substantial presence test in 2023, can be considered as residents for the whole 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Yes, that would appear to apply to you based on the information you have provided above. If both you and your spouse are choosing to be treated as Resident Aliens for the entire year, you can make that election by attaching a statement to your return signed by both you and your spouse declaring that you are both making the choice to be treated as US residents for the entire year and your name address and TIN or ITIN of both spouses.

You will need to include both of your worldwide income for the entire year on your returns if you choose this status.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Hi @Vanessa A , thank you for your response!

I wanted to double check my actions:

- File form 4868 for both me and my spouse, to get an extension to file tax return.

- Wait until we both pass substantial presence test for 2024 to be eligible for the first-year choice.

- File joint resident tax return, including a statement that we:

a) Choose first-year choice (become dual-status aliens for a year)

b) Based on a), choose resident alien status for the whole 2023 year for both me and my spouse based on the rule from the screenshot.

Could you please confirm if this is correct?

Also, is it possible to add this statement when e-filing through TurboTax? Or should we file paper tax return with the statement?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are dual-status aliens choosing to be treated as US residents for the entire year eligible for standard deduction and earned income credit?

Yes. This would need to be filed by mail. Here are the complete procedures for filing the return. To complete this, you need to purchase a Turbo Tax Desktop program to complete step 4 in this return.

- Determine your main tax return:

- If you’re a nonresident alien who’s changed to a resident alien and are a U.S. resident on the last day of the tax year, Form 1040 is your main return. Include Form 1040-NR as an “informational statement” and be sure to write Dual-Status Return across the top of it.

- If you’re a resident alien who gives up residence in the U.S. during the year and are not a U.S. resident on the last day of the tax year, Form 1040-NR is your main return . Write Dual-Status Return across the top of the return. Attach an “informational statement” to your return to show the income for the part of the year you’re a resident. You can use Form 1040 as the statement, but be sure to write Dual-Status Statement across the top.

- Fill out your 1040-NR. Print it. You will need to prepare this in Sprint Tax because Turbo Tax does not prepare US 1040 returns.

- Start filling out your 1040.

- Open the 1040/1040SR Worksheet in Forms mode when you have completed the interview section of the 1040.

- Scroll down to the Line 17z - Other Taxes Smart Worksheet on Schedule 2 Part II, Line 17(z) and enter the federal tax withheld from your 1040-NR.

- Finish filling out your 1040. Choose to file by mail.

- Print and sign your 1040. Write Dual-status return at the top of the form.

- Mail your 1040 and 1040-NR together

If you aren’t enclosing a payment, mail your return and statement to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

If you’re enclosing a payment, mail your return and statement to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 2

nirbhee

Level 3

rroop1

New Member

shikhiss13

Level 1

dvrjtc

New Member