- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Anyone else having problem e-filing with IRS Form 2210 under tax reform

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

MJB -

Try what I did last night - use the ovedrride to eliminate the X's in any and all of the Part II boxes on the Form 2210 form. Obviously, with an $11k refund, you DO NOT need to file the 2210, and using override seems to be the only way to eliminate the form from your return. Good Luck.

BTW, I now have BOTH my Fed and SC returns accepted.

Tom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

THAnk you and please have some one you wish to participate - give you a hug from me !! I so sincerely appreciate your encouragement and support during this stressful mess (ugh) I was with IBM in development and sales and so understand when there are bugs not properly beta tested but this (having used TT since it was on DOS) is really a night mare and might just be what HRBlock was wishing for. (smile)

Thanks again - here is what i have done today.

Now I am packing for my trip and gong to take a walk on the beach - and get back into relaxed mode.

BTW

I tried the over ride trick and it would not work - it got to the red X but would not eliminate it

and could not eliminate the form out of turbo tax. but -- now i have the print out and also teh BLANK 2210 forms that i downloaded from IRS..gov so can create my own - if i need too. My friends i visit are CPAs so we can play with my forms - i am not taking my PC (smile)

I got this message with my rejection today

"

This return was not e filed due to a timing issue or a processing error that has been corrected.

No changes are needed to your tax return

It just needs to be e filed again

Open the rejected return

Review it for errors

And resubmit the return for electronic filing

If the reject continues you may need to print an f file this return by mail.""

I just resubmitted what i had submitted before and am taking the hard copy with me on my trip and may just USPS it from south Florida - while enjoying great weather and friends!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

MJB,

I am not a tax expert (nor do I play one on TV) but I think I have gained some understanding of this #$*^@ program after toiling on it for countless hours.

1. I think you do need to file form 2210 since you made variable estimated payments (per the instructions on form 2210)

2. If Box D is marked, you must have said "yes" when TT asked you if wanted to figure your tax withheld on the actual days it was withheld (I assume you must have had some income that had automatic withholdiing on it. That question comes up after you input all the information for your quarterly income and payments you need for filling out 2210 AI. You should answer "yes" to annualized income and "no" to the method of using days actual withheld. Of course, if that results in a penalty then you don't want to do that. If you paid too much upfront, I would think you will be okay using annualized income (Method C) as I did.

3. The printout for my filing included all pages of Form 2210 as well as schedule AI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I am so thrilled that you have BOTH your returns accepted and PROUD for you that you were patient enough to endure this "goat rodeo" that TT has put everyone through.

HURRAH for you - i hope you have plans for great golf or sailing or something wonderful for the rest of the weekend!! you deserve it !!I promise to let you know the results of my journey with TT this year.

thanks again

Where are you ?

I am in Ponte Vedra Beach Fla - North / east of jax but headed south to singer island then sarasota to visit friends in the next warmer section of the state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Big Red-

neither am I a tax expert and do not desire to become one at 76 years old- (smile) but since we are on the topic

I do not have any auto withholding, have pension plan and soc sec - an never filled out the question you think I must have.

TT first had just the part two A check and nothing not even page 2 or 3 or statement

the next time it came up with the A and the the D ?? checked adn pages 2 and 3 but no explanation statement even tho that form is on this form list

now it has all 4 pages (a and D checked) but I still cannot print the explanation statement

so the bugs still exist and I tried to re e file as they suggested and we shall see waht happens as I am ready to print and USPS

with filled out blank forms I got from IRA.gov

I hope your are done , accepted and all is well and not a problem in the future.

MJB

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Heck.... we are neighbors.... I am just outside of Savannah, to the north in SC.

Good luck with your trials and tribulations, and have safe travels.

Tom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Hi All,

I've been reading all the comments here for days and going crazy like the rest of you trying different

things and getting multiple rejections. I'm a virgin at forums, never replied to a post before, so

not sure how to add this reply. I will hit "reply" on this last response and hopefully someone will

see it and pass it on if necessary so all can see. Maybe it's way too big and will not work???

Anyway, this afternoon I figured out an easy way past this 2210 E-File rejection mess that does not

involve doing various bad things to fool TTax into excluding form 2210 (For instance I saw people

talking about changing their 2017 Tax amount to zero so it would skip generating form 2210, etc.)

I have Desktop Windows TTax Premier 2018.

In my case I had some tax withheld, and I also paid quarterly estimated tax payments.

This is what I did to get past the problems:

1) Go to section > Federal Taxes/Other Tax Situations/Additional Tax Payments/Underpayment Penalties

2) I went thru the section normally and on the screen for Annualized Income Method I selected YES.

Even though my income was fairly uniform over the year other than some dividends and capital gains,

I just chopped it up into the pieces TTax wanted. My idea was if I enter all my income details, TTax

will be forced to fill and actually send all 3 pages of form 2210 + the explanation text.

That way the IRS E-file algorithm will get all the required possible forms plus the explanation

text, even though in the end I did not owe a penalty.

It was not difficult to calculate and enter the required income info, so I just did it in 15 minutes.

3) TTax asks for 2018 Annualized Adjusted Gross Income for four periods:

1/1/2018 to 3/31/2018 = $____ This is just 3/12 x your total 2018 AGI

1/1/2018 to 5/31/2018 = $____ This is just 5/12 x your total 2018 AGI

1/1/2018 to 8/31/2018 = $____ This is just 8/12 x your total 2018 AGI

1/1/2018 to 12/31/2018 = $____ This is your total 2018 AGI from line 7 of your form 1040

3) TTax then asks for 2018 Net Capital Gains + Qualified Dividends for three periods:

1/1/2018 to 3/31/2018 -- 1/1/2018 to 5/31/2018 -- 1/1/2018 to 8/31/2018

Short-Term Capital Gain/Loss $____ $____ $____

Long-Term Capital Gain/Loss $____ $____ $____

Qualified Dividends $____ $ ____ $____

(All this info was on my Vanguard brokerage accounts 1099-B and 1099-DIV tax forms and my Shedule D)

4) On the last Conclusion screen, leave the box checked for Annualized Income Installment Method and

say Done.

5) Say NO on next Annual Withholding screen, unless you need to enter actual withholding amounts & dates.

6) In the end I get to the last screen that says "I do not owe penalty, however Form 2210 will be filed."

7) In my case this resulted in both Box A 85% Waiver and Box C Annualized Income Statement Method being

checked off on Form 2210, and TTax added Form 2210AI and 2210 Waiver Explanation Statement automatically.

😎 I then went thru Federal and State review again with no errors, then went back to "Check E-File Status"

section and resubmitted my federal and state return one last time, and both were accepted sucessfully.

9) Checking the Print file of "All official Forms required for filing" I saw that TTax populated

parts I + II + IV of Form 2210, added Form 2210AI at end of Form 2210 and added an Additional Information

document at the very end of the federal return after the Electronic Postmark page. So IRS got it all OK.

Hopefully this helps everybody file before supposed 3/1/18 TTax fix. Sorry my note is soooo very long!!!

Why Intuit couldn't tell us all to do this days ago is beyond me - It should work for everyone's various cases I hope.

Goodnight,

Rob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Hi All, (I'm not sure if better to put this as reply to first or last post, so will do both ???)

I've been reading all the comments here for days and going crazy like the rest of you trying different

things and getting multiple rejections. I'm a virgin at forums, never replied to a post before, so

not sure how to add this reply. I will hit "reply" on this last response and hopefully someone will

see it and pass it on if necessary so all can see. Maybe it's way too big and will not work???

Anyway, this afternoon I figured out an easy way past this 2210 E-File rejection mess that does not

involve doing various bad things to fool TTax into excluding form 2210 (For instance I saw people

talking about changing their 2017 Tax amount to zero so it would skip generating form 2210, etc.)

I have Desktop Windows TTax Premier 2018.

In my case I had some tax withheld, and I also paid quarterly estimated tax payments.

This is what I did to get past the problems:

1) Go to section > Federal Taxes/Other Tax Situations/Additional Tax Payments/Underpayment Penalties

2) I went thru the section normally and on the screen for Annualized Income Method I selected YES.

Even though my income was fairly uniform over the year other than some dividends and capital gains,

I just chopped it up into the pieces TTax wanted. My idea was if I enter all my income details, TTax

will be forced to fill and actually send all 3 pages of form 2210 + the explanation text.

That way the IRS E-file algorithm will get all the required possible forms plus the explanation

text, even though in the end I did not owe a penalty.

It was not difficult to calculate and enter the required income info, so I just did it in 15 minutes.

3) TTax asks for 2018 Annualized Adjusted Gross Income for four periods:

1/1/2018 to 3/31/2018 = $____ This is just 3/12 x your total 2018 AGI

1/1/2018 to 5/31/2018 = $____ This is just 5/12 x your total 2018 AGI

1/1/2018 to 8/31/2018 = $____ This is just 8/12 x your total 2018 AGI

1/1/2018 to 12/31/2018 = $____ This is your total 2018 AGI from line 7 of your form 1040

3) TTax then asks for 2018 Net Capital Gains + Qualified Dividends for three periods:

1/1/2018 to 3/31/2018 -- 1/1/2018 to 5/31/2018 -- 1/1/2018 to 8/31/2018

Short-Term Capital Gain/Loss $____ $____ $____

Long-Term Capital Gain/Loss $____ $____ $____

Qualified Dividends $____ $ ____ $____

(All this info was on my Vanguard brokerage accounts 1099-B and 1099-DIV tax forms and my Shedule D)

4) On the last Conclusion screen, leave the box checked for Annualized Income Installment Method and

say Done.

5) Say NO on next Annual Withholding screen, unless you need to enter actual withholding amounts & dates.

6) In the end I get to the last screen that says "I do not owe penalty, however Form 2210 will be filed."

7) In my case this resulted in both Box A 85% Waiver and Box C Annualized Income Statement Method being

checked off on Form 2210, and TTax added Form 2210AI and 2210 Waiver Explanation Statement automatically.

😎 I then went thru Federal and State review again with no errors, then went back to "Check E-File Status"

section and resubmitted my federal and state return one last time, and both were accepted sucessfully.

9) Checking the Print file of "All official Forms required for filing" I saw that TTax populated

parts I + II + IV of Form 2210, added Form 2210AI at end of Form 2210 and added an Additional Information

document at the very end of the federal return after the Electronic Postmark page. So IRS got it all OK.

Hopefully this helps everybody file before supposed 3/1/18 TTax fix. Sorry my note is soooo very long!!!

Why Intuit couldn't tell us all to do this days ago is beyond me - It should work for everyone's various cases I hope.

Goodnight,

Rob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Sorry, I stupidly thought that if I also replied on top message on top page 1 my message would be seen on page 1 too.

Obviously I have no idea what I'm doing and how to post a reply on a forum.

Just wanted to make sure all people saw it in case it helps them avoid my headaches and wasted time of the last 3 days, and waiting in vain for intuit to fix it all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Hi rafranks2

ROB

WOW this is thorough and helpful

but what a complex solution you have had to generate.

Thank you for providing the details and thorough analysis.

I refiled my yesterday and am not sure if it is rejected, but am taking your instructions with me on the road

and will definitely try it when mine is rejected again.

I believe TT needs to put you on the team !! Thanks

I will let you know my progress.

MJB

Martha

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I am using TT Online. I was able successfully to file yesterday (Saturday Feb 23). A week ago a spent over five hours on different calls with TT customer service because I could not figure out why my efiling had been rejected twice at Federal level. It turns out that (in my opinion) there was a logic/programming glitch either with TT or with the IRS with respect to how to handle Form 2210 (seems it was affecting people like some retirees with low withholding taxes but who had made regular and adequate estimated tax payments). The solution proffered by TT (to send in my return by mail) made no sense at all. Then I read a post that TT/IRS would have worked out a fix by Friday 22nd. So I re-filed on the following day (yesterday) and it went through fine. So, thank you TT/IRS for getting this done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Hi Martha,

The reason I didn't think to try it sooner was that it sounded like it made things overcomplicated, and it generated some extra data on form 2210AI that scared me. But in actuality, it was just a matter of taking 15 minutes to add up and plug in the numbers that were easily available on my 1040 and 1099s, then TTax generated the rest. It took much longer to explain it than to actually do it.

I thought the nice thing is that it just refines your income amount for each quarter, and generates all the forms the IRS could want and need. It doesn't involve tricking TTax by doing overrides and changing values to zero so form 2210 is deleted. And if you just have simple flat income for the year, and no investments, then dividing up your AGI into 4 chunks just takes 1 minute and done.

Anyway, if this all helps one person, it was worth my time explaining it.

Goodluck,

Rob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I am getting this exact same issue. Only 3 values are showing up on the form and I can find no way to update this with the online version. This is REALLY frustrating. Does Turbo Tax have ANY software support at all? Nearly impossible to find an answer to anything. I might have to switch back to HR Block next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

TT On-line resolution for this issue is to print and mail the return to the IRS. No thank you TT. That is not an acceptable solution. Part of what we are buying is the convenience associated with e-filing. I may be going back to HR Block next year after this fiasco.

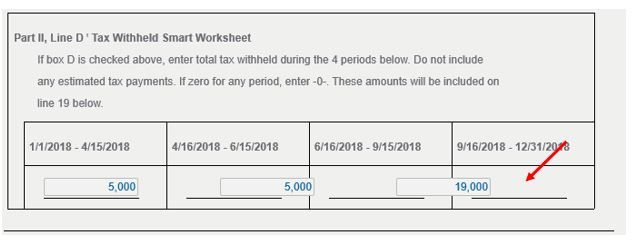

I tried to file my return but it will not let me because of an issue on Form 2210 that I cannot fix:

Form 2210: Line D Withholding-1. The sum of the four columns is not equal to your total withholding of $4745 for the year.

Line D Withholding $5000

See how the columns are offset…Where is my fourth Quarter estimated tax payment?

Come on TurboTax Online...get your sh*t together. We didn't pay for this amateur web programming and terrible support.

WHEN WILL THIS BE FIXED???????????????????????????????????????????????????????????????????????????????????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Another update from someone using the TurboTax Online version (not software specific to Mac or Windows).

I attempted to efile today based on previous comments saying that issues had been fixed. We vastly overpaid on estimated taxes this year, so we did not have a penalty, but TTO did require us to fill out the Form 2210. The secondary AI form was also included when I viewed all the forms on the return.

I didn't do anything differently from my previous 3 attempts, but the IRS accepted my federal return today about 30 minutes after submittal. Hopefully everyone else is now getting successful attempts. I'm sharing this so that others reading this and waiting for some confidence in their efile attempts might get the nerve back up to try again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DMB31

Level 1

Pony42

New Member

user17727761400

New Member

kevinbsmith

New Member

Tony81266

Level 1