- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Anyone else having problem e-filing with IRS Form 2210 under tax reform

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Mon, Feb 25. My third efile over the last five days was rejected today because of Form 2210. Do I only have two free efiles remaining? If so, what will the 6th efile cost?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Thank you. This worked for me. I was getting worried because I had mailed the 1040-V with the payment and the corresponding state form. If I had to do a paper filing, I was worried that I would have months of explaining to the tax authorities why I had mailed a payment prior to filing a paper return. Getting the annualized portion of the 2210 completed seemed to do the trick. It's superfluous as you observe, but it seems to work.

The message from Turbotax on the rejections was not helpful. It said that this was a timing error with their 2/22 fix and I should just refile. That was simply wrong, twice. Again, thanks for sharing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

How did you add the explanation form? TurboTax generated the explanation statement for me, but will not submit it with the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

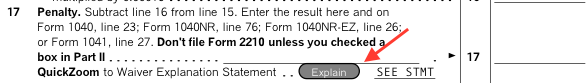

The text SEE STMT was inserted by TT after I prepared the statement. In the filing process, TT gave me the option of printing out a copy of the return for filing. The statement was there. Note that you must choose copy of Return for Filing, not copy of all forms and worksheets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Tues, Feb 26. Are filers still having the IRS reject their efiling for the Form 2210? I haven't seen any postings here in a couple of days. I've still got to re efile and I'm hoping the problem is fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I'm going to wait until the promised March 1 "fix" to try again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

My refile after the Friday update was rejected. I am out of town and do not expect to attempt an fix and refile until after the next update. Even then I might have to just print and file by USPS -

It is very disappointing as I want that LARGE refund I am due - and should not be tied up with some silly penalty and form 2210. but

Life goes on and I will address it in a week or so.

MJB

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

My last e file after the Friday update was rejected. (reject number 6 all caused by form 2210 as it appears that the latest one did not have teh expiation form attached). I am out of town and do not expect to attempt an fix and refile until after the next update. Even then I might have to just print and file by USPS -

It is very disappointing as I want that LARGE refund I am due - and should not be tied up with some silly penalty and form 2210. but

Life goes on and I will address it in a week or so.

MJB

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

@FD wrote:Tues, Feb 26. Are filers still having the IRS reject their efiling for the Form 2210? I haven't seen any postings here in a couple of days. I've still got to re efile and I'm hoping the problem is fixed.

My last e file after the Friday update was rejected. (reject number 6 all caused by form 2210 as it appears that the latest one did not have teh expiation form attached). I am out of town and do not expect to attempt an fix and refile until after the next update. Even then I might have to just print and file by USPS -

It is very disappointing as I want that LARGE refund I am due - and should not be tied up with some silly penalty and form 2210. but

Life goes on and I will address it in a week or so.

MJB

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

@CharlieP wrote:I'm going to wait until the promised March 1 "fix" to try again.

@CharlieP wrote:I'm going to wait until the promised March 1 "fix" to try again.

me too

My last e file after the Friday update was rejected. (reject number 6 all caused by form 2210 as it appears that the latest one did not have teh expiation form attached). I am out of town and do not expect to attempt an fix and refile until after the next update. Even then I might have to just print and file by USPS -

It is very disappointing as I want that LARGE refund I am due - and should not be tied up with some silly penalty and form 2210. but

Life goes on and I will address it in a week or so.

MJB

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

It looks like they changed it to the 8th :(

Does anybody know for the online people if changing the prior year due to 0 has any other affect in the tax forms other than just getting rid of 2210 form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Not sure what you are worried about. by removing the 2210, if the IRS determines that you owe a penalty they will let you know. There should not be any other implications to your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I used someone's work-around on the ONLINE version. Go through and enter zeros in the TWO fields where 2017 tax penalty has been filled in automatically. This takes Form 2210 out of your filing. It worked for me. Finally e-filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Thanks for this update- I am out of town and not near my PC with the Tax program and data- but will certainly try it when i get back in 10 days -

I tried to remove the form 2210 on earlier attempts and TT would not allow me to delete that form, while still not allowing me to attach the explanation.

I have decided to just enjoy my vacation - but when i get back will try the work around to delete the form.

Were you using the on line version?? because i have the CD installed version and it is my understanding that the two versions work differently.

Thanks and i hope you get your refund ASAP.

MJB

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17728241842

New Member

Yomama1

Level 1

vlebovici

New Member

mckimbo

New Member

crawfordjoey91

New Member