- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Your HSA contributions are not subject to Income tax, Soc...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

I'm trying to figure out why the 401k pre-tax deductions are reflected in Box 1 Wages, but HSA pre-tax payroll employee contributions are not being removed. Implies I'll be taxed incorrectly on my HSA contributions.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

Your HSA contributions are not subject to Income tax, Social Security Tax, or Medicare Tax; therefore, Boxes 1, 3, & 5 of your W2 have already been reduced by your $5,250 HSA Contributions.

On the other hand, your 401(k) contributions are not subject to Income Tax and reduce Box 1 of your W2; however, your 401(k) Contributions are subject to Social Security Tax and Medicare Tax so they are not deducted from Boxes 3 & 5 of your W2.

If this doesn't make sense or you have additional questions regarding this, please comment below so that I can assist you further.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

Your HSA contributions are not subject to Income tax, Social Security Tax, or Medicare Tax; therefore, Boxes 1, 3, & 5 of your W2 have already been reduced by your $5,250 HSA Contributions.

On the other hand, your 401(k) contributions are not subject to Income Tax and reduce Box 1 of your W2; however, your 401(k) Contributions are subject to Social Security Tax and Medicare Tax so they are not deducted from Boxes 3 & 5 of your W2.

If this doesn't make sense or you have additional questions regarding this, please comment below so that I can assist you further.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

Kleed is saying that his Box 1 value was not reduced by the $5,250 that he contributed to his HSA. My W-2 is the same, no reduction in Box 1 for MY contributions I made to the HSA (ONLY the value for the 401K contributions reduces the wage value in box 1). But box 12 indicates the full amount I contributed as well as my employer. So, if I put in the amount from box 12(W), TT can't correct for the difference between what I contributed and my employer contributed. Should I ignore the number in box 12W and, only enter the value my employer actually contributed on my behalf.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

READ that answer again ... the HSA was not included in boxes 1, 3 & 5 ... it was only entered in box 12 as a code W. For the 401K only box 1 is reduced and not 3 & 5. If you don't understand the W-2 ask the employer to explain it to you before you do something incorrect on the return.

ALL contributions the HSA thru the payroll system (both employee and employer) are listed on the W-2 box 12 code W ... do NOT try to enter them anywhere else in the program or the IRS will send you an audit letter later.

The HSA is handled in 3 parts in the TT program :

First the contribution:

https://ttlc.intuit.com/replies/4557768

https://ttlc.intuit.com/replies/4785646

Next the limitations screen to confirm you are eligible to make the contributions:

Until you complete the HSA portion of the TurboTax interview to establish your eligibility for an HSA contribution, TurboTax will treat the amount entered on the W-2 form as an excess HSA contribution.

https://ttlc.intuit.com/replies/4788059

And lastly any distribution:

https://ttlc.intuit.com/replies/4787864

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

I have the same problem as the original poster.

My W2 Box 1 amount has NOT been reduced by my portion of the HSA contributions reported in Box 12 as W.

Box 1 HAS correctly been reduced by my 401k contributions reported in Box 12 as D.

In TurboTax, if I enter my contributions, it warns me that these are above the limit since Box 12 W shows that the limit has already been contributed.

Is my employer creating the W2 incorrectly?

Thanks, Mike

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

In the program you do NOT enter the HSA contributions AGAIN ... if you (or the employer) paid via the payroll system they are already being handled when you entered the code W on the W-2.

The HSA contributions are NOT subject to fed or FICA taxes and will not be included in boxes 1, 3 or 5.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

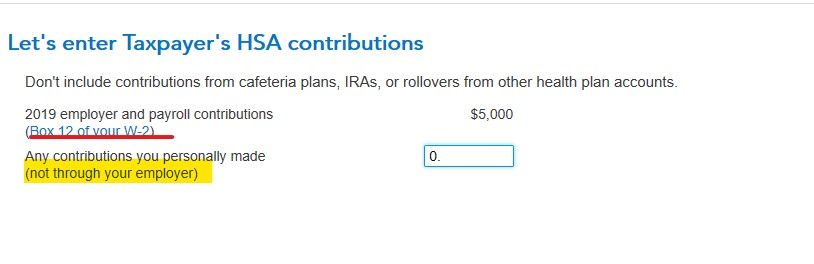

The program transfers the amount from the W-2 to this screen ... do NOT add the amount again ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

HSA - only your portion of any HSA contribution (what's taken out of your paycheck) would reduce box 1 of the W-2. if the employer made the entire HSA CONTRIBUTION, box 1 wouldn't be reduced. box 12 would still show the amount as code W. the amount appears on form 8889 line 9 and you would get no deduction since, in this case, it was employer contributions and not deductions from your paychecks. if there were deductions from your paycheck for the HSA box 1 should have been reduced. the 8889 works the same way, you get no deduction because your taxable wages have been reduced. both the employer's match and your contributions would show up as code W and flow to line 9 of the 8889.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

Sorry, my bad. My W2 DOES CORRECTLY deduct my HSA contributions from Box 1.

THIS IS NOT AN ISSUE. I am sorry to have wasted your time.

Although I had looked at this for a long time, I just realized I was forgetting to include deducted taxes in my wages for Box 1, the amount of which was very close to my HSA contribs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

So does that apply to both Roth 401K and Traditional 401Ks?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

No, Roth 401(k) are after-tax contributions and will be included in the box 1 amount on your W-2. Only the pre-tax contributions to the Traditional 401(k) will reduce the amount in box 1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 Box 1 Wages reflects 401k contributions, but not $5,250 in HSA pre-tax payroll deductions. Box 12 Code W shows HSA contributions $1,500 Employer and $5,520 Employee.

Yes, that is what i thought as well, but i have a roth 401k and i noticed that my box 1 amt was lower than the box 16,18 amount so i dug further. What i found was, with Roth 401Ks, the company match is actually into a Traditional 401K. So that is the part that is pre-tax contrib, the company match. When you have a Roth IRA and company match, you will actually have 2 types of 401Ks, one Roth for your contribs and one trad for the company matches. So i learned something new. Yay.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ir63

Level 2

bgoodreau01

Returning Member

tcondon21

Returning Member

RyanK

Level 2

CTinHI

Level 1