- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Will I receive the latest stimulus check if I file my 2020 taxes as an independent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I receive the latest stimulus check if I file my 2020 taxes as an independent?

Last tax-year (2019) I qualified and filed as a dependent, making me ineligible for the upcoming stimulus check. This tax-year (2020), I qualify as an "adult"/independent and will therefore file as one. Now, if I file my taxes on January 1st, is there any chance the IRS will look at that return when determining my eligibility? Or if I file as an independent for the 2020 tax-year, is there a chance that, some time into 2021, I'll receive the check?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I receive the latest stimulus check if I file my 2020 taxes as an independent?

Do NOT try to file your return on the 1st of January.

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

At this point, we do not know yet what the new stimulus bill will mean in terms of changes to the 2020 Form 1040, software programming, software updates, etc., etc. Do NOT be in a hurry to file your 2020 tax return until more is known. It is never a good idea to file early, and it would be especially foolish to file an early 2020 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I receive the latest stimulus check if I file my 2020 taxes as an independent?

Do NOT try to file your return on the 1st of January.

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

At this point, we do not know yet what the new stimulus bill will mean in terms of changes to the 2020 Form 1040, software programming, software updates, etc., etc. Do NOT be in a hurry to file your 2020 tax return until more is known. It is never a good idea to file early, and it would be especially foolish to file an early 2020 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I receive the latest stimulus check if I file my 2020 taxes as an independent?

Your eligibility for the Recovery Rebate Credit (stimulus) is based on your 2020 tax return. If you are not a dependent on the 2020 federal tax return and are otherwise eligible you will receive the credit on your Form 1040 Line 30.

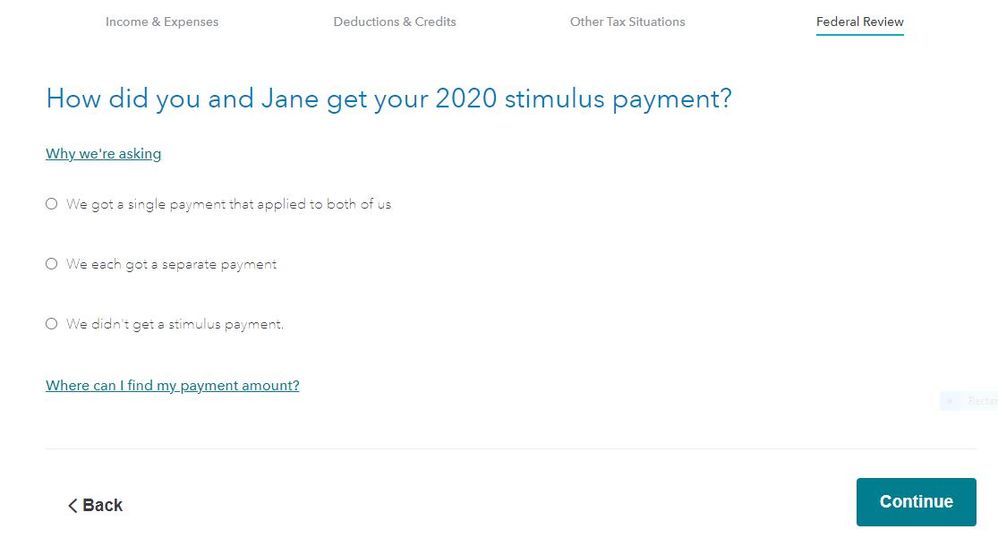

TurboTax asks you about the stimulus payment received or not received in 2020 after you have completed the Other Tax Situations section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I receive the latest stimulus check if I file my 2020 taxes as an independent?

suggest REALLY WAITING to file your 2020 tax return until there is clear understanding on how this 2nd stimulus payment will work.

@DoninGAand @xmasbaby0 provided excellent instructions on how the 2020 tax return will get you the 1st stimulus payment. The IRS has this well thought out, but I suspect they weren't expecting a 2nd stimulus so quickly!!

The 2nd stimulus payment is probably going to work the same way as the 1st and that means you won't receive it for the same reason: you were marked as a 'dependent' for the 2019 tax year which is the basis of how they determine who to send checks to.

The IRS is going to have to clarify how folks in your situation are to get the 2nd stimulus check- and it maybe through the 2020 tax return....suggest waiting and be patient about filing until the IRS explains this.

Being patient and understanding how it is going to work will really save you a lot of potential headaches !!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nachellelewis0

New Member

ladder3bridge

New Member

soulhotel57

New Member

tinaroberts0669

New Member

blueberry42710

Level 2