- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where will I see the option to claim the Recovery Rebate Credit on this 2020 tax return? I entered most of my info but it never asked me what I received in 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where will I see the option to claim the Recovery Rebate Credit on this 2020 tax return? I entered most of my info but it never asked me what I received in 2019.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where will I see the option to claim the Recovery Rebate Credit on this 2020 tax return? I entered most of my info but it never asked me what I received in 2019.

If you do not receive any other stimulus payments by January 15, 2021, then the stimulus payment for which you are eligible to receive will be entered on your 2020 federal tax return as a tax credit on Form 1040 Line 30.

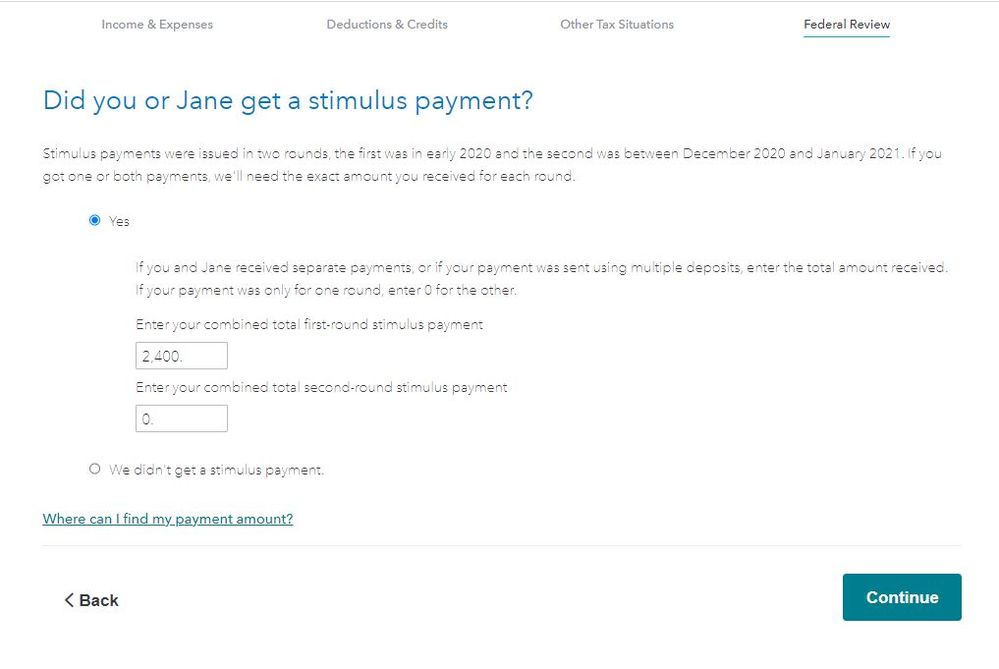

The TurboTax program will ask about stimulus payments in the Federal Review section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where will I see the option to claim the Recovery Rebate Credit on this 2020 tax return? I entered most of my info but it never asked me what I received in 2019.

Thanks so much for your quick reply. I'll check that area after I enter some more info on my return later this month. Much appreciated.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

psberg0306

Level 2

kkrana

Level 1

kac42

Level 2

Propeller2127

Returning Member

elliottulik

New Member