- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where do itemize gambling losses in premium?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

Gambling

To enter the W-2G or other documents For your Gambling winnings--Go to Federal>Wages & Income>Less Common Income>Gambling Winnings

You can enter your winnings, and then keep clicking through the interview to enter gambling losses.

https://www.irs.gov/help/ita/how-do-i-claim-my-gambling-winnings-and-or-losses

Gambling winnings are taxable income. Losses are an itemized deduction. If you do not have enough itemized deductions to exceed your standard deduction, your losses will have no effect.

https://blog.turbotax.intuit.com/income-and-investments/how-are-gambling-winnings-taxed-8891/

https://ttlc.intuit.com/questions/1900352-can-i-deduct-my-gambling-losses

2023 STANDARD DEDUCTION AMOUNTS

SINGLE $13,850 (65 or older/legally blind + $1850)

MARRIED FILING SEPARATELY $13,850 (65 or older/legally blind + $1500)

MARRIED FILING JOINTLY $27,700 (65+/legally blind) ) + $1500 per spouse

HEAD OF HOUSEHOLD $20,800 (65 or older/blind) + $1850)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

I’m not sure where in premium to list itemized deductions (gambling losses). Where exactly do I go in Premium to list itemized deductions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

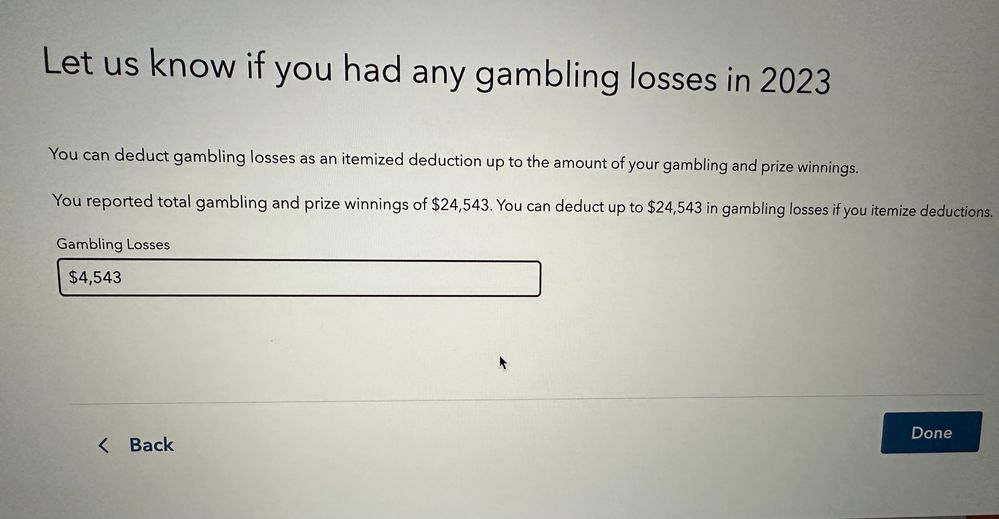

Yes, you can deduct your gambling losses if you itemize your deductions.

A few things you need to keep in mind when entering your gambling losses:

• You can deduct your gambling losses, but only to offset the income from your gambling winnings. You can't deduct your losses without reporting any winnings.

• The amount of gambling losses you can deduct can never exceed the winnings you report as income.

• To report your gambling losses, you must itemize your income tax deductions on Schedule A. If you claim the Standard Deduction, then you can't reduce your tax by your gambling losses.

• The IRS doesn't permit you to subtract your losses from your winnings and report the difference on your tax return. You must report your winnings and losses separately.

To get to your itemized deduction in your TurboTax Program, type "itemized deductions" in your search bar at the top right of your screen and select the "Jump to itemized dedudtions"

You first need to enter your gambling winnings reported to you on Form w-2G. The easiest way to do this is type "W-2g" into the search bar at the top right corner of your screen. Then select "jump to W-2g"

Select "Yes"and continue through the screens to enter your Form W-2 information.

This screen will ask you to enter your Form W-2G information.

Once you have entered all of your forms W-2-G select "Done"

You will then be asked about your gambling losses. This is where you will enter your gambling loss information.

In general, if you need to get to your Itemized Deductions you can type "itemized deductions" in your search bar and select "Jump to itemized deductions".

Click here for information on gambling losses and your taxes.

Please feel free to come back to TurboTax Community with additional information or questions or click here for help in contacting Turbo Tax Support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

Thank you, Linda. However, the issue I’m having is after jumping to itemized deductions. I can’t figure out where in itemized deductions the gambling losses are entered. Sorry I wasn’t clear about that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

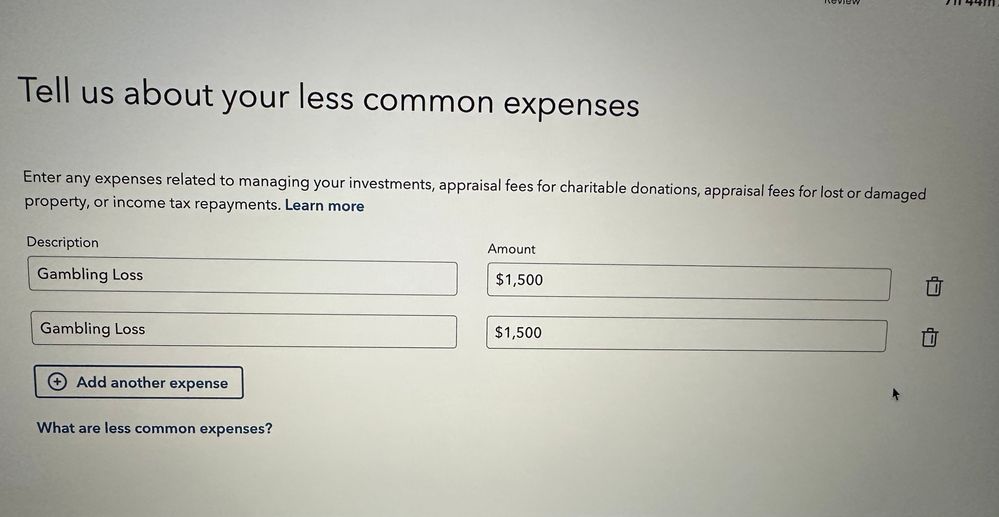

When you enter your gambling income it will ask you about your gambling losses. Use the information below to enter your gambling losses

- Search (upper right) > Type gambling losses > Click the Jump to .... link > Continue to answer the questions until you reach the screen shown below where you can enter your losses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

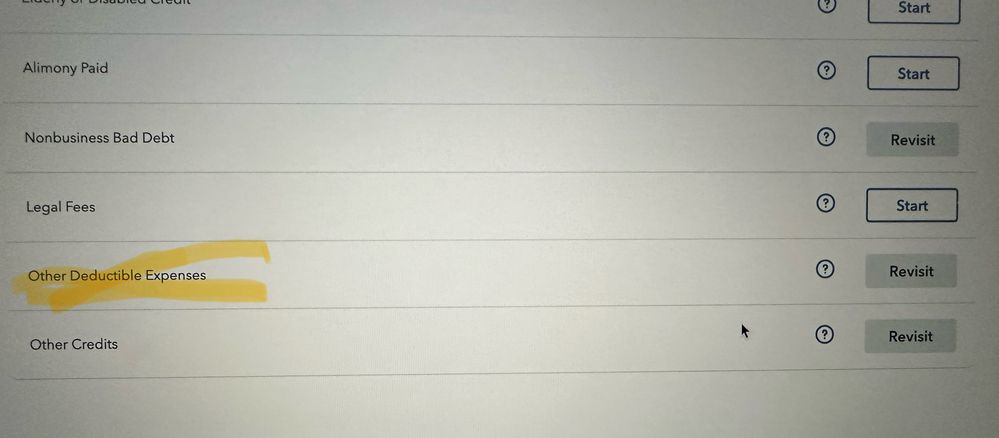

I appreciate all of the comments. I found where to input Total Gambling Losses, but still not sure where to itemize gambling losses. When I jump to Itemized Deductions, do I itemize gambling losses in “Less Common Expenses “?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

No. You only put them where you entered them.

You may not be able to benefit from them if you do not have total itemized expenses greater than your standard deduction.

Itemized expenses include mortgage interest, gambling losses up to winnings, charitable contributions, state and local taxes up to $10,000, medical expenses in excess of 7.5% of your AGI and casualty and losses in excess of 10% of you AGI with the first $100 not counting towards the loss. Your health insurance and all medical expenses are only deductible for the amount that is over 7.5% of your AGI. This means if your AGI is $50,000, then the amount that is over $3,750 is deductible.

Then your total itemized expenses would need to be greater than your standard deduction below in order to benefit from your expenses.

The 2023 Standard Deductions are as follows:

- Married Filing Joint (MFJ) $27,700

- Married Filing Separate (MFS) $13,850

- Head of Household (HOH) $20,800

- Single $13,850

Blind or over 65 and MFJ or MFS add $1,500

Single or HOH if blind or over 65 add $1,850

Standard versus Itemized Deduction

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

Just so I’m clear, I only enter my Gambling Losses here, unless I’m prompted otherwise? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

Correct!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

Thank you, everyone!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

If my gambling losses equal gambling winnings, how much will income tax from winnings be reduced?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do itemize gambling losses in premium?

@gwheeler72-gmail It does not work quite that way, although gamblers usually hope for the winnings and losses to be a wash.

Gambling

To enter the W-2G or other documents For your Gambling winnings--Go to Federal>Wages & Income>Less Common Income>Gambling Winnings

You can enter your winnings, and then keep clicking through the interview to enter gambling losses.

https://www.irs.gov/help/ita/how-do-i-claim-my-gambling-winnings-and-or-losses

Gambling winnings are taxable income. Losses are an itemized deduction. If you do not have enough itemized deductions to exceed your standard deduction, your losses will have no effect.

https://blog.turbotax.intuit.com/income-and-investments/how-are-gambling-winnings-taxed-8891/

https://ttlc.intuit.com/questions/1900352-can-i-deduct-my-gambling-losses

2023 STANDARD DEDUCTION AMOUNTS

SINGLE $13,850 (65 or older/legally blind + $1850)

MARRIED FILING SEPARATELY $13,850 (65 or older/legally blind + $1500)

MARRIED FILING JOINTLY $27,700 (65+/legally blind) ) + $1500 per spouse

HEAD OF HOUSEHOLD $20,800 (65 or older/blind) + $1850)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

StPaulResident

Returning Member

jeffandkarleen

Returning Member

boriserl2

New Member

swizo68124

New Member

megan12345678910

New Member