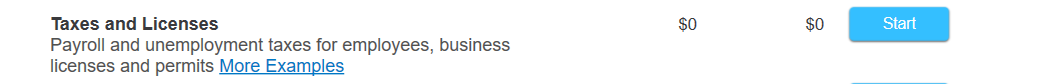

Assuming this is a single-member LLC that is being reported as a business on Schedule C, you will report the $800 LLC fee as part of your other common business expenses, and more specifically under the taxes and licenses section.

Please see where do I enter my self-employment business expenses, like home office, vehicle mileage, and suppli... for more details on getting to the input section.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"