- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- When I leave the box as zero I get the good news "your pr...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

If I enter the property tax paid in the two areas where it asks for it, Turbo Tax adds them together. Am I misreading something? Under the personal deductions and credit section it says "You reported $xx.xx in property tax on your home office. This amount should be the total property taxes paid on your main residence." That sentence is not clear if I am supposed to enter the same dollar amount or enter zero since I already entered it under the Business Income & Expense section.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

Enter the total amount of property tax paid in both places (business expenses and personal deductions).

In my test case, I first entered $20,000 in property tax in the business expenses. I also entered home square footage as 3,000 and office square footage as 300, so the amount of home expenses like property tax to be allocated to the business is 10%.

When I went to personal expenses for Schedule A, the field for Property Taxes was already filled in with $20,000. If so, just leave it. If it's blank, then enter the same amount as you entered back on the business expenses page (i.e. the whole amount, like $20,000 in my example).

When I had reached a stopping point, the amount of the property tax allocated to the business was $2,000 (10% of $20,000), and the amount of property tax allocated to Schedule A was $18,000, just as you would have expected.

In other words, put the total amount paid in both places. If you set up the allocation process correctly in the business section, TurboTax will correctly divide the amount between your business and your itemized deductions.

I am a bit concerned that you said "It ends up doubling" - go back and re-enter the numbers the way I said, and then check the output (this means that you will have to manually compute what your Itemized Deductions should be and what your net Schedule C income should be, for comparison). If you are doing this online, you can see the results on the left at Tax Tools->Tools->View Tax Summary.

If you are doing this with the desktop product, I believe you can see the actual forms (Schedule A and Schedule C) by going to Forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

So far, it looks like online and desktop look to be operating the same way, although I understand your point about possible confusion on what to enter. Even when I deleted TurboTax's $20,000 entry and coded $20,000 again (like you did), the calculations remained correct.

It seems you are on the ball and have done your own due diligence to verify that the deductions are correct and in the correct places. Since we on AnswerXchange can't see your screen, if you want to pursue this, I would suggest that you contact phone support where an agent (with your permission) can see your screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

The bug is still there in 2021.

On the "Enter any additional property tax you paid in 2021" page. It has the entry that I previously entered.

But if I leave the Property Taxes box blank. It will double my property taxes deduction minus the home office portion.

I have to enter "0" in the field in order for it to calculate it correctly without doubling the property tax deduction amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

The bug still exists for 2024 as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

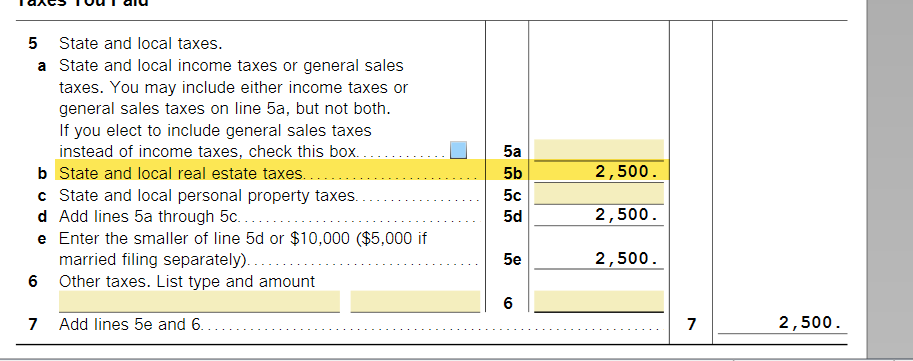

The property tax routine seems to be working properly as far as I can tell. I entered the property tax in the home office section of TurboTax and when I go to the personal section, under Your Home in the Deductions and Credits section, I see where I get a message that says Don't enter your home office deduction, $3,000 is already included, which is the amount I entered in the business section. Then, when I go to the Schedule A, I see where $2,500 is deducted as an itemized deduction, which is the total property tax less the amount allocated to the home office, as it should be:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deduct property tax twice? Business>Income & Expense>Enter Real Estate Taxes AND Personal>Deductions & Credits>Enter the property taxes you paid.It ends up doubling.

I spoke directly with Turbotax on this issue. I have the Home & Business edition, and I have more than one business. After entering the data together with Turbotax support specifically in the Home Office deduction for each business (should reflect as a percent), the property taxes were doubled in the "excess property tax" section. The solution was to zero that out at the end of the process when reviewing total property taxes; however, others may have entered this data without realizing that it was doubled and will receive a larger deduction/refund due to this issue. I believe there is an error in how Turbotax calculates this as that doubled figure should not appear there. It was escalated to management at Turbotax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

johneramsayjr

New Member

Katie1996

Level 1

margaretp40

New Member

emberrbiss

New Member

user17554733324

New Member