- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- What do the yellow highlighted borders around buttons mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do the yellow highlighted borders around buttons mean?

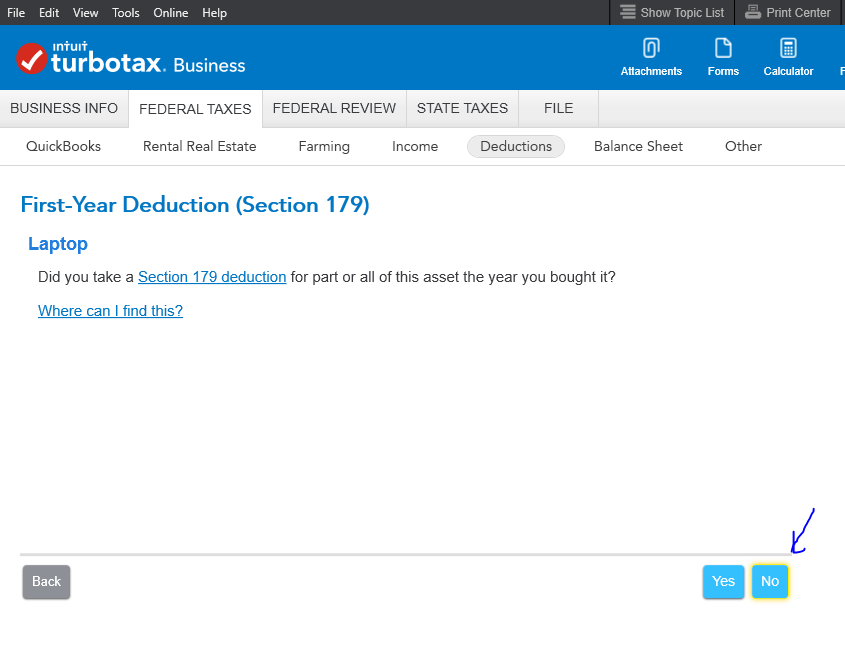

After I have completed answering all the questions in turbo tax, I'll go back through all the questions to review my entries before submitting my taxes just to make sure I didn't miss anything. In taking this second pass through the questions, often I'll get stuck when I get to a screen (like the one shown below) where I can't remember what my answer was on the first pass through the software. In that case, I've been wondering if the yellow highlighted border that shows up around one of the buttons indicates what I choose on my last pass through the software. Does anyone know what these yellow borders are for?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do the yellow highlighted borders around buttons mean?

The yellow border does not indicate your previous answer. It indicates the element on the screen that currently has "focus," i.e. the currently selected element. If you press Enter, it's the same as if you clicked the button with the yellow border.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do the yellow highlighted borders around buttons mean?

The yellow border does not indicate your previous answer. It indicates the element on the screen that currently has "focus," i.e. the currently selected element. If you press Enter, it's the same as if you clicked the button with the yellow border.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do the yellow highlighted borders around buttons mean?

In lieu of revisiting the input screens (which as you see requires recompletion sometimes) it may be best to switch to the FORMS mode and/or print center to review the return without corrupting the entries.

This tutorial is meant for the personal programs but much of it still works with the BUSINESS version ... in case you don't already know this ...

This is my mini version of a tutorial that should be in the downloaded program:

What is Forms Mode?

Forms Mode lets you view and make changes to your tax forms "behind the scenes."

If you're adventurous, you can even prepare your return in Forms Mode, but we don't recommend it. You may miss obscure credits and deductions you qualify for, and you may forget to report things that will come back and haunt you later.

Forms Mode is exclusively available in the TurboTax CD/Download software. It is not available in TurboTax Online.

Related Information:

- Why would I use Forms Mode?

- How do I switch to Forms Mode in the TurboTax for Windows software?

- How do I switch to Forms Mode in the TurboTax for Mac software?

If you want to play around with different figures and tax scenarios without affecting your original return you can ….

- >>>In the TurboTax CD/Download software by creating a test copy:

- 1. Open your return in TurboTax.

- 2. From the File menu, choose Save As.

- 3. Give the copy a new name to distinguish it from the original (for example, by adding "Test" or "Example" to the file name).

- 4. Click Save. You are now safely working in the test copy and anything you do here will not affect the original.

- https://ttlc.intuit.com/questions/1900642-how-to-make-a-test-copy-of-your-return

- >> use the WHAT IF tool:

- - Click Forms Icon (upper right of screen) or Ctrl 2 (forms view)

- - Click on the Open Form Icon

- - In the “Type a form name.” area type What-If (with the dash), click on the name of the worksheet - click on Open Form

- - You will see the worksheet on the right side of the screen; enter the information right into the form

- - To get back to interview mode - click on the Step-by-Step Icon (upper right of screen) or Ctrl 1

It's always a good idea to make a backup copy of your tax data file, in case your original gets lost or corrupted. Here's how:

- From the File menu in the upper-left corner of TurboTax, choose Save As (Windows) or Save (Mac).

- Browse to where you want to save your backup.

- Tip: If you're saving to a portable device, save it to your computer first to prevent data corruption. Then, after completing Step 4, copy or move the backup file to your device.

- In the File name field, enter a name that will distinguish it from the original tax file (for example, add "Backup" or "Copy" to the file name)

- Click Save and then close TurboTax.

- Restart TurboTax and open the backup copy to make sure it's not corrupted. If you get an error, delete the backup and repeat these steps.

If you make changes to your original tax return file, repeat these steps to ensure your original and backup copies are in-synch.

Related Information:

- Retrieve a Tax File from a Portable Device

- What's the difference between the tax data file and the PDF file?

AND save it as a PDF so you have access to a copy even if you don’t have the program still installed and operational :

- How do I save my return as a PDF in the TurboTax software for Windows?

- How do I save my return as a PDF in the TurboTax software for Mac?

AND protect the files :

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bk1968

Level 1

tranalli

Level 2

carriskoul

Level 3

capnbobl1011

Level 3

iblankm

Level 2