- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- TurboTax Updates on Unemployment did not change my refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Updates on Unemployment did not change my refund

To be simple let's say I was getting 2,000 back, and I received 20,400 in unemployment. I went in and adjusted it to 10,000 to see what would happen when they passed the bill removing 10,400 via tax-free funds.. and it went up to 3,000 (I was happy and decided to wait for the update) When they actually passed the bill, I thought that when I logged back in, it would adjust but nothing? I noticed Turbotax said it updated their system but again it never adjusted my return? is there a way to see if I got the newest version? I am using the online version OR should it not of adjusted my return I have no idea, just want to know if anyone else had their return change?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Updates on Unemployment did not change my refund

Have you re-entered the full amount of unemployment compensation you received in 2020?

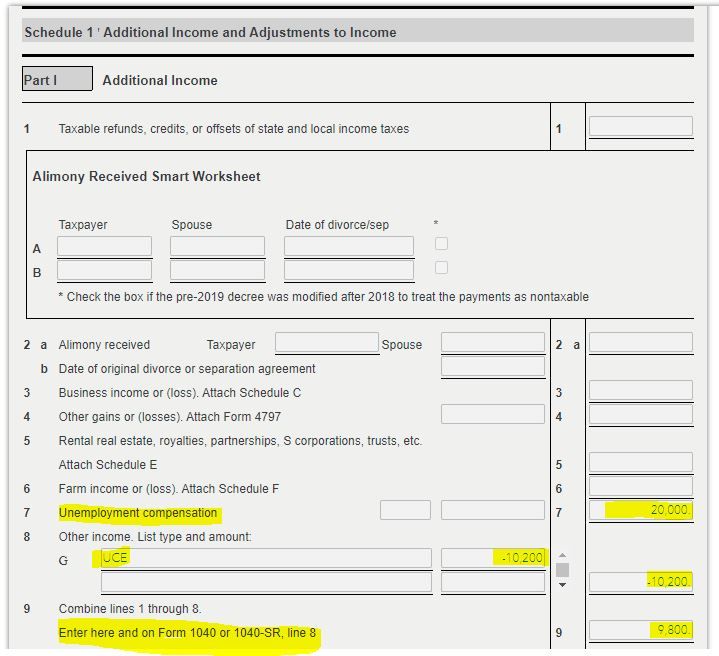

The exclusion amount is shown on Schedule 1 Line 8 as a negative number and your unemployment compensation is on Line 7

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Updates on Unemployment did not change my refund

Uh, did you put your return back to the full 20,400 after you took out the 10,200?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Updates on Unemployment did not change my refund

Have you re-entered the full amount of unemployment compensation you received in 2020?

The exclusion amount is shown on Schedule 1 Line 8 as a negative number and your unemployment compensation is on Line 7

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Updates on Unemployment did not change my refund

There is also an income limit in order to take this deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Updates on Unemployment did not change my refund

Simply reducing the amount of unemployment compensation will not necessarily give you a correct result. Various items that depend on AGI require that excluded unemployment compensation be added back when calculating the modified AGI for the particular purpose. Such items include limits related to IRA contributions and the calculation of the taxable amount of Social Security benefits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Updates on Unemployment did not change my refund

yes, I changed it to see if there would be a difference then changed it back.. lol I used the tool and did it properly. 🙂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

doubleO7

Level 4

stays

New Member

randob

Level 2

TimO610

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

ProfDude

Level 1