- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

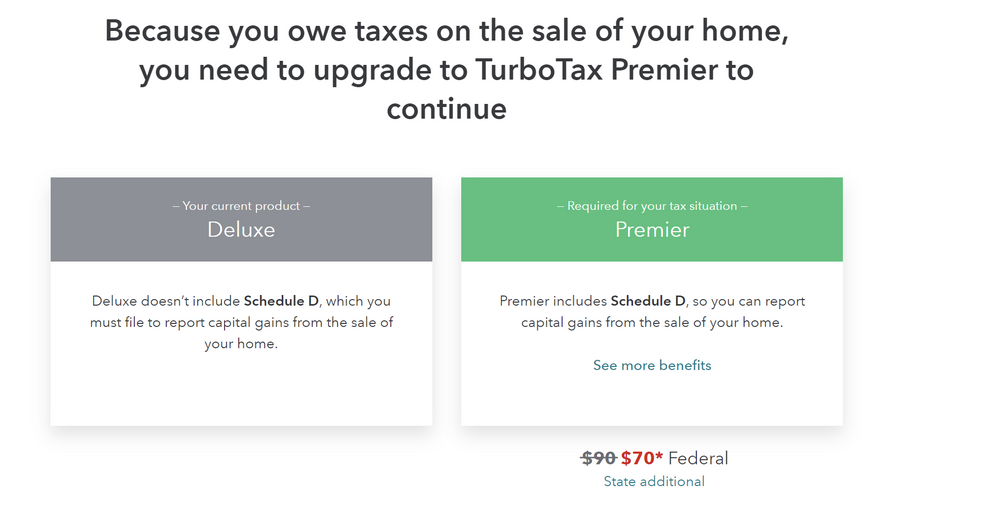

- Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

It depends. Is this a personal residence or a sale of a rental home? If rental home, then a Premier version of Turbo Tax may be required depending on your unique situation. Tell us the situation regarding the sale of your home. Also if you did not qualify for the capital gains exclusion on a personal residence involving the ownership or use tests, then this may be another reason why the program prompted you to upgrade to Premier.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

I defiantly do not owe taxes on my home...It was my only home/residence I have lived/owned in for 20 years...My gain on the sale was only 80k....So I agree with turbo tax telling me good news you dont owe any taxes on the sale of the home....My "beef" is why is turbo tax pushing me into a higher turbo tax product...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

THe only reason I am reporting this sale of the home is because the closing agent automatically sends 1099-s forms out regardless if a person owes or does not owe taxes, so I am forced to report it when filing, although I dont owe anything....thanks for your help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

so how did you get around it, because I'm running into the same problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

It depends. if you wish to report the home sale and keep the home sale worksheet calculations proving that you don't owe taxes, you will need to upgrade to Turbo Tax Premier.

If you choose not to report the sale, then you don't need to upgrade. It's up to you whether or not to report.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

I am also running into this currently as I put my information in...looks like you got a whole lot of help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

If you got a 1099-S form at closing you MUST report the sale even if you will not owe anything. If you did not get the 1099-S and you can exclude the entire gain then back up and remove the sale completely.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

I only got a closing summary at closing. I have read that actual 1099-S forms have to be mailed by Feb. 15, so I'll wait until then to see if I get one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax says I don't owe taxes on my home sale then the next page wants me to upgrade from deluxe to premier, "because you owe taxes on the sale of my home"....????

Call your closing company ... they are almost always issued at closing so they don't need to send them out in January. If you qualifying to exempt the sale one would not have been issued. The closing company and/or your RE agent would have asked you 3 questions to determine if one was required ...

1) was this your personal residence for 2 out of the last 5 years ?

2) did you ever use the home for business use or as a rental ?

3) did you sell a personal residence in the past 2 years and take the exclusion ?

If you answered Yes, No & No AND the sale price was $250K ($500K married) or less then a 1099-S was not and will not be issued.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Priller

Level 3

awootten

New Member

Priller

Level 3

taxanaut

Level 3

in Education

KenMO

New Member